Income a bit higher than expected due to higher interest income, but as per the charts income growth has slowed and seems the only thing keeping spending growing even at these very modest levels is consumers dipping into savings: Highlights Inflation is showing the slightest bit of life yet probably more than enough to assure a rate hike at this month’s FOMC. The core PCE price index, which is the inflation gauge FOMC members most closely watch, rose an as-expected 0.2 percent in October with September revised 1 tenth higher and now also at 0.2 percent. October’s year-on-year rate also made expectations at 1.4 percent with the prior month again revised 1 tenth higher and also at 1.4 percent. These rates are far from overheating but the forward direction, however glacial,

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

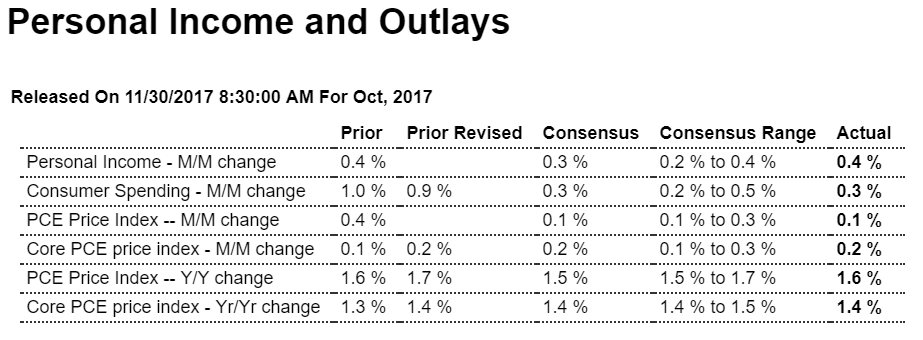

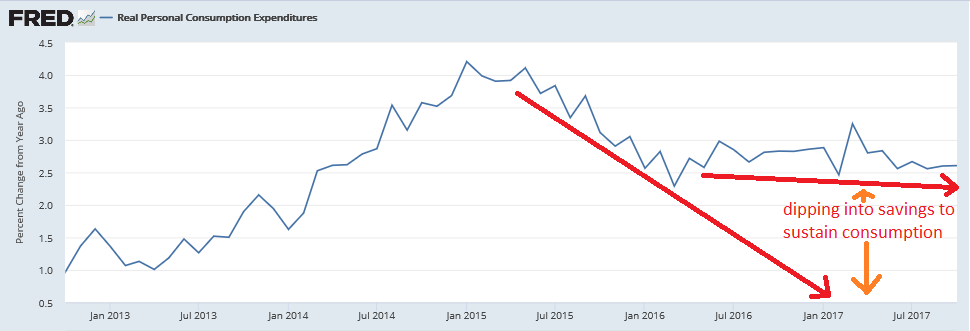

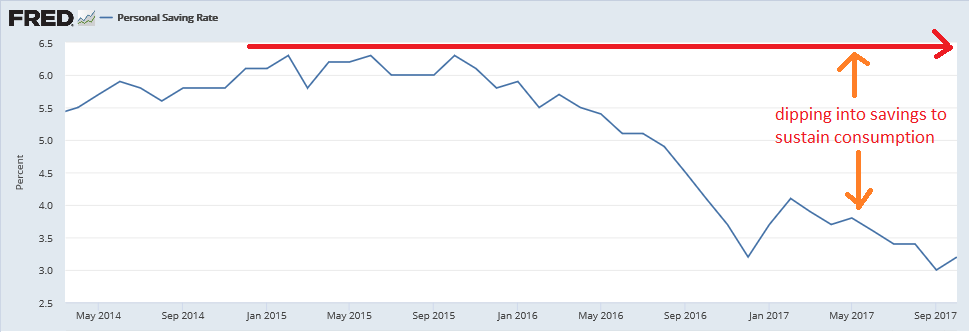

Income a bit higher than expected due to higher interest income, but as per the charts income growth has slowed and seems the only thing keeping spending growing even at these very modest levels is consumers dipping into savings:

Highlights

Inflation is showing the slightest bit of life yet probably more than enough to assure a rate hike at this month’s FOMC. The core PCE price index, which is the inflation gauge FOMC members most closely watch, rose an as-expected 0.2 percent in October with September revised 1 tenth higher and now also at 0.2 percent. October’s year-on-year rate also made expectations at 1.4 percent with the prior month again revised 1 tenth higher and also at 1.4 percent. These rates are far from overheating but the forward direction, however glacial, is favorable for policy makers who are trying to push inflation gradually higher.

Other readings in the report are mixed with personal income getting a special boost from interest income and rising 0.4 percent which is 1 tenth above expectations and actually at the high estimate. Yet the wages & salaries component for income, which is key, is up only 0.3 percent which is soft and down 2 tenths from September. Spending is also soft, up 0.3 percent as expected and reflecting a slight downtick in durable goods as vehicle sales in October, though strong, couldn’t match September’s hurricane-replacement spike.

The savings rate remains low though it did rise 2 tenths to 3.2 percent. In comparison to employment or the sparks appearing in the factory and housing sectors, this report offers a more subdued view of the economy, much like yesterday’s Beige Book where modest-to-moderate was the theme. For Fed policy, spending and income don’t point to any urgency for a rate hike but the high level of employment does as it threatens, at least in theory, to ignite a burst of wage-push inflation.

