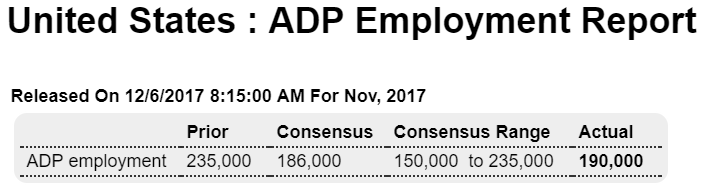

Winding down from post hurricane levels, however keep in mind this is a forecast of Friday’s number, not report of actual private payrolls: Highlights A pre-hurricane total of 190,000 is ADP’s call for November private payroll growth which would follow a hurricane-related upswing of 252,000 in October and 15,000 downswing in September. This fits with Econoday’s consensus for Friday’s November report where private payrolls are expected to rise 184,000. Demand for labor has been very strong this year though wage traction has still been limited. Note that ADP’s October call is unrevised at 235,000. The quarterly chart for the growth of hours worked shows a lower growth rate: Overall looks to be flat to down vs last year: Planned Capital Spending – November 2017 Combined

Topics:

WARREN MOSLER considers the following as important: Economic Releases, Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Winding down from post hurricane levels, however keep in mind this is a forecast of Friday’s number, not report of actual private payrolls:

Highlights

A pre-hurricane total of 190,000 is ADP’s call for November private payroll growth which would follow a hurricane-related upswing of 252,000 in October and 15,000 downswing in September. This fits with Econoday’s consensus for Friday’s November report where private payrolls are expected to rise 184,000. Demand for labor has been very strong this year though wage traction has still been limited. Note that ADP’s October call is unrevised at 235,000.

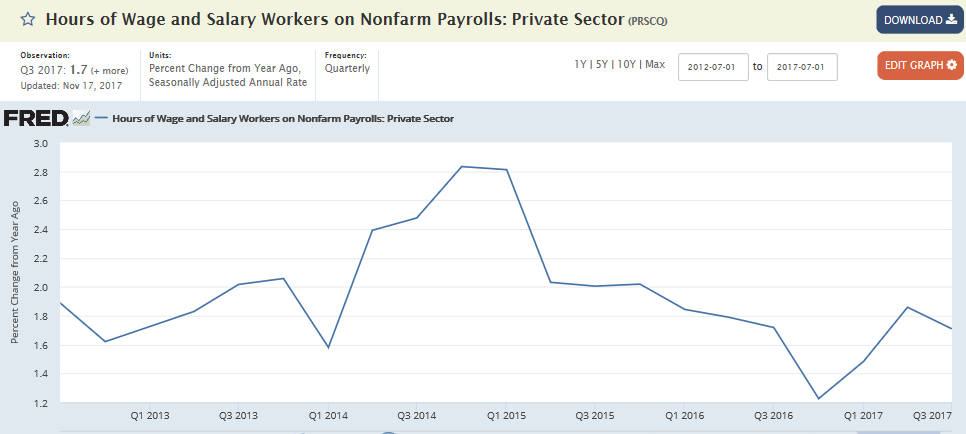

The quarterly chart for the growth of hours worked shows a lower growth rate:

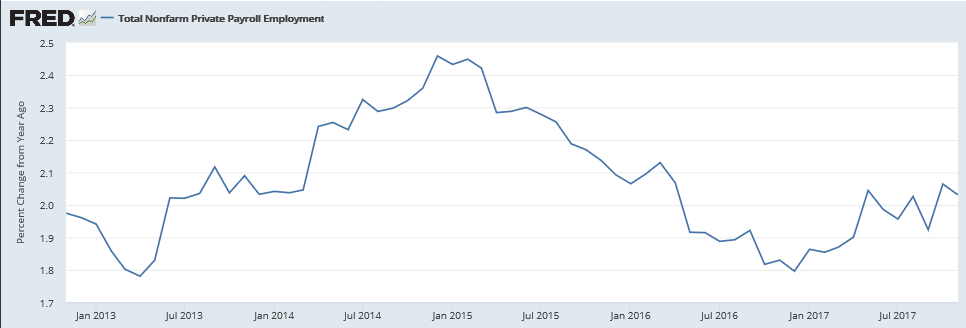

Overall looks to be flat to down vs last year:

Planned Capital Spending – November 2017

Combined U.S. & Canadian Industrial Spending Falls 30 Percent

RALEIGH, NC –December 1, 2017

Research by Industrial Reports, Inc. shows combined U.S. and Canadian planned capital spending dropped dramatically in November compared to October. November spending for the two nations totaled $36.83 billion compared to October’s $53.37 billion. The research organization reported 239 planned U.S. and Canadian projects in November.

Planned U.S. project spending sunk in November with $30.33 billion in planned investment compared to the October total of $48.97 billion. However, Canadian planned investment improved with $6.50 billion in November compared to $4.40 billion in October. Projects in both nations ranged in value from $800,000 to $6 billion.

Process projects led U.S. spending with $22.83 billion in planned investment, followed by manufacturing projects with $3.24 billion. Power and energy projects reported $1.96 billion in planned U.S. spending.

In Canada, process projects led all markets with $6.19 billion in planned spending, while power and energy projects accounted for $84 million.

Texas led the U.S. in planned investment for the month with $11.90 billion, followed by Louisiana with $4.98 billion and California with $2.02 billion

In Canada, Alberta led the provinces and territories with $4.51 billion in planned spending. British Columbia reported $591 million and Ontario reported $267 million.

Texas was the leader in U.S. project activity with 19 planned projects. New York and Ohio each reported 13 planned projects while North Carolina reported 12.

Alberta led Canadian project activity with eight planned projects. British Columbia reported seven and Ontario five.

More evidence Saudis may be on the move towards higher prices:

Aramco Raises Light Crude Pricing to Asia to Three-Year High

Aramco raises Arab Light pricing for January sales by 40c/bbl to $1.65 vs Oman/Dubai benchmark, according to emailed statement.

Co. increases pricing for all grades to Asia and NW Europe Co. cuts pricing for all grades to U.S. Aramco raises Light, Extra Light pricing to Mediterranean region, keeps Medium, Heavy grades unchanged