As previously discussed, the US bill for oil imports went up: Highlights Fourth-quarter net exports get off to a weak start as October’s trade deficit, at .7 billion, comes in much deeper than expected and well beyond September’s revised .9 billion. Exports, at 5.9 billion in the month, failed to improve in the while imports, at 4.6 billion, rose a steep 1.6 percent. Price effects for oil, up more than to .26 per barrel, are to blame for much of the rise in imports inflating costs of industrial supplies including crude where the deficit rose .5 billion to .7 billion, but consumer goods are also to blame, imports of which rose 0 million in the month to .0 billion. Exports of capital goods are the largest category on the export side and they

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

As previously discussed, the US bill for oil imports went up:

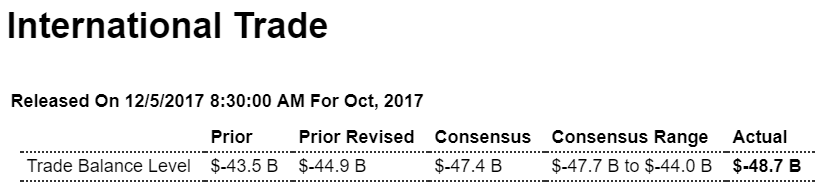

Highlights

Fourth-quarter net exports get off to a weak start as October’s trade deficit, at $48.7 billion, comes in much deeper than expected and well beyond September’s revised $44.9 billion. Exports, at $195.9 billion in the month, failed to improve in the while imports, at $244.6 billion, rose a steep 1.6 percent. Price effects for oil, up more than $2 to $47.26 per barrel, are to blame for much of the rise in imports inflating costs of industrial supplies including crude where the deficit rose $1.5 billion to $10.7 billion, but consumer goods are also to blame, imports of which rose $800 million in the month to $50.0 billion.

Exports of capital goods are the largest category on the export side and they fell back $1.2 billion to $43.9 billion and reflect a $1.1 billion drop in aircraft where strength in orders, however, points to better aircraft exports to come. Exports for both vehicles, at $12.6 billion, and consumer goods, at $16.3 billion, both declined.

Country data show the monthly gap with China deepening $600 million to $35.2 billion and with Japan by $1.6 billion to $6.4 billion. The EU gap widened by $2.3 billion to $13.7 billion. The gap with Mexico rose $900 million to $6.6 billion and Canada $1.5 billion deeper at $1.8 billion.

Today’s report is not favorable for fourth-quarter GDP but doesn’t derail at all what has been an ongoing run of mostly solid economic results.

Looks like things are settling down:

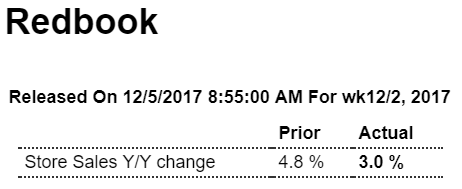

Highlights

Same store sales were up 3.0 percent year-on-year in the December 2 week, decelerating by a steep 1.5 percentage points from the prior week’s pace. Month-to-date sales versus the previous month were down 0.9 percent, 0.7 percentage points weaker than last week’s reading, while the gain in full month year-on-year sales shed 0.5 percentage points to 3.0 percent. The week’s sharp setback from the strongest reading in 3 years registered in the prior week by retailers in Redbook’s same-store sample may signal more moderate growth in ex-auto ex-gas retail sales during the key Christmas sales period.

The surveys are starting to come off their trumped up levels:

Markit PMI services:

ISM non manufacturing: