Still contracting: Commercial loan growth has flattened this year: Oil capex seems to be headed south again. Might take higher prices to bring it back. And the way the decline curves work output should be peaking soon and then declining: Highlights The Baker Hughes North American rig count is down 33 rigs in the September 20 week to 987. The U.S. rig count is down 18 rigs from last week to 868 and is down 185 rigs from last year at this time. The Canadian count is down 15 rigs from last week to 119 and, compared to last year, is down 78 rigs. For the U.S. count, rigs classified as drilling for oil are down 14 rigs at 719, gas rigs are down 5 at 148 and miscellaneous rigs are up 1 at 1. For the Canadian count, oil rigs are down 11 at 82 and gas rigs are down 4 at 37.

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

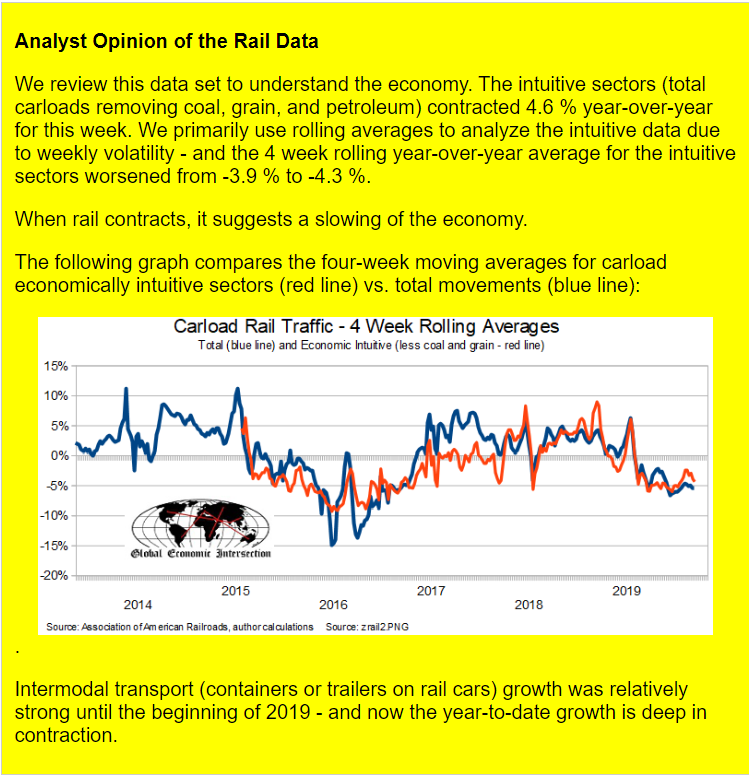

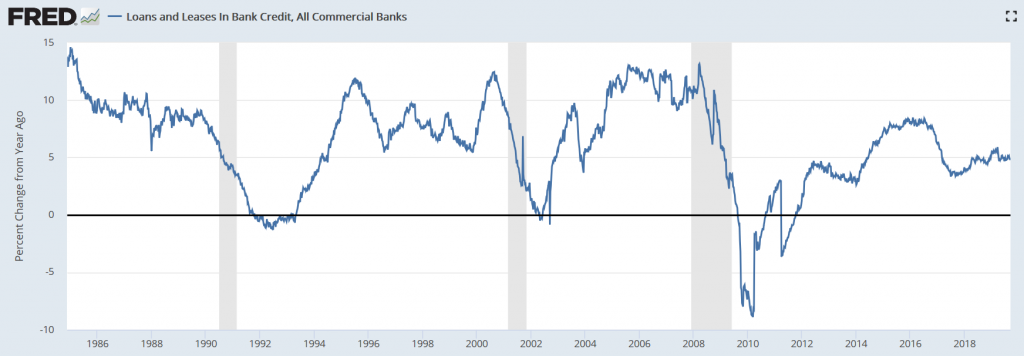

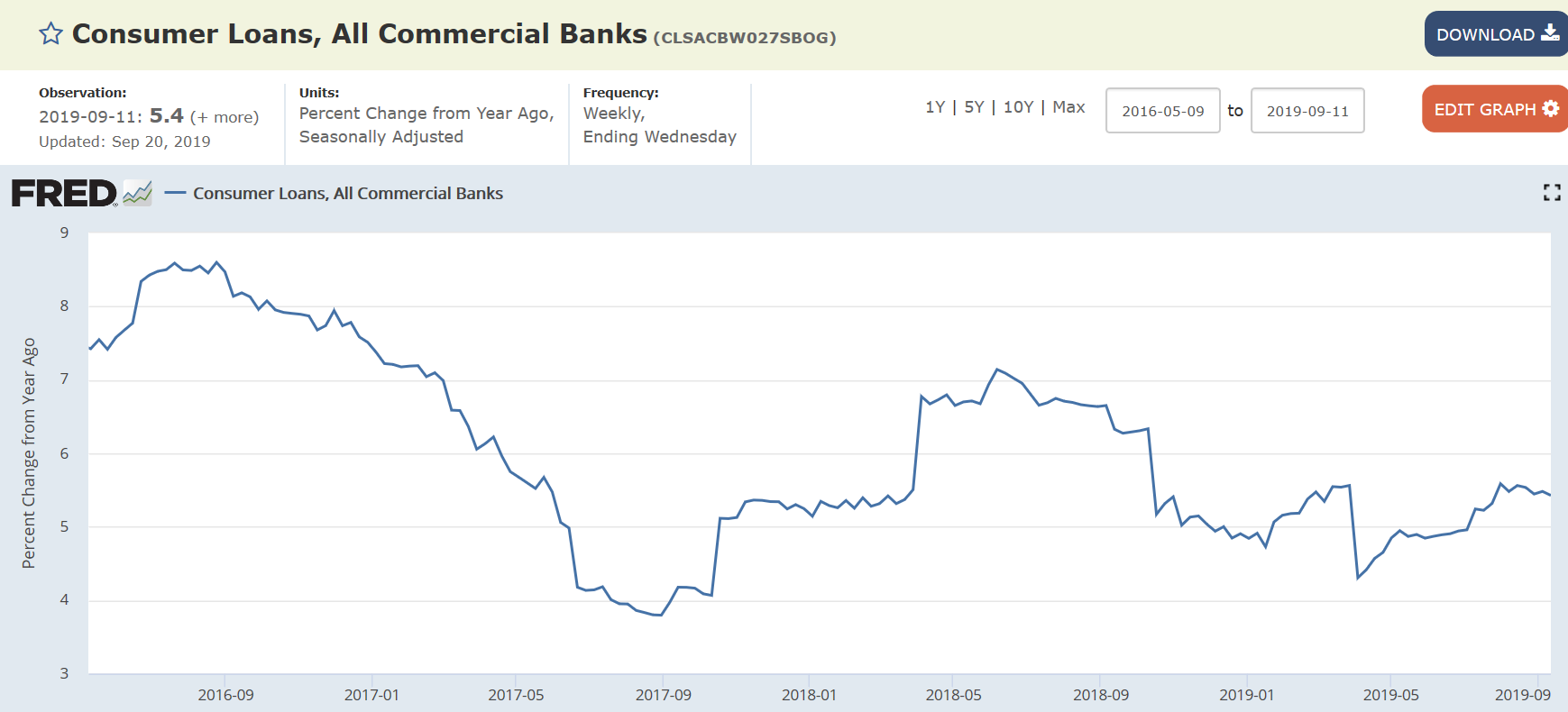

Still contracting:

