Bad: Highlights In the first sub-50 reading in 2-1/2 years, the Chicago PMI fell more than 4 points in June to miss Econoday’s low-end expectations. Deterioration in June was wide with only employment showing improvement. But further gains for employment in this sample are in question given contraction in new orders and a second straight month of contraction for backlog orders. In contrast to the general weakness, input prices are rising with some members of the sample blaming tariffs for the pressure. Looks to me like, with a lag, personal income has resumed it’s decline after a partial recovery, along with most other indicators, this time due to tariffs: Note: The President may be entirely focused on the money he’s collecting from the tariffs and reluctant to give

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

Bad:

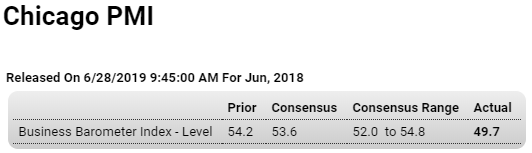

Highlights

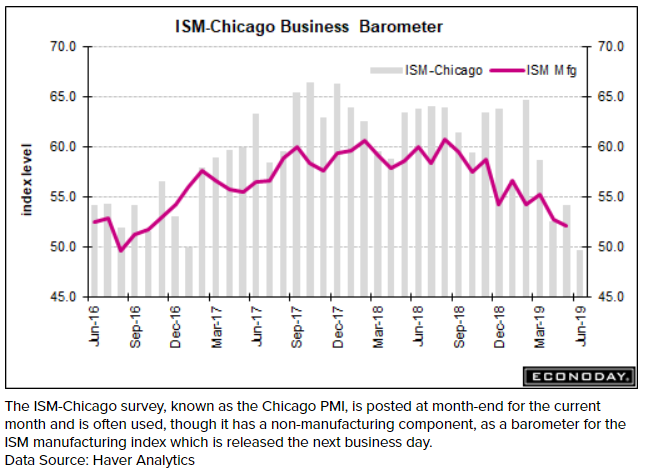

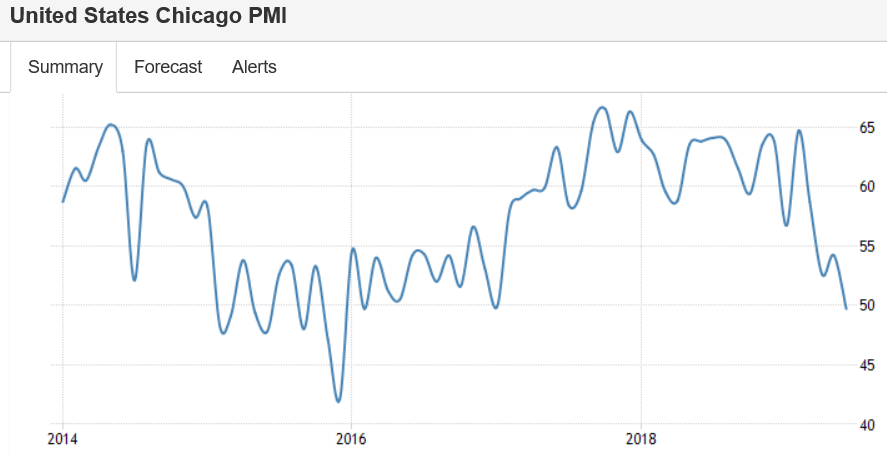

In the first sub-50 reading in 2-1/2 years, the Chicago PMI fell more than 4 points in June to miss Econoday’s low-end expectations. Deterioration in June was wide with only employment showing improvement. But further gains for employment in this sample are in question given contraction in new orders and a second straight month of contraction for backlog orders. In contrast to the general weakness, input prices are rising with some members of the sample blaming tariffs for the pressure.

