Most all euro area indicators still in collapse due to tariffs: Production held up even as consumer spending slowed: Highlights The outcome was expected but not the mix. The third estimate of first-quarter GDP rose 3.1 percent and is unchanged from the second estimate. But consumer spending did not live up to expectations, at only a 0.9 percent growth rate in the quarter vs 1.3 percent in the prior estimate and expectations for 1.3 percent. Making up the difference is an upgrade to nonresidential fixed investment, now at a 4.4 percent growth rate vs 2.3 percent in the second estimate, and also an upgrade to residential investment which is now at 2.0 percent contraction vs the second estimate’s 3.5 percent contraction. Government purchases are also upgraded, by 3

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

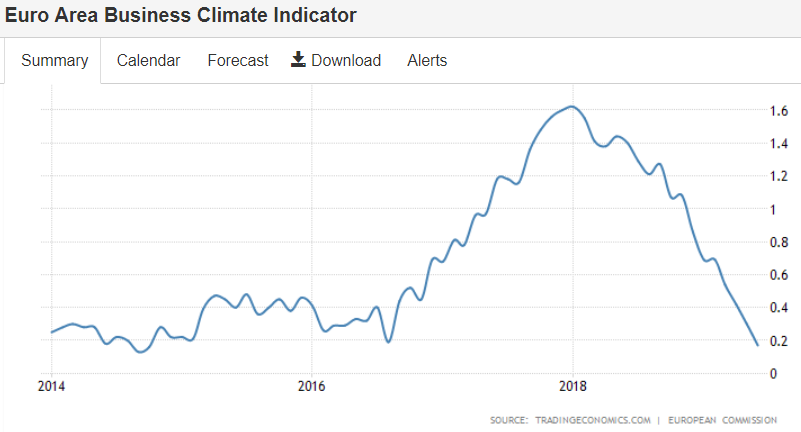

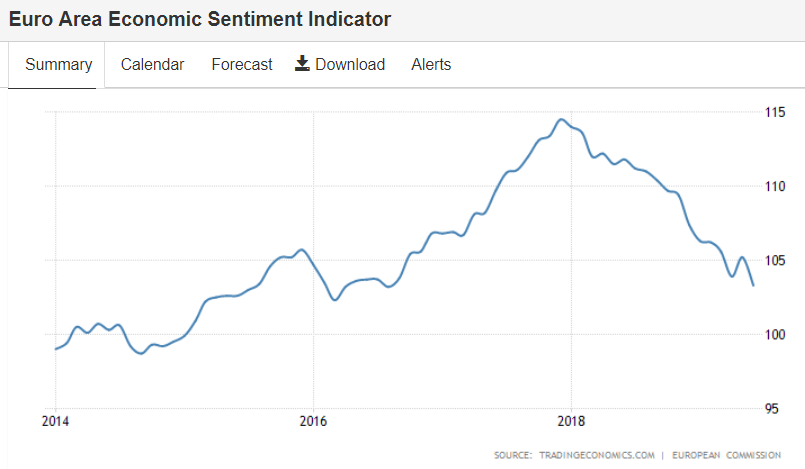

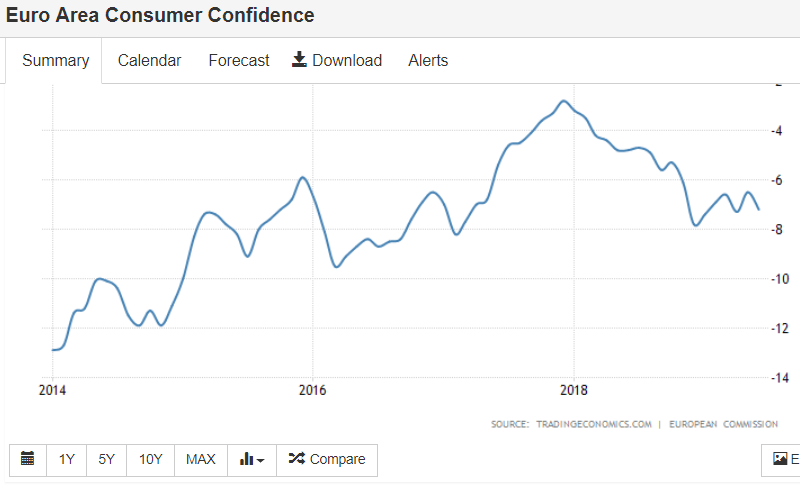

Most all euro area indicators still in collapse due to tariffs:

