Very friendly article! Modern Money Theory Explained (Vice) Nice increase but year over year remains weak: Highlights With the rise in mortgage rates taking a pause, purchase applications for home mortgages rose by a seasonally adjusted 6.0 percent in the February 23 week. But unadjusted, purchase applications were down 1.0 percent from the prior week, putting the year-on-year gain in the Purchase Index at a rather slim 3.0 percent, while applications for refinancing, which tend to be more sensitive to the level of interest rates, fell 1.0 percent, taking the refinance share of mortgage activity down 2.6 percentage points to 41.8 percent. The average interest rate on 30-year fixed rate conforming mortgages (3,100 or less) remained unchanged from the prior week at 4.64

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

Very friendly article!

Modern Money Theory Explained (Vice)

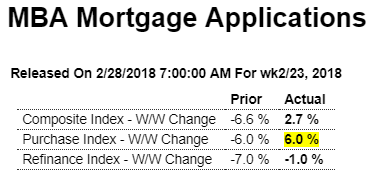

Nice increase but year over year remains weak:

Highlights

With the rise in mortgage rates taking a pause, purchase applications for home mortgages rose by a seasonally adjusted 6.0 percent in the February 23 week. But unadjusted, purchase applications were down 1.0 percent from the prior week, putting the year-on-year gain in the Purchase Index at a rather slim 3.0 percent, while applications for refinancing, which tend to be more sensitive to the level of interest rates, fell 1.0 percent, taking the refinance share of mortgage activity down 2.6 percentage points to 41.8 percent. The average interest rate on 30-year fixed rate conforming mortgages ($453,100 or less) remained unchanged from the prior week at 4.64 percent, the highest level in 4 years. The week’s results include an adjustment for the Presidents’ Day holiday.

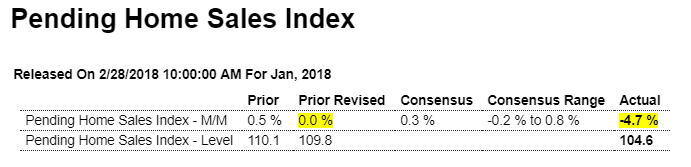

Way down and prior month revised lower as well:

Highlights

Existing home sales appear to be slowing, the latest evidence coming from the pending home sales index which fell an unexpected 4.7 percent in January to a 104.6 level that is the lowest in nearly 3-1/2 years. Today’s result points to a third straight decline for final sales of existing homes which fell very sharply in both January and December.

Lack of supply is a key factor holding down sales along with rising mortgage rates, at an average of 4.64 percent for 30-year mortgages as reported earlier this morning by the Mortgage Bankers Association. Regional sales data show wide declines especially for the Northeast which had been rebounding in prior months.

The housing sector accelerated at the end of last year but, despite strong leadership from the new home market, appears to have slowed so far this year.