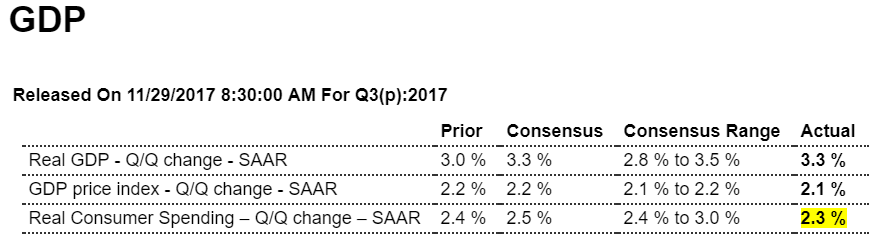

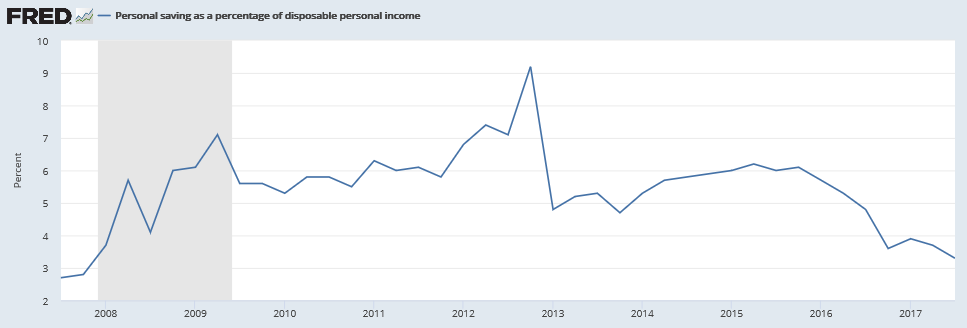

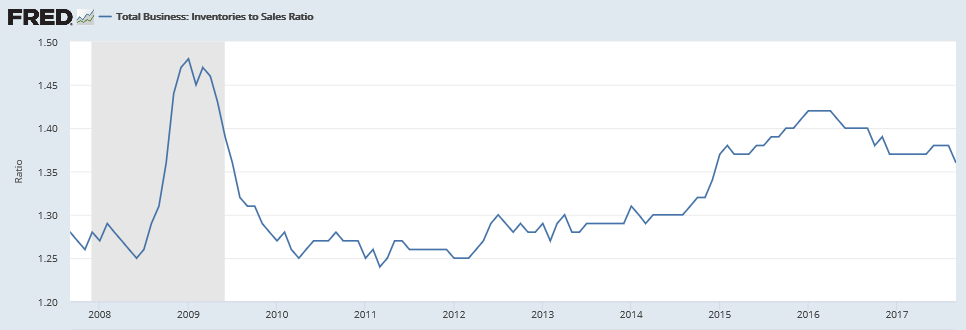

First revision has the consumer a bit weaker than expected, which means the savings rate isn’t quite as weak as initially reported. The savings rate, however, is still unsustainable weak, meaning either consumer spending falls further or personal income growth reverses its deceleration. The other revisions include an increase in already too high inventories that have already turned negative in Q4, and a smaller trade deficit that is now showing increases in q4. And the hurricane assisted boost in auto sales has more recently reversed as well: Highlights Third-quarter GDP proved even more solid than the first estimate, revised 3 tenths higher in the second estimate to an as-expected 3.3 percent annualized rate. Nonresidential investment and inventory growth added a little

Topics:

WARREN MOSLER considers the following as important: Economic Releases, Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

First revision has the consumer a bit weaker than expected, which means the savings rate isn’t quite as weak as initially reported. The savings rate, however, is still unsustainable weak, meaning either consumer spending falls further or personal income growth reverses its deceleration. The other revisions include an increase in already too high inventories that have already turned negative in Q4, and a smaller trade deficit that is now showing increases in q4. And the hurricane assisted boost in auto sales has more recently reversed as well:

Highlights

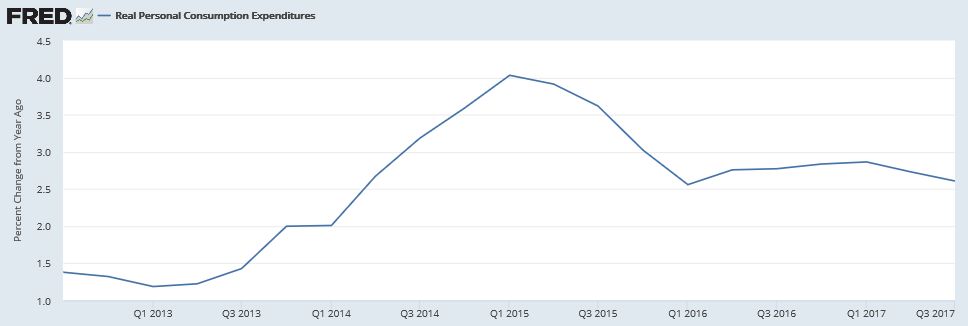

Third-quarter GDP proved even more solid than the first estimate, revised 3 tenths higher in the second estimate to an as-expected 3.3 percent annualized rate. Nonresidential investment and inventory growth added a little more in the second estimate while residential investment and net exports subtracted a little less. These offset a slightly smaller contribution from consumer spending, at a 2.3 percent rate vs 2.4 percent in the first estimate and expectations for 2.5 percent. The drop off on the consumer side was centered in durables which, despite a slight downgrade, still grew at an 8.1 percent rate getting a boost from hurricane-replacement demand for autos.

Turning back to inventories, whether builds are actually positive or negative for the outlook are always difficult to assess, but given this year’s general strength in consumer and business demand, the third-quarter build is probably a positive for the outlook, suggesting that businesses were stocking up for strength ahead including for the holiday shopping season.

Consumer spending, despite auto sales, wasn’t on fire in the third quarter though the outlook for the fourth quarter, given what are very high expectations for holiday spending, are positive. Early expectations for fourth-quarter GDP are once again in the 3 percent range.

This is being held up by consumers dipping into savings to sustain their spending:

This is from two weeks ago:

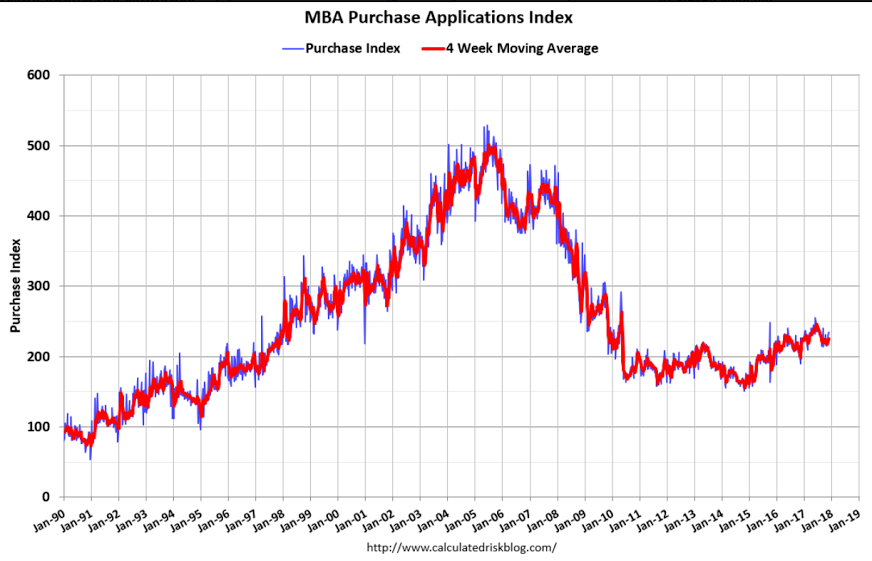

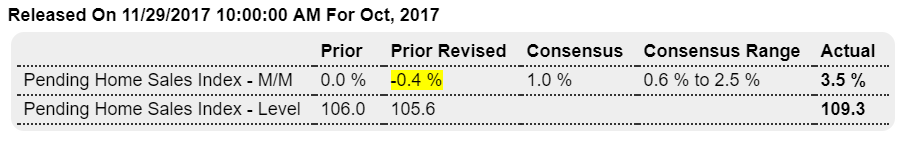

Hurricane story, sales still very weak historically:

Highlights

Led by a hurricane bounce in the South, the pending home sales index jumped a much sharper-than-expected 3.5 percent in October which points to continued gains for final sales of existing homes. Pending sales in the South jumped 7.4 percent in October after falling 3.0 percent during the hurricane swept month of September. The index level in the South, at 123.6, far outdistances all other regions and compares against 109.3 for the total index. October’s overall gain follows two months of sharp increases in new home sales and will boost confidence that housing, after a mostly flat year, is pivoting higher at year end.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, rose 3.5 percent to 109.3 in October from a downwardly revised 105.6 in September. The index is now at its highest reading since June (110.0), but is still 0.6 percent below a year ago.

Read more at http://www.calculatedriskblog.com/#vRbrDXSwqADlwL5M.99

And no sign of a sudden spike in mtg purchase apps here: