This alone could add maybe 2% to nominal GDP. How much real output it adds is another question, of course: Trump signs massive spending deal into law and ends year’s second government shutdown Self-professed fiscal hawks in the House also opposed the bill. The nonpartisan Congressional Budget Office estimated Thursday that it would cost about 0 billion. Most of that would come in the first year.The deal includes: A 5 billion increase in military spending; A 1 billion boost to domestic program spending; Nearly billion in funding for disaster relief efforts in Texas, Florida and Puerto Rico; Two years of funding for community health centers; Another four-year extension of the Children’s Health Insurance Program, for a total of a decade; Funding for existing

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

This alone could add maybe 2% to nominal GDP. How much real output it adds is another question, of course:

Trump signs massive spending deal into law and ends year’s second government shutdown

Self-professed fiscal hawks in the House also opposed the bill. The nonpartisan Congressional Budget Office estimated Thursday that it would cost about $320 billion. Most of that would come in the first year.

The deal includes:A $165 billion increase in military spending; A $131 billion boost to domestic program spending; Nearly $90 billion in funding for disaster relief efforts in Texas, Florida and Puerto Rico; Two years of funding for community health centers; Another four-year extension of the Children’s Health Insurance Program, for a total of a decade; Funding for existing infrastructure programs related to transportation, drinking water and broadband.

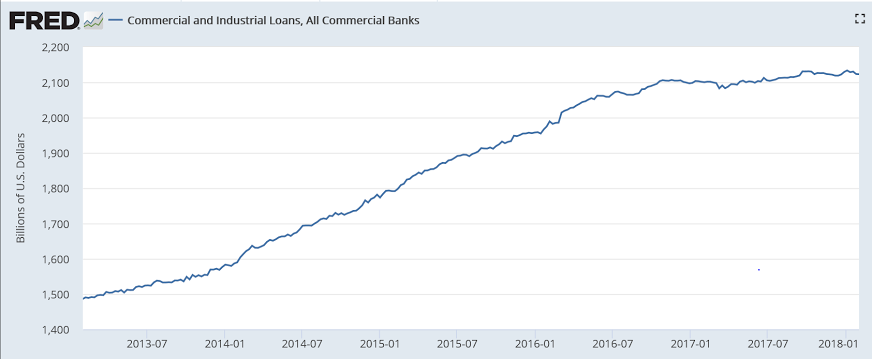

Notice how this went flat right around election time, and has yet to start growing:

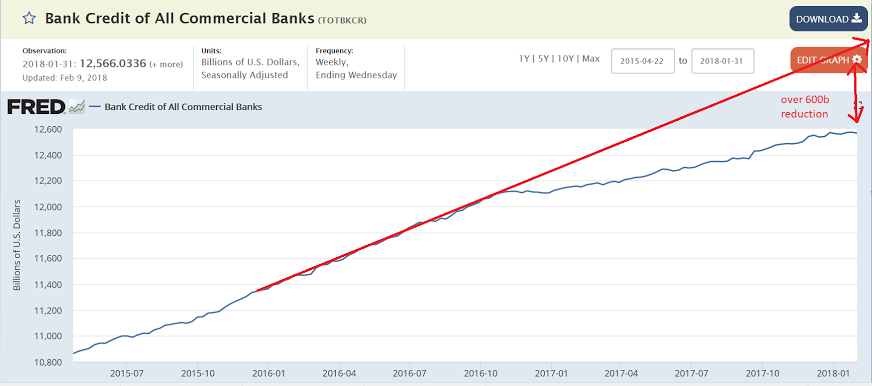

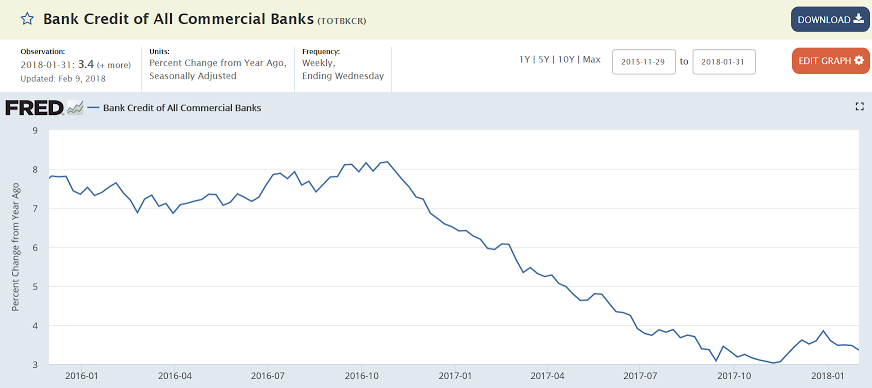

Looking at it this way reveals that there was a reduction in bank lending growth of over $600 billion in 2017 vs 2016, which can be thought of as a reduction of that much private sector deficit spending. Some of this was ‘replaced’ by increased govt. deficit spending and some by other sources of private sector deficit spending, but not all of it, which is consistent with the slowing of housing, vehicles, and other components of total spending: