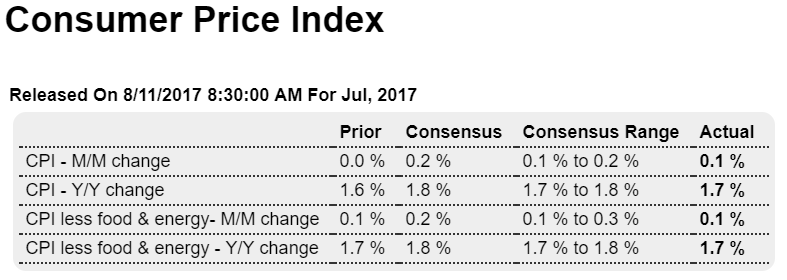

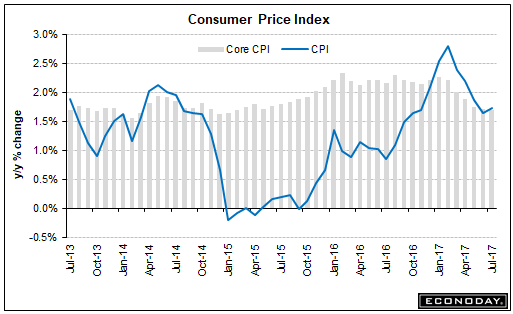

So the Fed is failing to meet its inflation target, wage growth remains weak, and all measures of credit expansion have been decelerating for more than 6 months: Highlights Consumer prices remain very soft, failing to match what were modest Econoday expectations for July. Total prices edged 1 tenth higher in July as did the core (less food & energy) which are both no better than the low estimates. Year-on-year rates are also at the low estimates, at 1.7 percent each. Moderation in housing costs remains a major disinflationary force, inching only 0.1 percent higher for a yearly 2.8 percent which is down 2 tenths from June. And wireless services, in keeping with the telecom revolution, continue to move lower, falling 0.3 percent on the month for a yearly decline of 13.3

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

So the Fed is failing to meet its inflation target, wage growth remains weak, and all measures of credit expansion have been decelerating for more than 6 months:

Highlights

Consumer prices remain very soft, failing to match what were modest Econoday expectations for July. Total prices edged 1 tenth higher in July as did the core (less food & energy) which are both no better than the low estimates. Year-on-year rates are also at the low estimates, at 1.7 percent each. Moderation in housing costs remains a major disinflationary force, inching only 0.1 percent higher for a yearly 2.8 percent which is down 2 tenths from June. And wireless services, in keeping with the telecom revolution, continue to move lower, falling 0.3 percent on the month for a yearly decline of 13.3 percent.

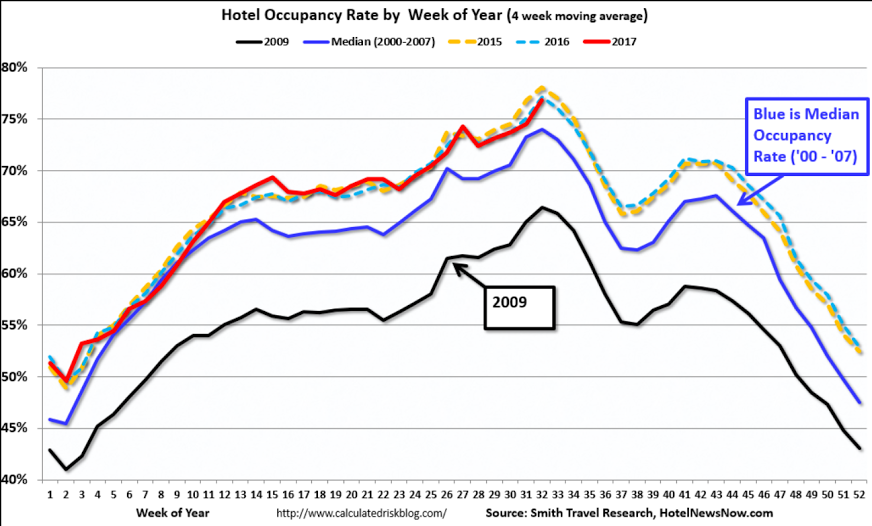

Vehicle sales have been weak this year and it’s being reflected in prices which fell 0.5 percent in the month. Lodging away from home is another major negative in the July report, falling a record 4.2 percent as motels and hotels cut prices. On the plus side, apparel prices, which had been on a long negative streak, rose 0.3 percent though the year-on-year rate remains in the negative camp at minus 0.4 percent. Medical care is a plus in the report, rising 0.4 percent for the second straight month with the year-on-year rate, however, edging lower to 2.6 percent. Energy prices are a negative in the report, at minus 0.1 percent, offset by a 0.2 percent rise for food.

Is the dip in inflation the result of one-time effects that will soon pass? Or is it the result of weak wages and general global disinflation? Lack of inflation remains the central trouble in the Federal Reserve’s policy efforts. Today’s results will not be improving expectations for the beginning of balance-sheet unwinding at the September FOMC.

Interesting how both core and headline CPI growth reversed and began deceleration just over 6 months ago as well:

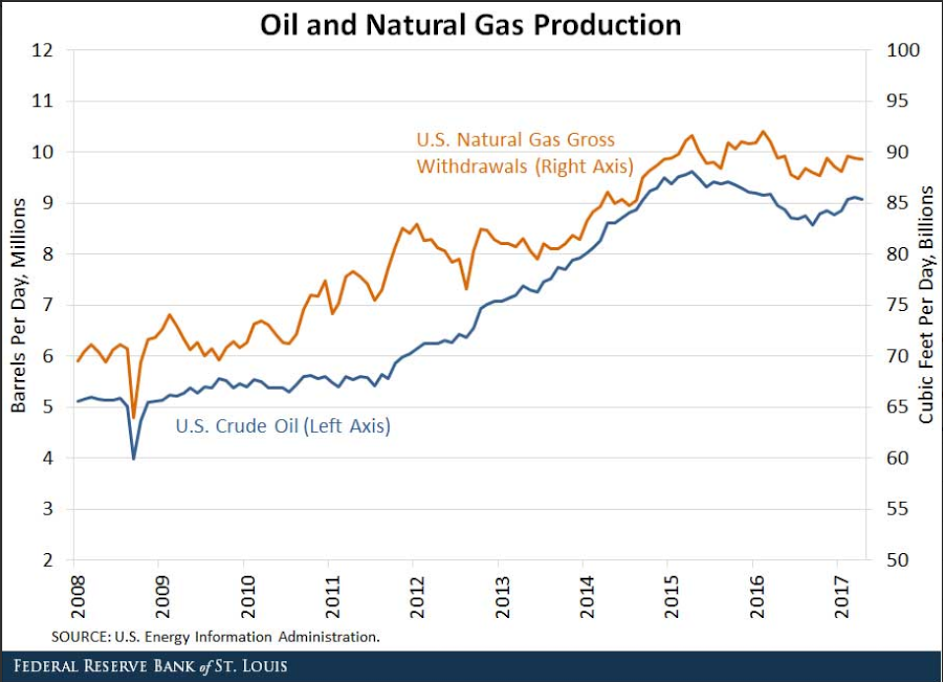

Crude production has leveled off? Gas as well?

Competition from Air B%B?

From HotelNewsNow.com: STR: US hotel results for week ending 5 August

The U.S. hotel industry reported mostly negative year-over-year results in the three key performance metrics during the week of 30 July through 5 August 2017, according to data from STR.

In comparison with the week of 31 July through 6 August 2016, the industry recorded the following:

Occupancy: -1.5% to 74.5% Average daily rate (ADR): +0.7% to US$129.00 Revenue per available room (RevPAR): -0.8% to US$96.08

Read more at http://www.calculatedriskblog.com/#Abl5O3RLz78wWYJb.99