The income curve remains bent, as the rate of growth shifted as oil related capital expenditures collapsed late in 2014

This is not sustainable:

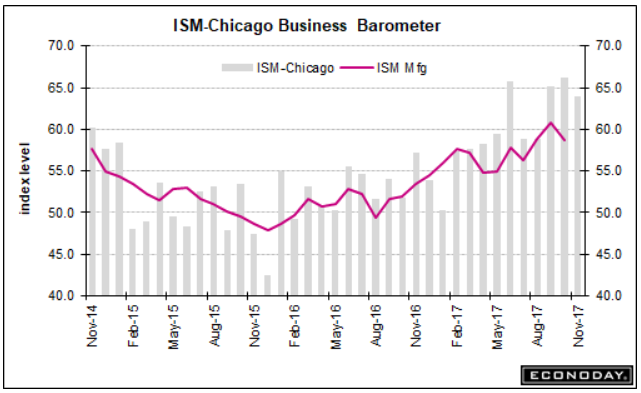

Survey data continues to show optimism so far generally unmatched by the hard data:

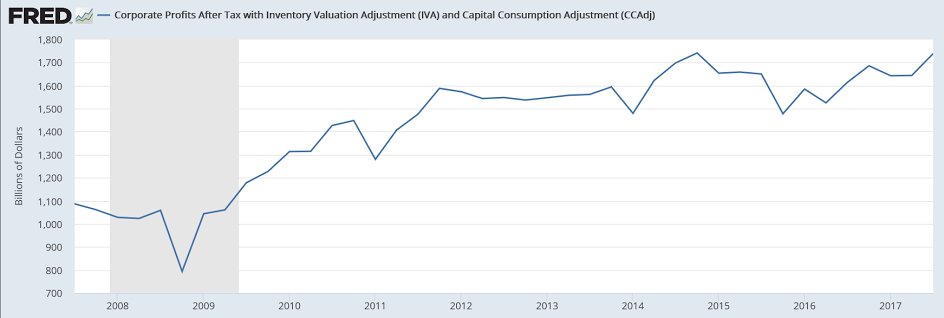

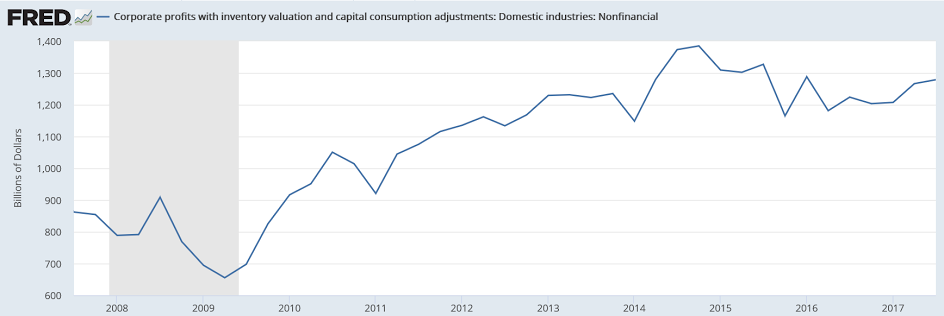

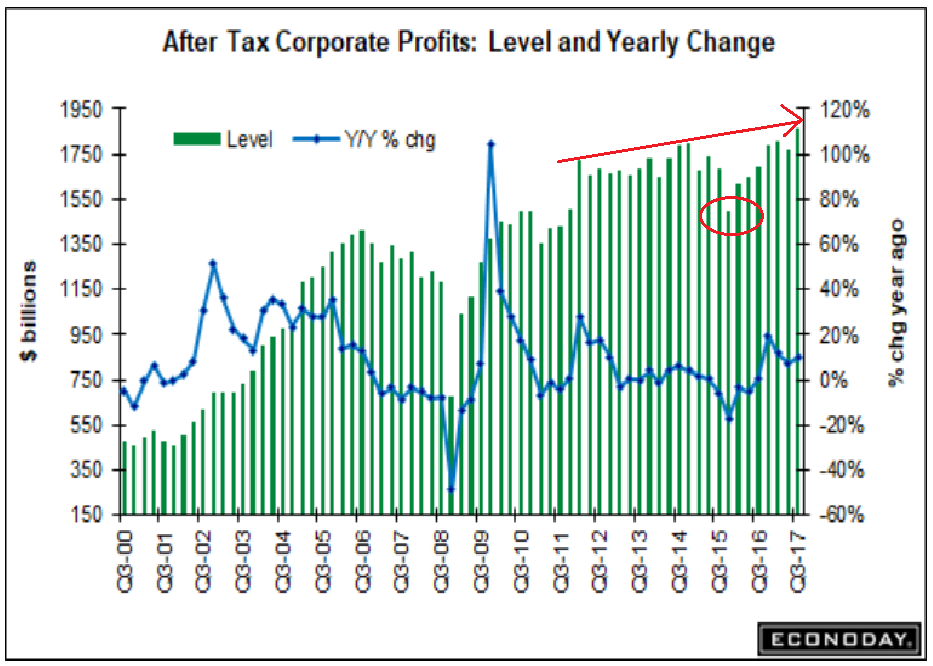

Corporate profits are up about 10% from a year ago, which was a low point, but nearly flat over the last 6 years or so: