As previously discussed, the food export spike was a one time event: Highlights With housing and manufacturing showing strength the outlook for fourth-quarter GDP was building, until that is this morning’s advance trade and inventory data. October’s goods deficit was much higher-than-expected, at .3 billion for a very sizable .2 billion increase from September. The details speak to weakness with exports down 1.0 percent, reflecting declines for food products and capital goods, while imports rose 1.5 percent on increases in industrial supplies and, once again, consumer goods. Inventory data for October show draws for both wholesalers and retailers, at minus 0.4 percent and minus 0.1 percent respectively which are both negative for GDP. Both trade, where the deficit

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

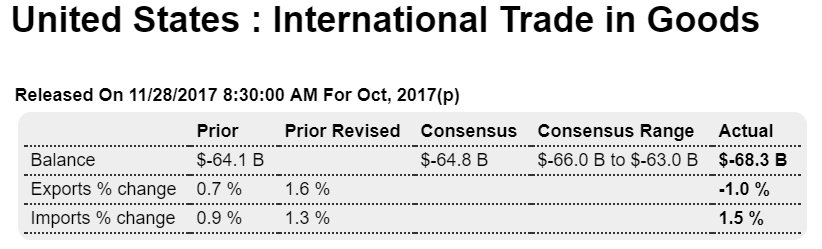

As previously discussed, the food export spike was a one time event:

Highlights

With housing and manufacturing showing strength the outlook for fourth-quarter GDP was building, until that is this morning’s advance trade and inventory data. October’s goods deficit was much higher-than-expected, at $68.3 billion for a very sizable $4.2 billion increase from September. The details speak to weakness with exports down 1.0 percent, reflecting declines for food products and capital goods, while imports rose 1.5 percent on increases in industrial supplies and, once again, consumer goods.

Inventory data for October show draws for both wholesalers and retailers, at minus 0.4 percent and minus 0.1 percent respectively which are both negative for GDP.

Both trade, where the deficit had been narrowing, and inventories, where builds had been rising, were positives for second- and third-quarter GDP but the opening fourth-quarter look at these two components point to understandable give back.

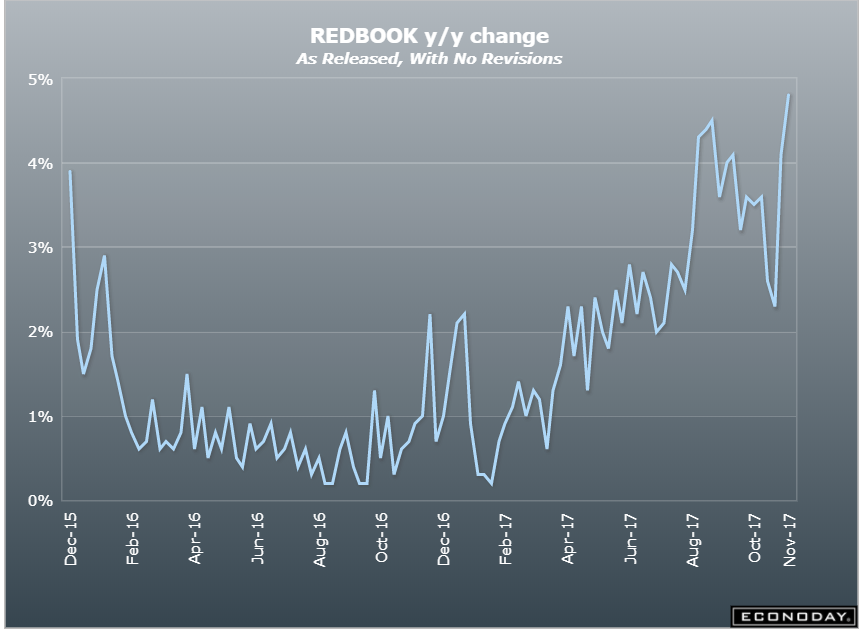

Definitely looking up for ‘same store sales’ and heading back to ‘normal’ levels, but not sure why. Could be due to fewer retail outlets or maybe higher prices?

Up nicely, but check out the details:

Highlights

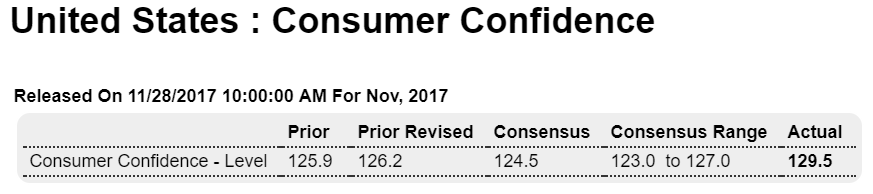

Consumer confidence continues to soar, at 129.5 in November which is a new 17-year high and easily surpasses Econoday’s top estimate. The strength is derived from the labor market where a very low 16.9 percent describe jobs as currently hard to get. This reading is closely watched and will boost expectations for another strong monthly employment report. And extending strength is expected for the labor market with optimists on the jobs outlook surging nearly 4 percentage points to 22.6 percent and nearly double pessimists who are down 6 tenths to only 11.0 percent. Confidence is likewise booming for the stock market where 46.0 percent see stocks rising over the next year which is up 3.8 points from October. Bears are down to 19.0 percent from last month’s 22.7 percent.

The combination of expected gains in jobs together with expected gains for stocks is making for unusual confidence in the year-ahead income outlook where 20.1 percent see gains and only 7.6 percent see declines. This is a core reading and underscores the report’s level of strength.

Not favorable, however, are inflation expectations which are down 2 tenths to 4.5 percent which is very low for this reading. Buying plans are mixed with cars, after a spike in October, back down but with housing up.

Wage growth has been limited but so has price inflation which perhaps is another factor boosting income expectations. In any case, consumer confidence as measured by this report and others is enjoying its best run in a generation.

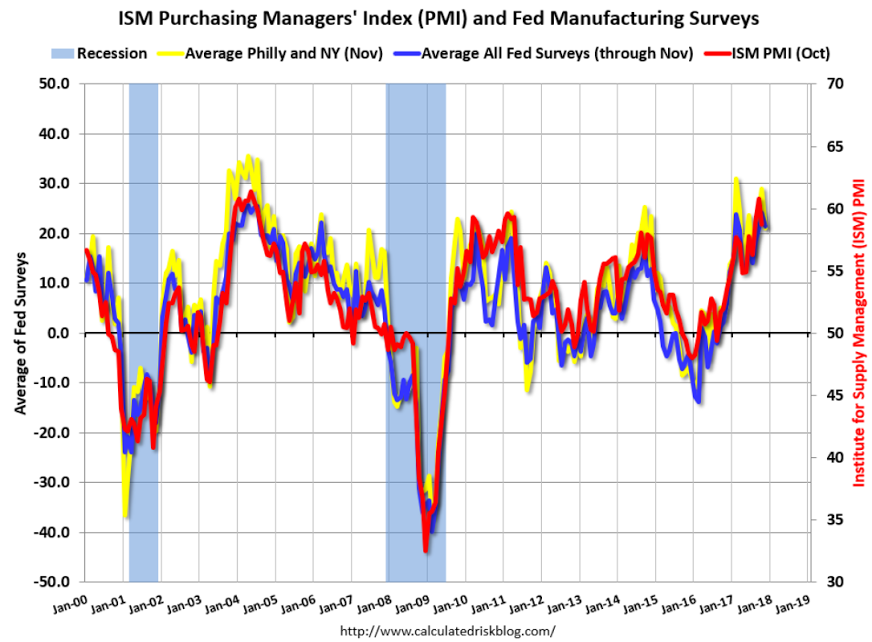

Survey data still optimistic: