A lot worse than expected as sales are clearly going south: U.S. Light Vehicle Sales decrease to 16.7 million annual rate in July Read more at https://www.calculatedriskblog.com/#ZO2HJY5rKwX1XQfU.99 Highlights Purchase applications for home mortgages fell a seasonally adjusted 3 percent in the July 27 week, posting the third weekly decline in a row, while applications for refinancing declined 2 percent. Unadjusted, purchase applications were just 1 percent above the level in the same week a year ago. The refinance share of mortgage activity increased by 0.3 percentage points from the prior week to 37.1 percent. Interest rates resumed their climb, with the average interest rate for 30-year fixed rate conforming mortgages (3,100 or less) rising 7 basis points from the

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

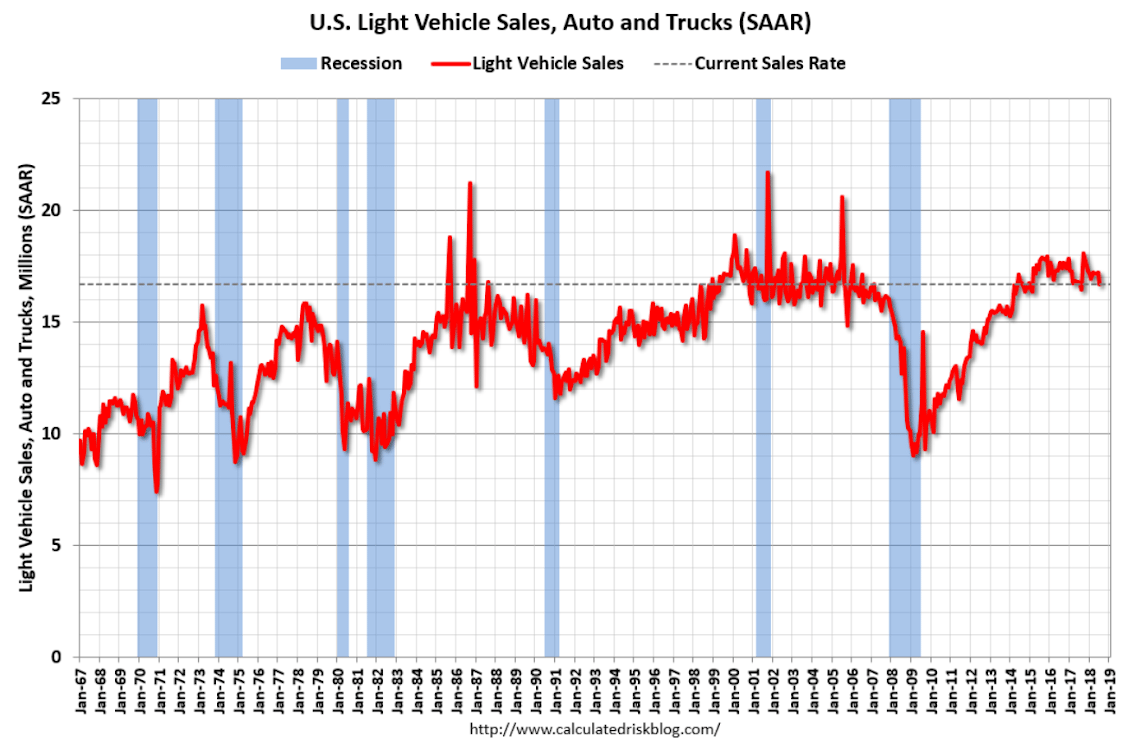

A lot worse than expected as sales are clearly going south:

U.S. Light Vehicle Sales decrease to 16.7 million annual rate in July

Read more at https://www.calculatedriskblog.com/#ZO2HJY5rKwX1XQfU.99

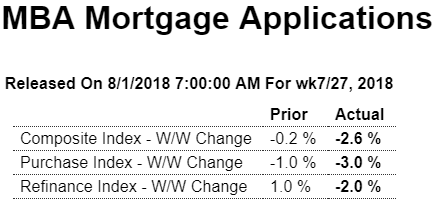

Highlights Purchase applications for home mortgages fell a seasonally adjusted 3 percent in the July 27 week, posting the third weekly decline in a row, while applications for refinancing declined 2 percent. Unadjusted, purchase applications were just 1 percent above the level in the same week a year ago. The refinance share of mortgage activity increased by 0.3 percentage points from the prior week to 37.1 percent. Interest rates resumed their climb, with the average interest rate for 30-year fixed rate conforming mortgages ($453,100 or less) rising 7 basis points from the prior week to 4.84 percent.

Highlights

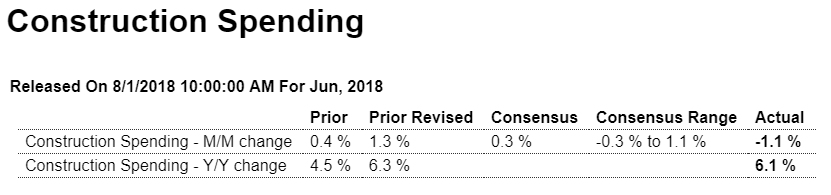

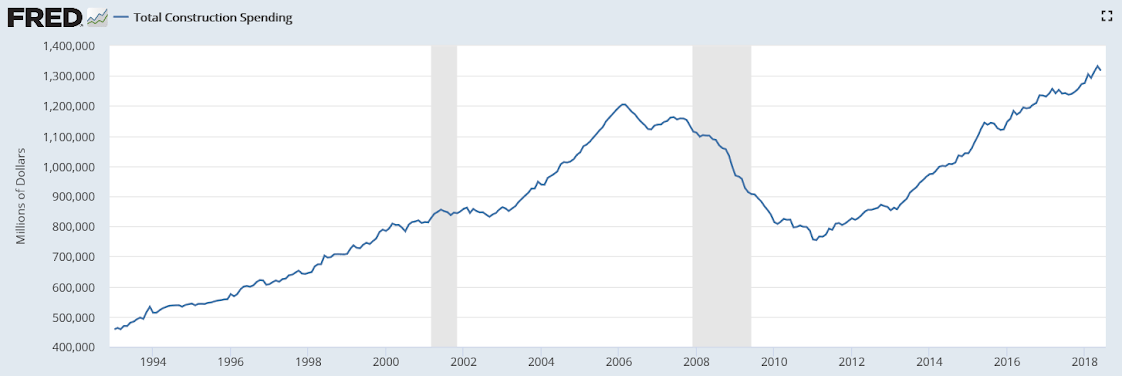

Volatility once again appears in construction spending data as a 1.1 percent June drop was unexpected, coming in far below a plus 0.3 percent consensus gain and Econoday’s low estimate of minus 0.3 percent. Part of the surprise is tied to a sharp 9-tenths upward revision to May, now at plus 1.3 percent, which made the comparison for July more difficult.

Residential spending slowed widely in June especially for new multi-family homes, down 2.8 percent in the month, but also for new single-family homes, down 0.4 percent. Home improvements inched 0.1 percent higher in the month.

Private nonresidential spending slipped 0.3 percent with spending on commercial and power projects down while manufacturing, which had been weak, managed a bounce higher. Public spending on educational projects and highways & streets both declined.

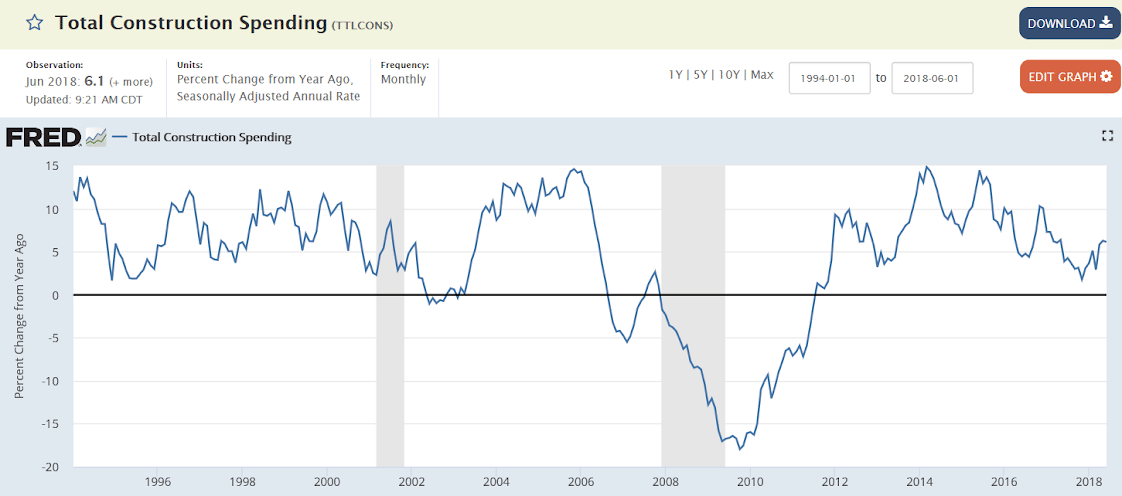

Part of the weakness in construction spending is likely tied to shortages of construction workers, especially skilled labor. High prices for construction materials is another likely negative. And for the residential sector, weakness in new construction will continue to limit buyer choices and overall home sales. Still, stepping back and looking at the year-on-year change offers a reminder that construction is overall very strong, with spending up a year-on-year 6.1 percent.

Doesn’t look strong to me. And these numbers are not adjusted for inflation:

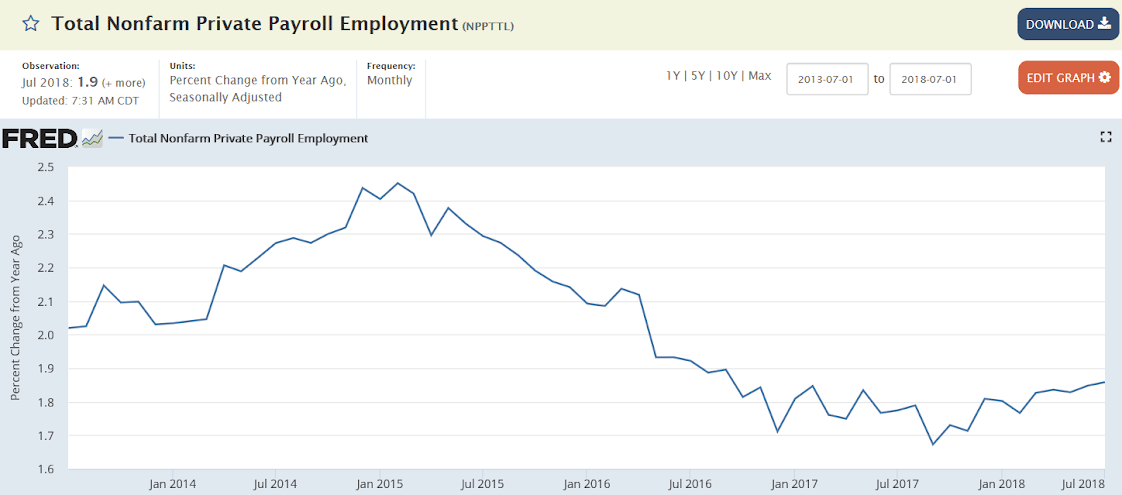

ADP payroll growth:

Another big loss for Tesla, again failing to meet expectations, and cash depleted to $2.2 billion. Stock only up about 5% after hours on expectations for q3… ;)