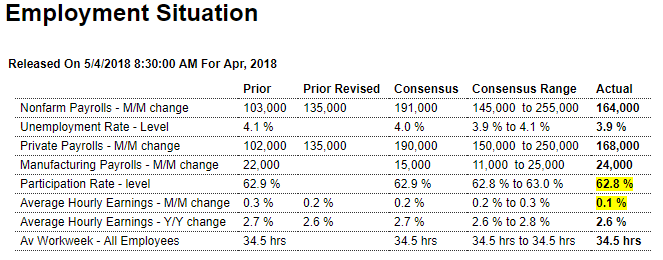

Economic intuitive sectors of employment were mixed with truck transport contracting. This month’s report internals (comparing household to establishment data sets) was inconsistent with the household survey showing seasonally adjusted employment expanding only 3,000 vs the headline establishment number expanding 164,000. The point here is that part of the headlines are from the household survey (such as the unemployment rate) and part is from the establishment survey (job growth). From a survey control point of view – the common element is jobs growth – and if they do not match, your confidence in either survey is diminished. [note that the household survey includes ALL jobs growth, not just non-farm). The household survey removed 236,000 people to the labor force.

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

Economic intuitive sectors of employment were mixed with truck transport contracting. This month’s report internals (comparing household to establishment data sets) was inconsistent with the household survey showing seasonally adjusted employment expanding only 3,000 vs the headline establishment number expanding 164,000. The point here is that part of the headlines are from the household survey (such as the unemployment rate) and part is from the establishment survey (job growth). From a survey control point of view – the common element is jobs growth – and if they do not match, your confidence in either survey is diminished. [note that the household survey includes ALL jobs growth, not just non-farm). The household survey removed 236,000 people to the labor force.

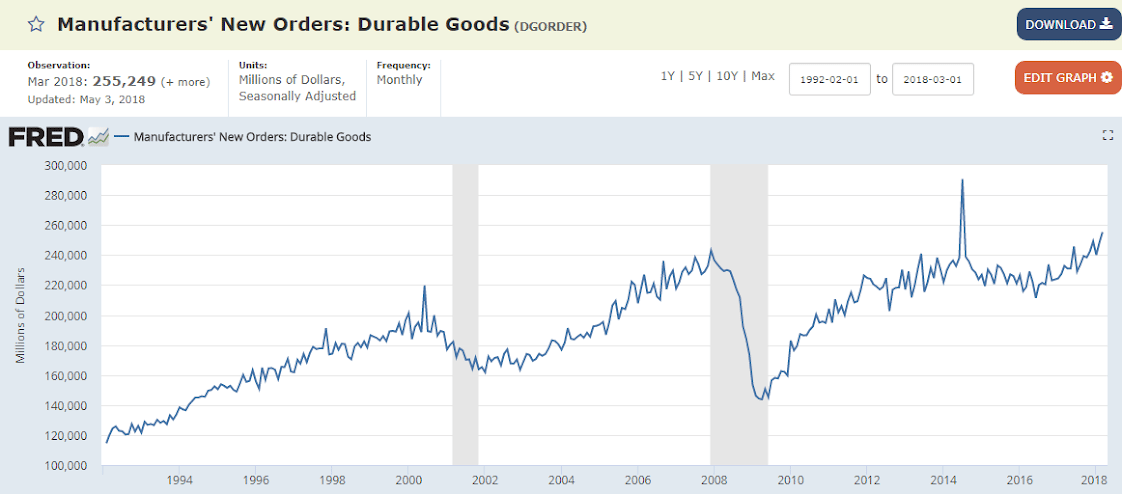

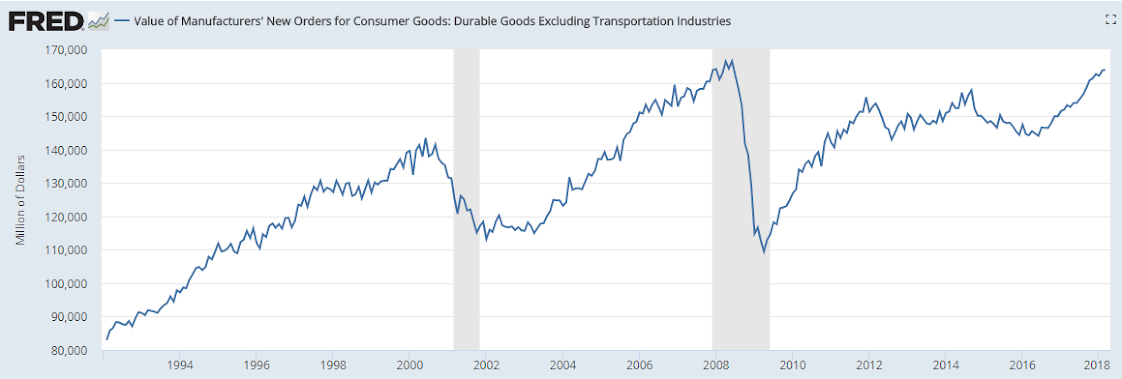

Growing modestly but on an inflation adjusted basis still well below 2008 levels:

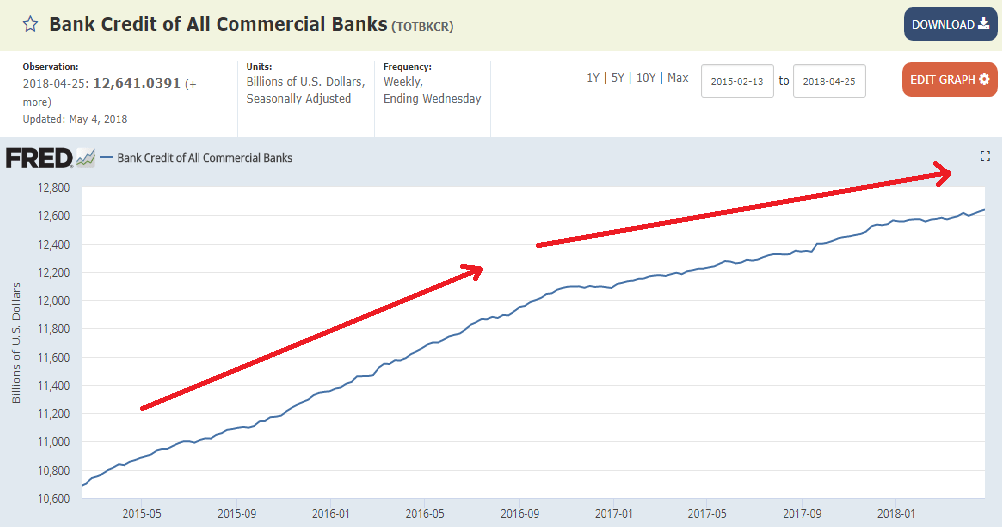

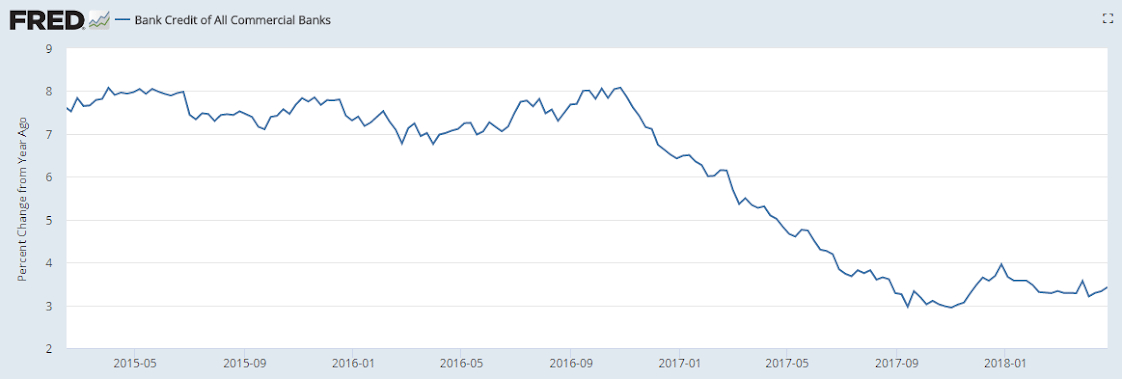

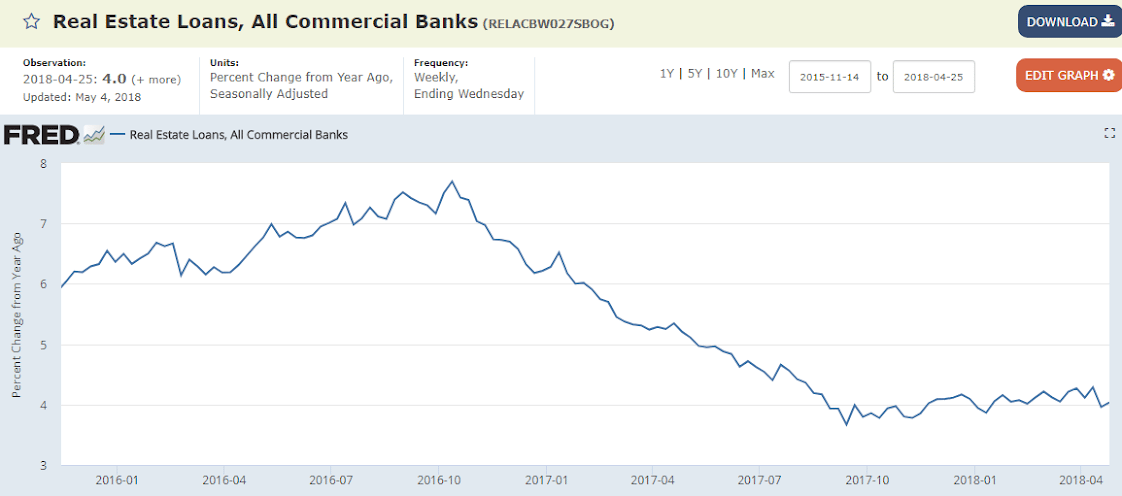

Total bank credit growth abruptly slowed in 2016 around election time and has yet to pick up:

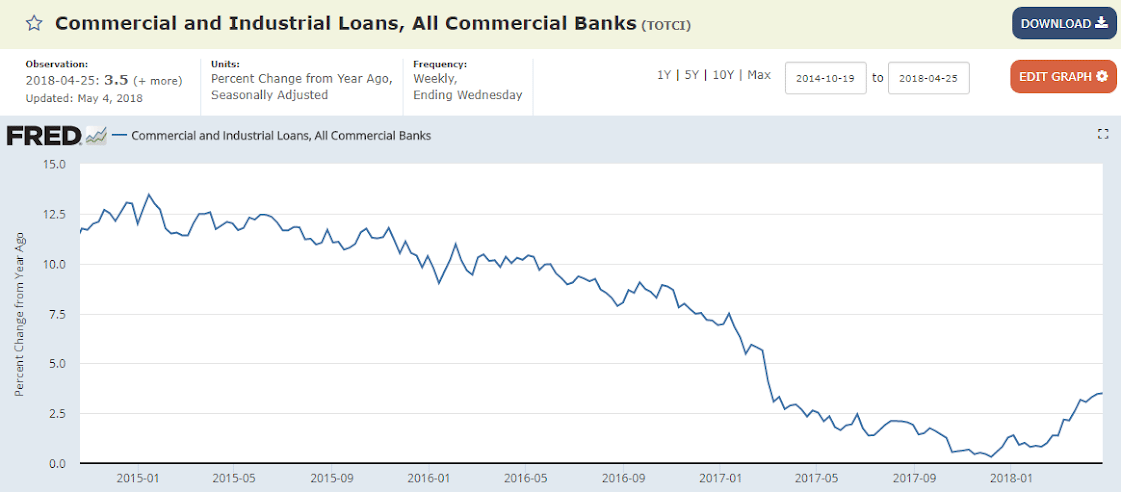

C and I loan growth picked up a bit recently but is still way down from prior rates of growth:

Some of the decline can be blamed on the Chinese Lunar New Year. The holiday cut into smartphone production. As a result, on a sequential basis, shipments declined 34% from the fourth quarter of last year. Since the fourth quarter includes the holiday shopping season, that decline might not be as ominous as the 13.4% drop year-over-year. Chinese shipments as a percentage of the total number of Q1 global smartphone deliveries dropped under 30%.