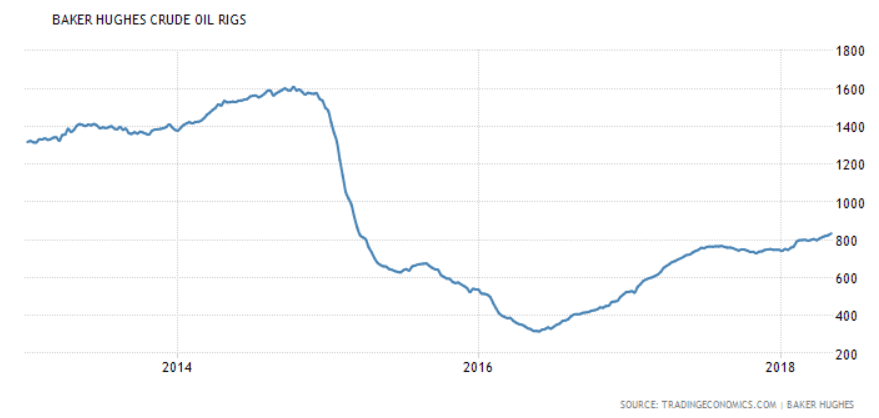

There is now growing evidence that the economy’s deceleration that followed the collapse of oil related capital expenditures at the end of 2014 continued for about two years after which it reversed course. This means the collapse in private sector deficit spending was replaced by other sources of deficit spending, some of it public, the rest private. The increase in private sector deficit spending was apparently not bank financed, as indicated by bank lending statistics, so seems it must have been done in the capital markets. First quarter weakness, if not reversed in q2, would indicate the contribution of private sector deficit spending is fading, as happened with consumer credit: The resumption of oil capex is part of the answer: Note the dip followed by a

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

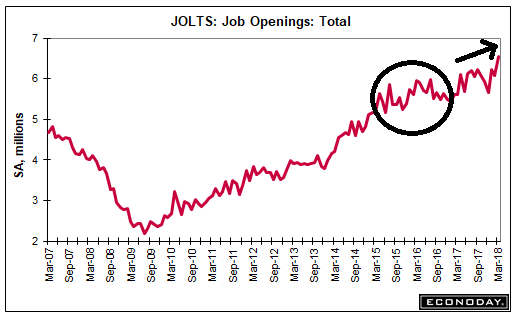

There is now growing evidence that the economy’s deceleration that followed the collapse of oil related capital expenditures at the end of 2014 continued for about two years after which it reversed course.

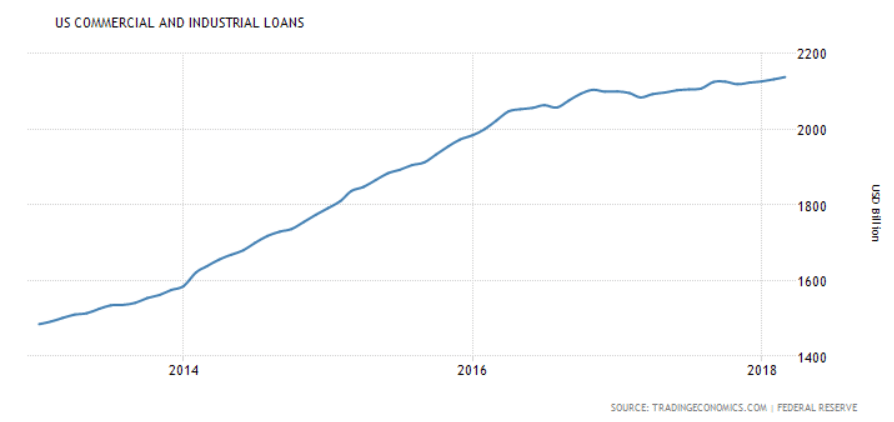

This means the collapse in private sector deficit spending was replaced by other sources of deficit spending, some of it public, the rest private. The increase in private sector deficit spending was apparently not bank financed, as indicated by bank lending statistics, so seems it must have been done in the capital markets.

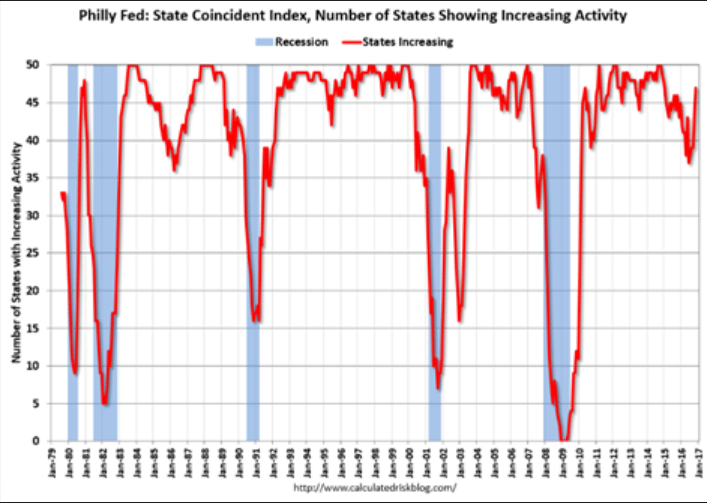

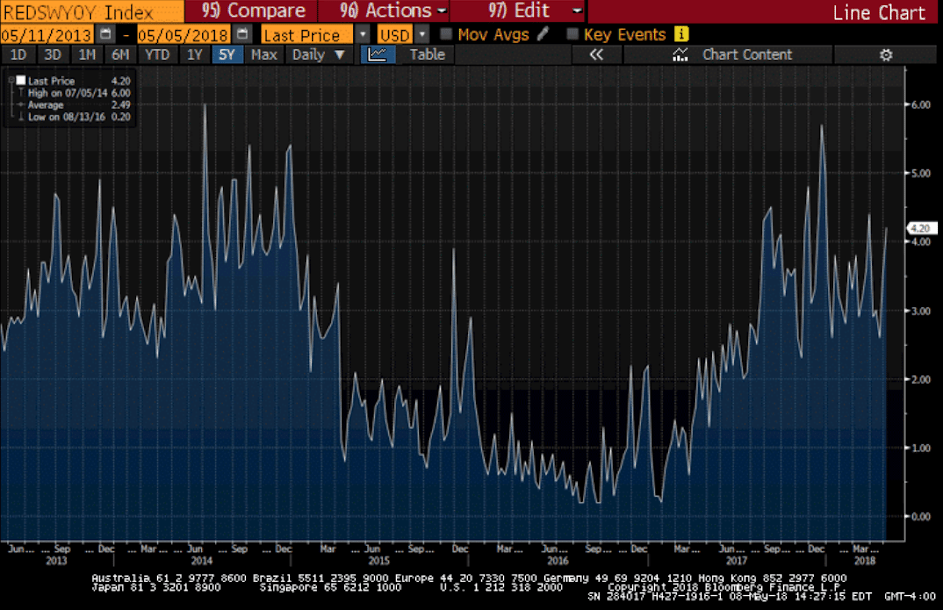

First quarter weakness, if not reversed in q2, would indicate the contribution of private sector deficit spending is fading, as happened with consumer credit:

The resumption of oil capex is part of the answer:

Note the dip followed by a recovery:

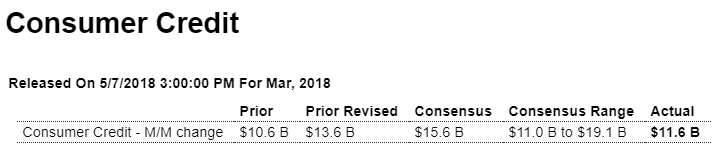

This is not contributing to the apparent reversal:

Highlights

Consumer credit came in on the low side of expectations, up $11.6 billion in March with February revised $3.0 billion higher to $13.6 billion. Revolving credit is once again the weak spot, down $2.6 billion in the month following a $0.5 billion decline in February. Weakness in revolving credit, which includes credit cards, explains at least part of the slowdown in first-quarter consumer spending. Non-revolving credit, which includes both student loans and vehicle loans, rose $14.2 billion in both March and February.

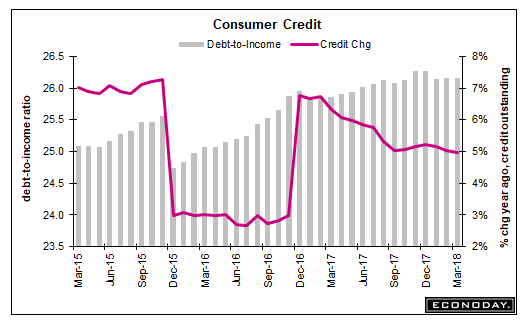

Interesting reversal- historically happens after a recession: