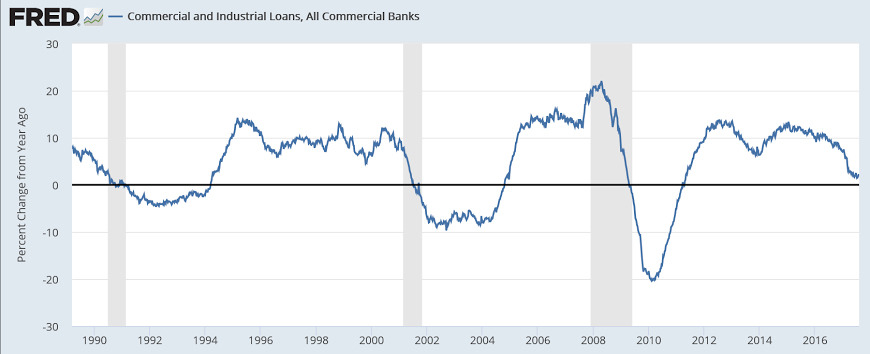

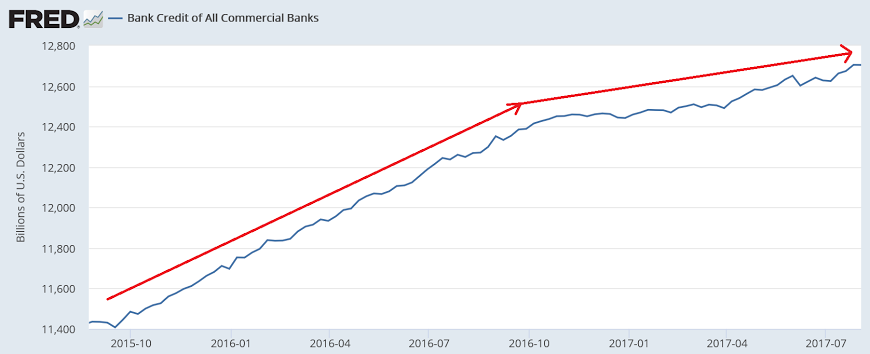

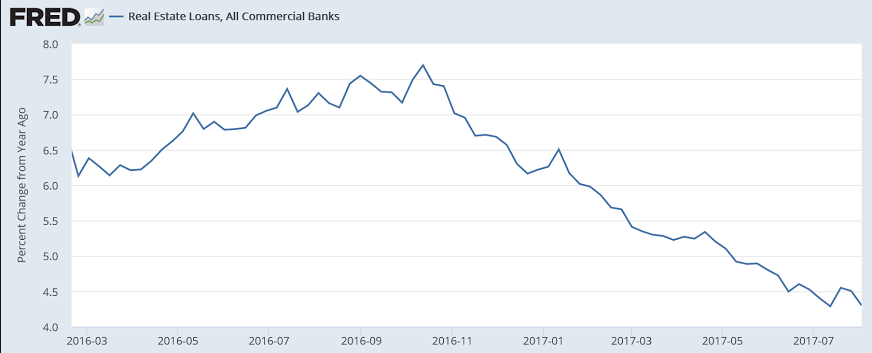

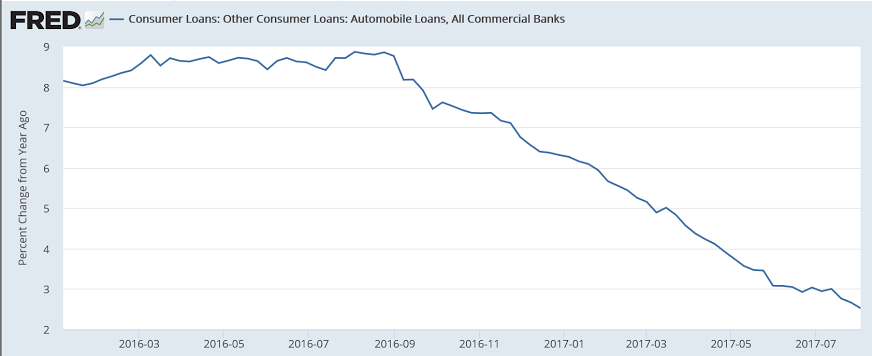

This kind of deceleration has always been associated with recession: Bending the curve: Actual lending continues to decelerate: So for the last 6 months the Fed is seeing a steep decline in credit growth and a softening in price pressures, wage growth, employment growth, auto sales, home sales and permits, retail sales, and personal income. Apart from that things are looking up!;)

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

This kind of deceleration has always been associated with recession:

Bending the curve:

Actual lending continues to decelerate:

So for the last 6 months the Fed is seeing a steep decline in credit growth and a softening in price pressures, wage growth, employment growth, auto sales, home sales and permits, retail sales, and personal income. Apart from that things are looking up!

;)