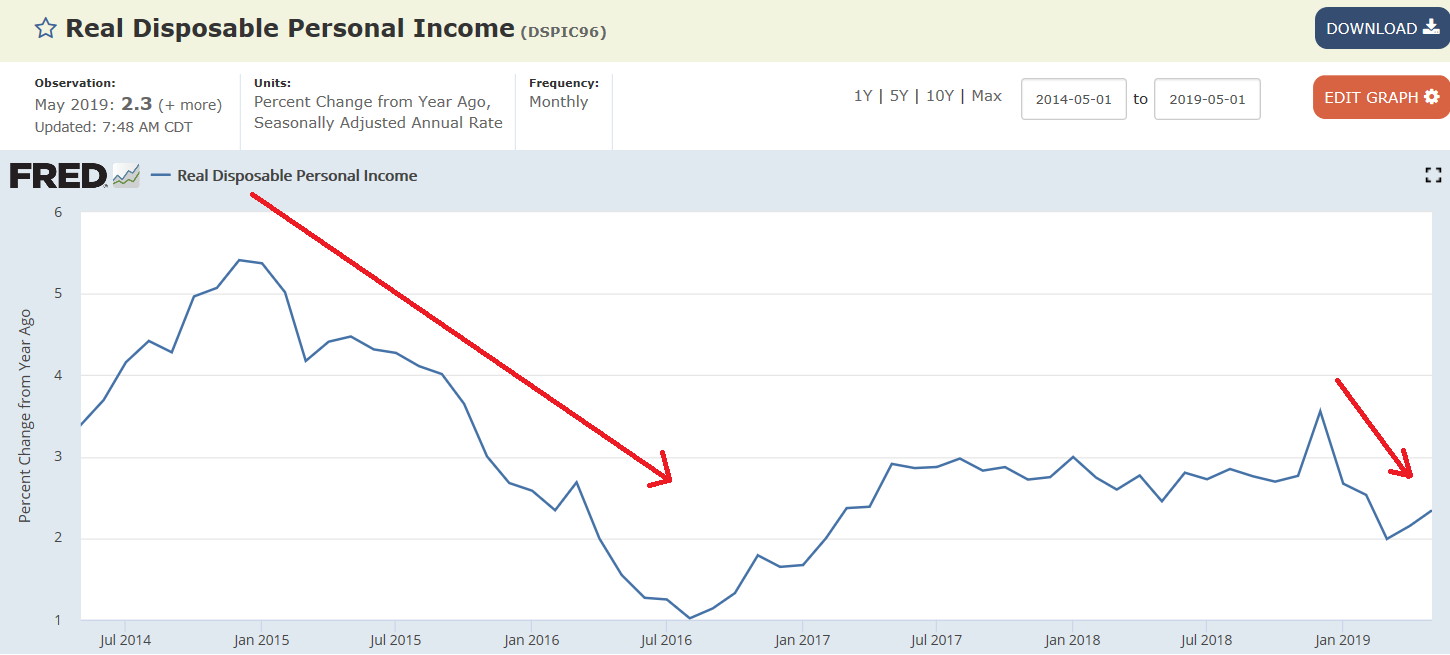

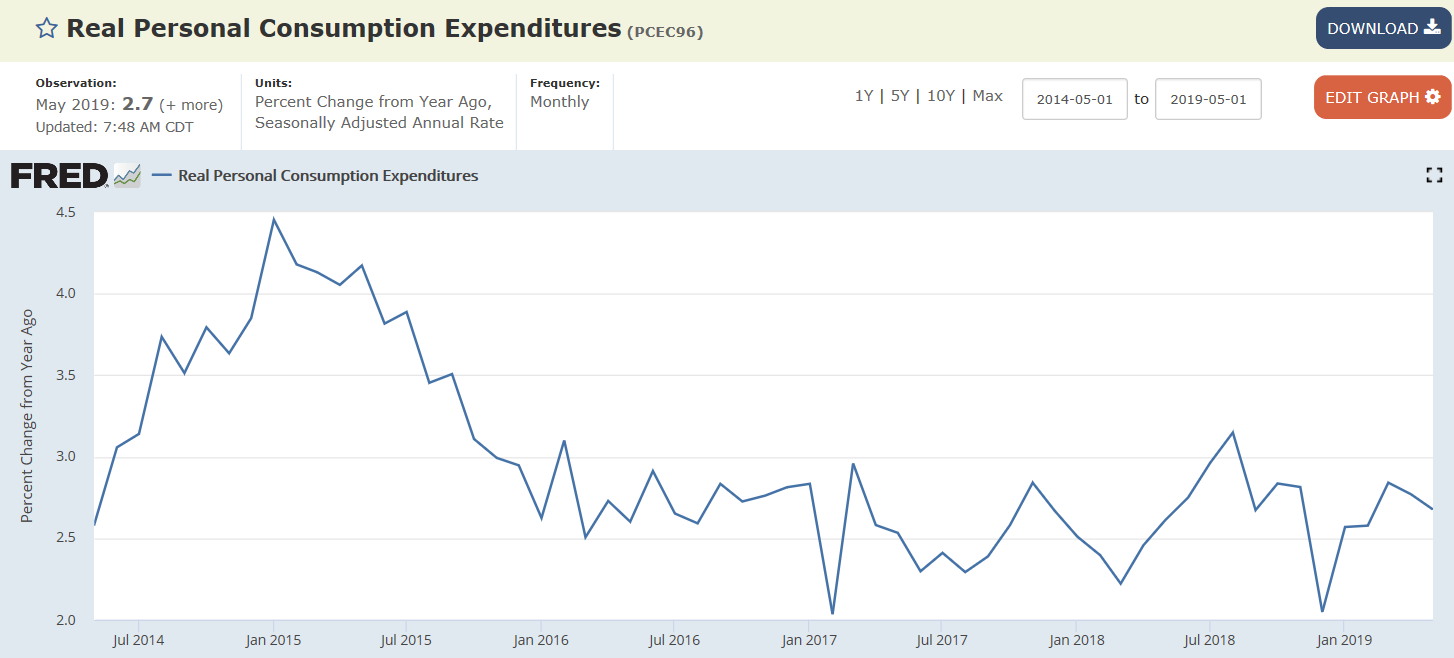

Looks to me like, with a lag, personal income has resumed it’s decline after a partial recovery, along with most other indicators, this time due to tariffs:

Note: The President may be entirely focused on the money he’s collecting from the tariffs and reluctant to give it up.