Highlights A snapback for manufacturing production led a jump into the positive column for the national activity index which at 0.10 marks the second positive score in three months. Yet the 3-month average, at minus 0.06, remains in the negative column for the seventh straight month. Manufacturing has been the center of weakness for this indicator but posted a strong gain in August’s industrial production report. Offsetting this strength was a drop below 50 to 49.1 for the ISM manufacturing report. And speaking to broad weakness, the other three components of the index (employment, sales/orders/inventories, consumption & housing) all posted marginal declines on the month of minus 0.2 percent. This report has been running well below GDP, offering an alternative and not

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

Highlights

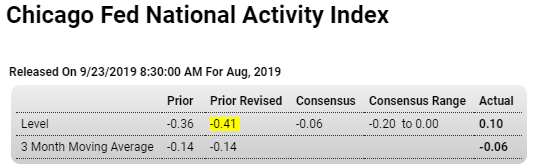

A snapback for manufacturing production led a jump into the positive column for the national activity index which at 0.10 marks the second positive score in three months. Yet the 3-month average, at minus 0.06, remains in the negative column for the seventh straight month.

Manufacturing has been the center of weakness for this indicator but posted a strong gain in August’s industrial production report. Offsetting this strength was a drop below 50 to 49.1 for the ISM manufacturing report. And speaking to broad weakness, the other three components of the index (employment, sales/orders/inventories, consumption & housing) all posted marginal declines on the month of minus 0.2 percent.

This report has been running well below GDP, offering an alternative and not very upbeat assessment of the 2019 economy. Of the 85 separate indicators that make up this report, 51 were available for August’s results.

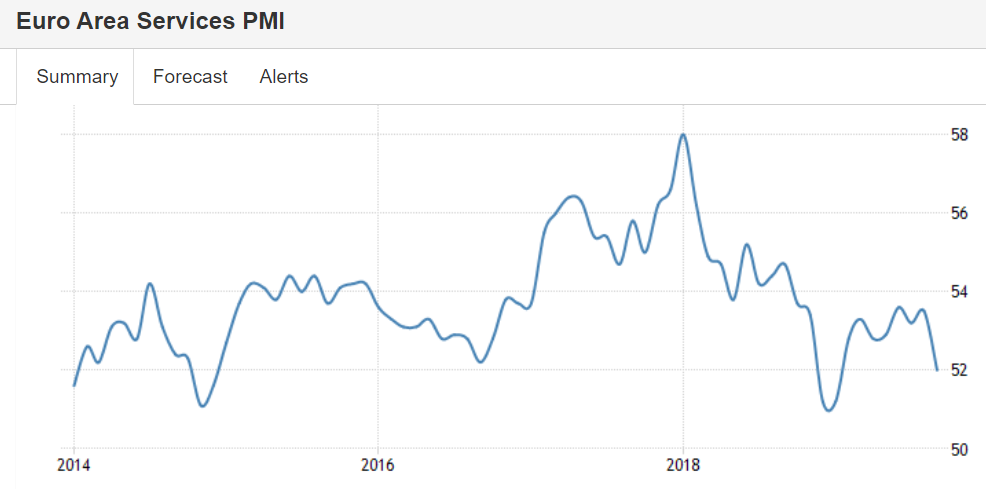

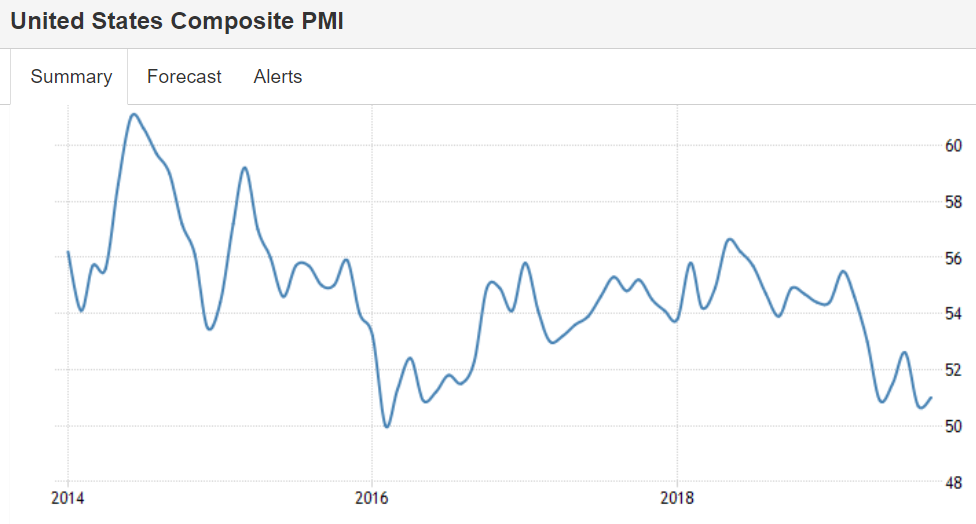

This is a composite of manufacturing and services and doesn’t look good:

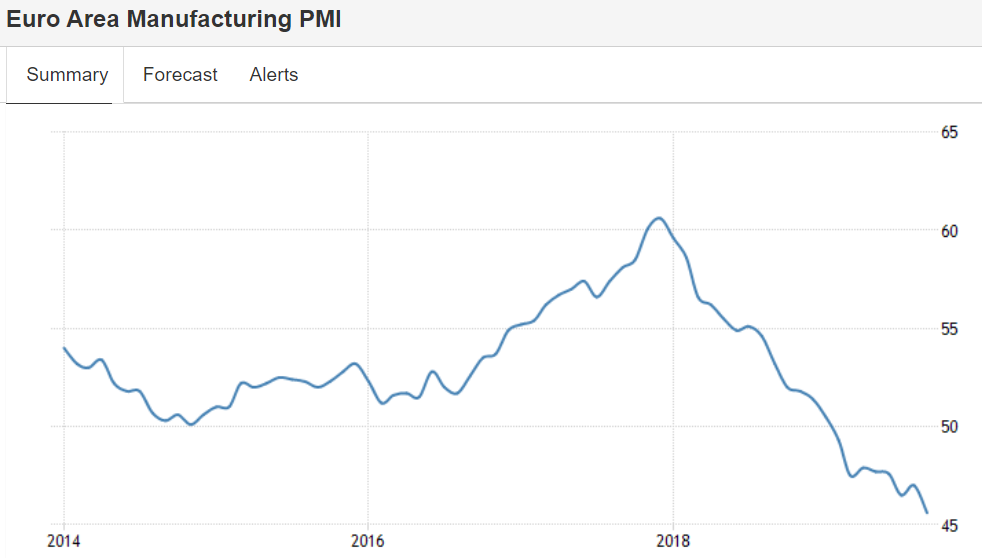

Looking like full blown recession in progress:

German Manufacturing PMI at Over 10-Year Low

The IHS Markit Germany Manufacturing PMI fell to 41.4 in September, missing market expectations of 44 and pointing to the steepest contraction in factory activity since the global financial crisis in mid-2009. Output shrank at the sharpest pace since July 2012 and new business dropped the most in more than a decade. Also, the job shedding rate accelerated to the fastest since January 2010.