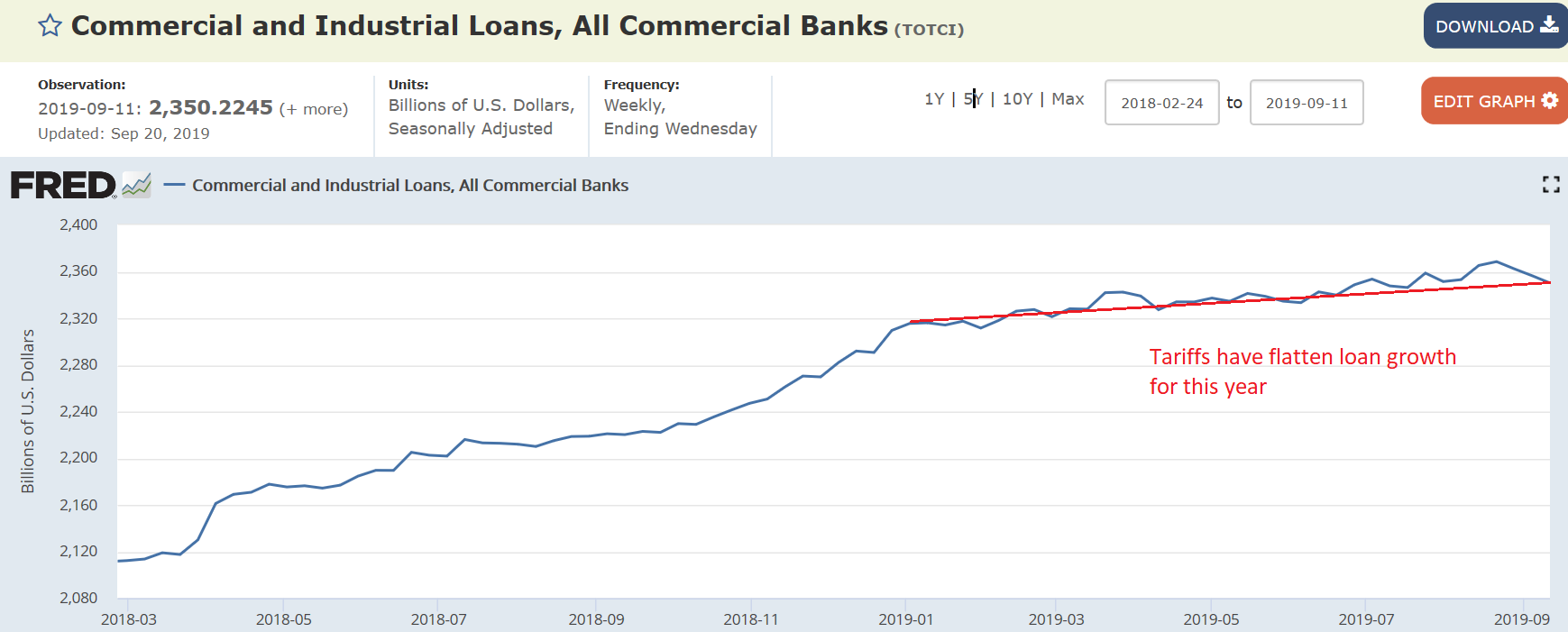

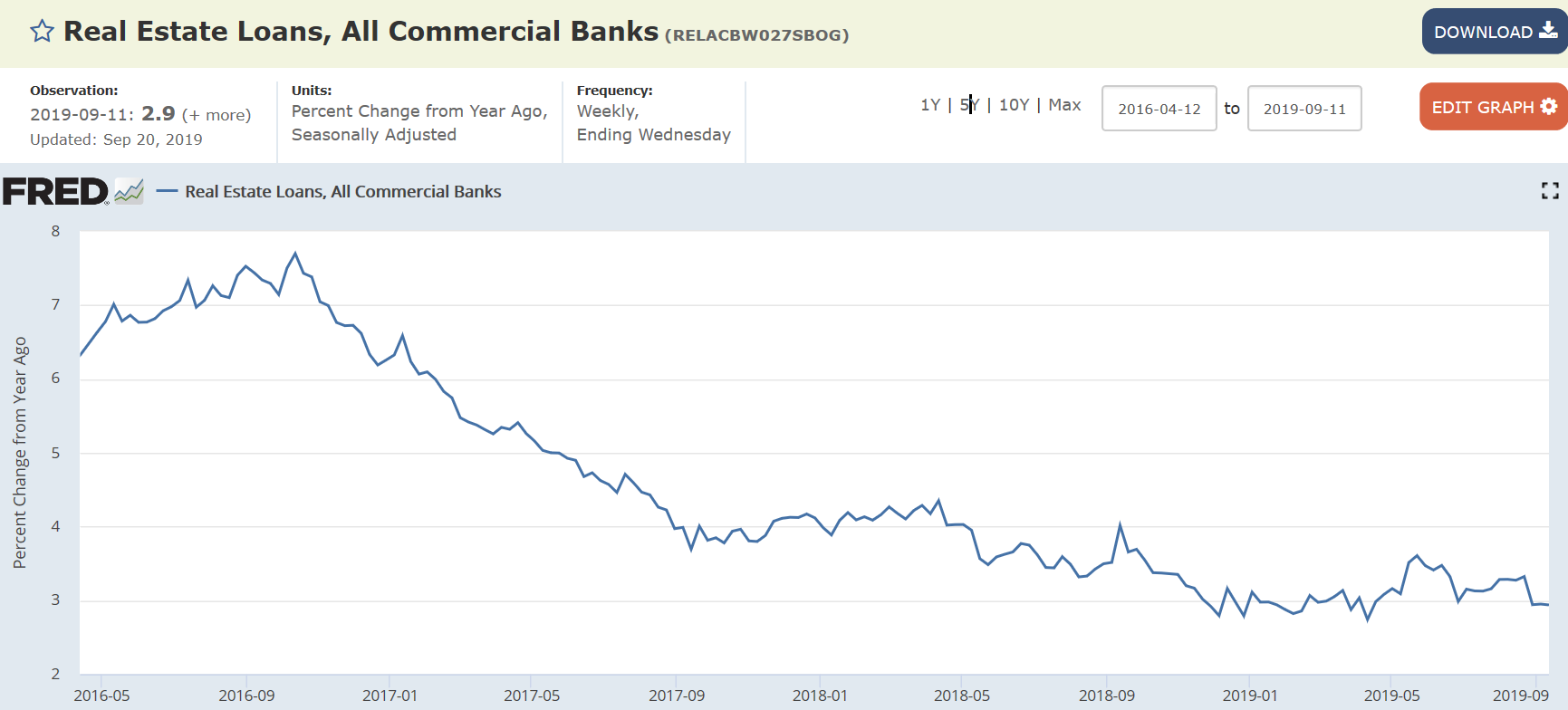

Commercial loan growth has flattened this year:

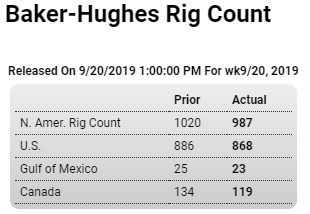

Oil capex seems to be headed south again. Might take higher prices to bring it back. And the way the decline curves work output should be peaking soon and then declining:

Highlights

The Baker Hughes North American rig count is down 33 rigs in the September 20 week to 987. The U.S. rig count is down 18 rigs from last week to 868 and is down 185 rigs from last year at this time. The Canadian count is down 15 rigs from last week to 119 and, compared to last year, is down 78 rigs.

For the U.S. count, rigs classified as drilling for oil are down 14 rigs at 719, gas rigs are down 5 at 148 and miscellaneous rigs are up 1 at 1. For the Canadian count, oil rigs are down 11 at 82 and gas rigs are down 4 at 37.

Accelerating:

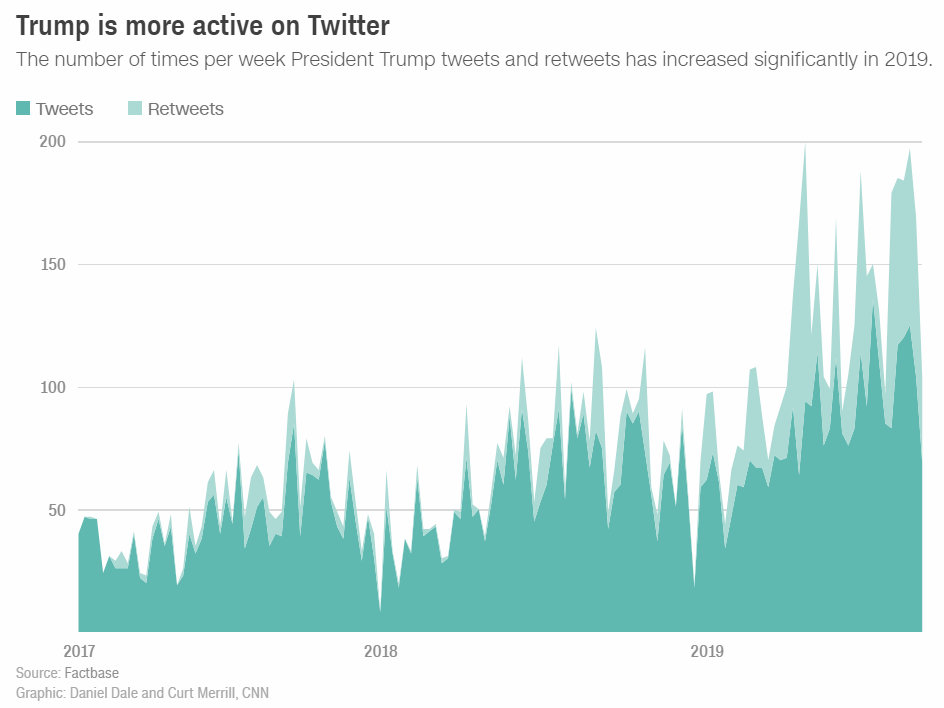

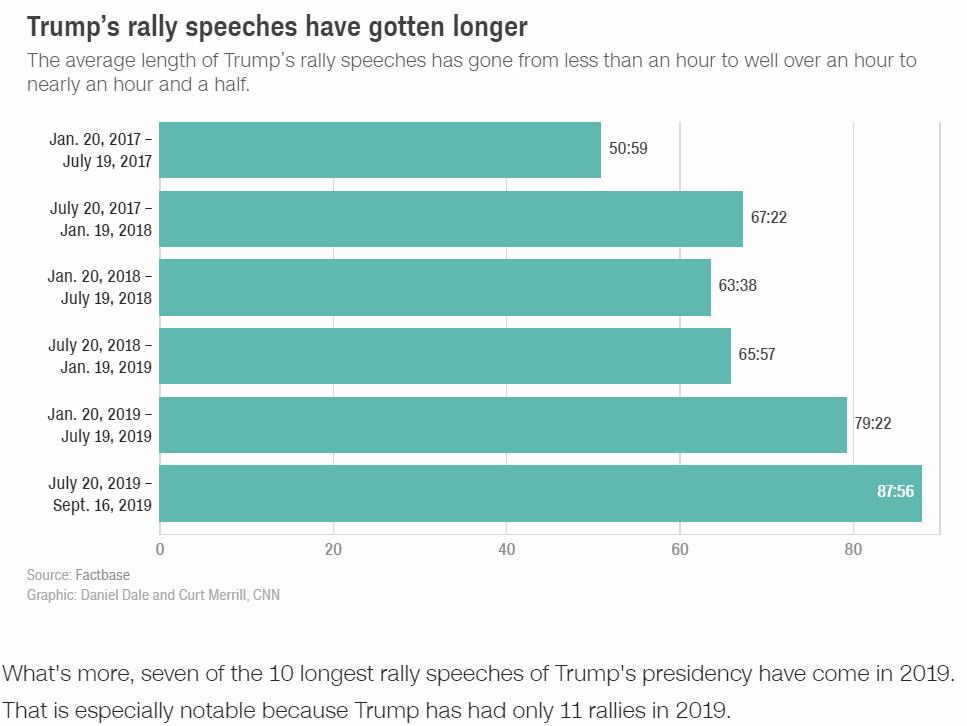

Trump unleashed: He’s talking more and tweeting more

It’s important not to mistake Trump’s own accessibility for transparency. As we documented in August, his lengthy exchanges with reporters in July and August were littered with dozens of false claims.

In general, there has been a strong correlation between how much Trump talks and how many false claims he makes. As his speaking time has increased over time, the frequency of his dishonesty has generally increased with it.

One way to visualize all this: it took Trump 343 days to make his first 1,000 false claims as president — then just 197 days to make his second 1,000, just 93 days to make his third 1,000, and just 75 days to make his fourth 1,000, Toronto Star editor Ed Tubb found when we worked for that newspaper. Trump then slowed a little after the midterms, taking 125 days to make his fifth 1,000.