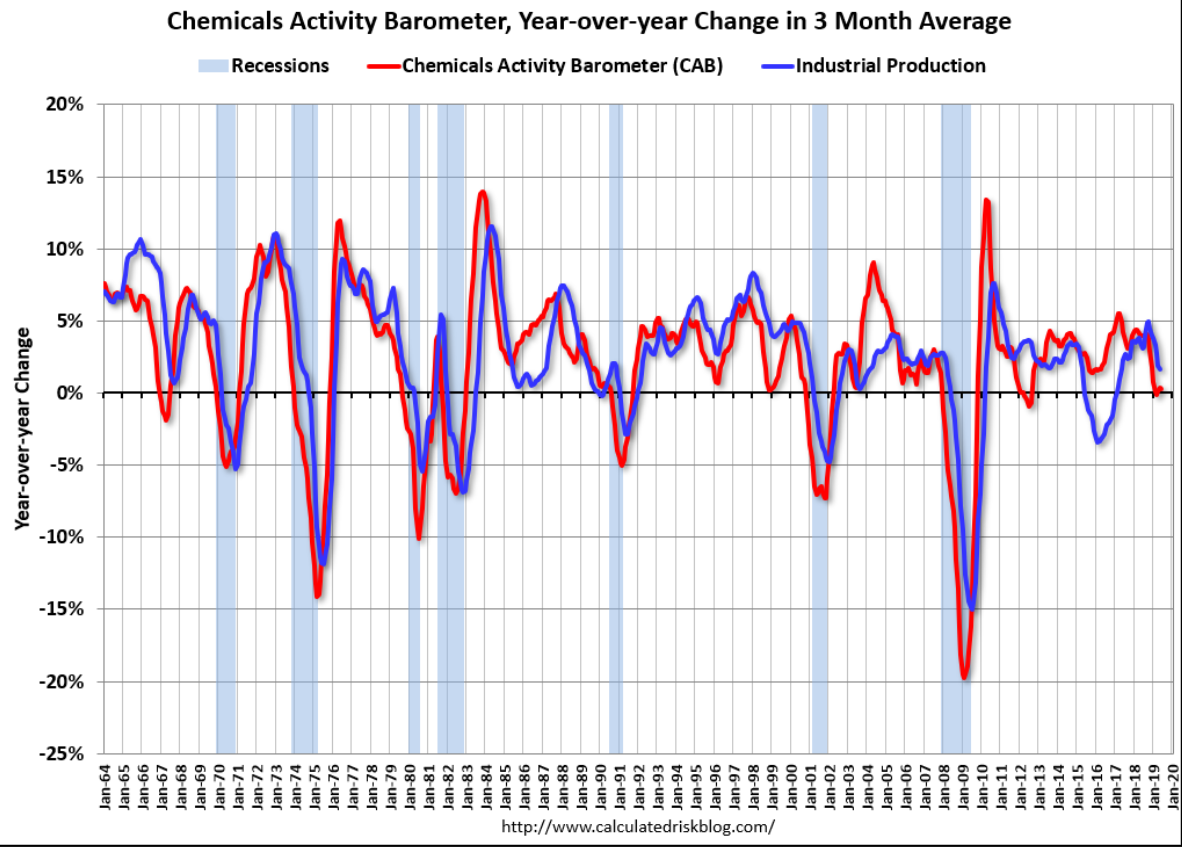

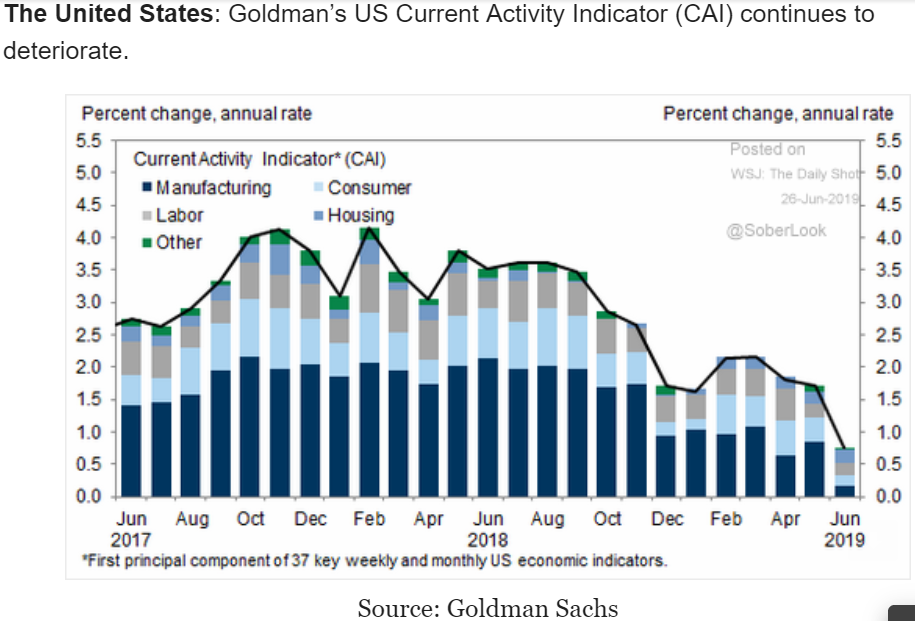

Production held up even as consumer spending slowed:

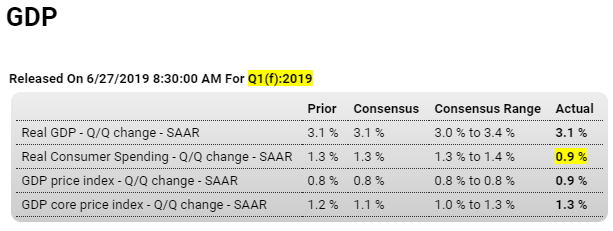

Highlights

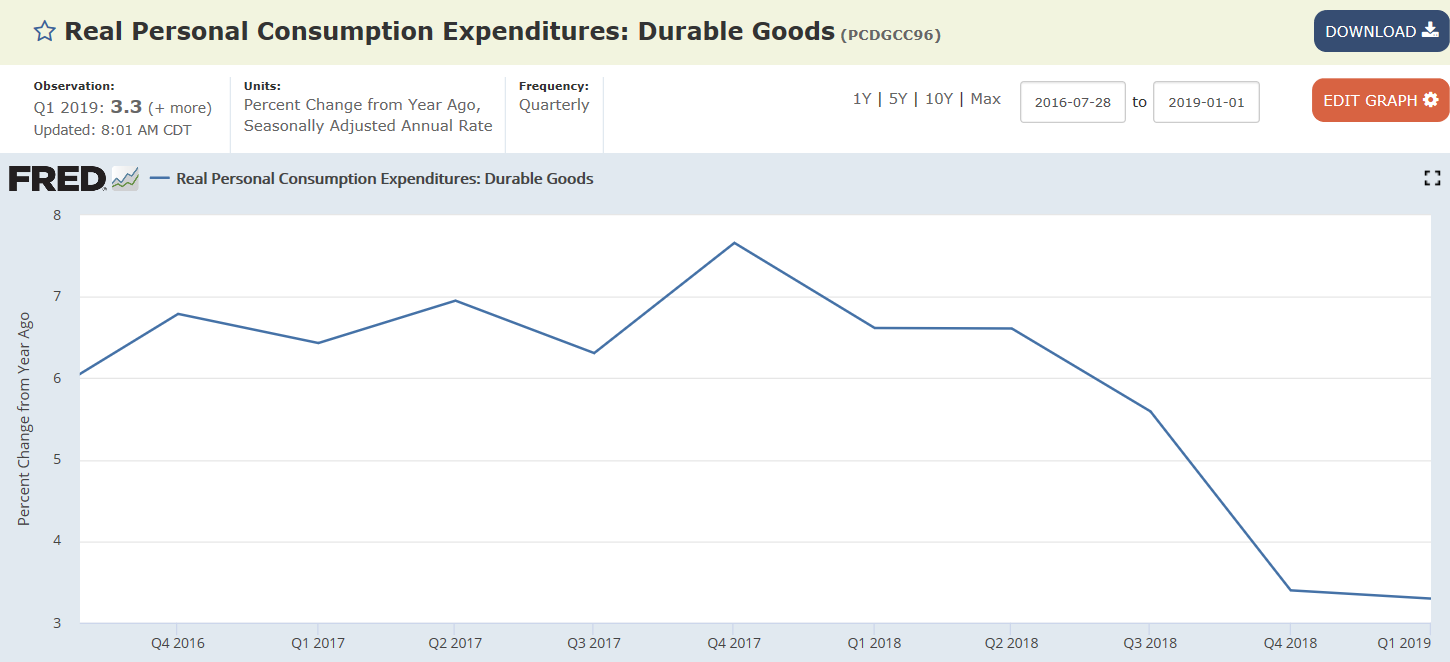

The outcome was expected but not the mix. The third estimate of first-quarter GDP rose 3.1 percent and is unchanged from the second estimate. But consumer spending did not live up to expectations, at only a 0.9 percent growth rate in the quarter vs 1.3 percent in the prior estimate and expectations for 1.3 percent.

Making up the difference is an upgrade to nonresidential fixed investment, now at a 4.4 percent growth rate vs 2.3 percent in the second estimate, and also an upgrade to residential investment which is now at 2.0 percent contraction vs the second estimate’s 3.5 percent contraction. Government purchases are also upgraded, by 3 tenths to plus 2.8 percent.

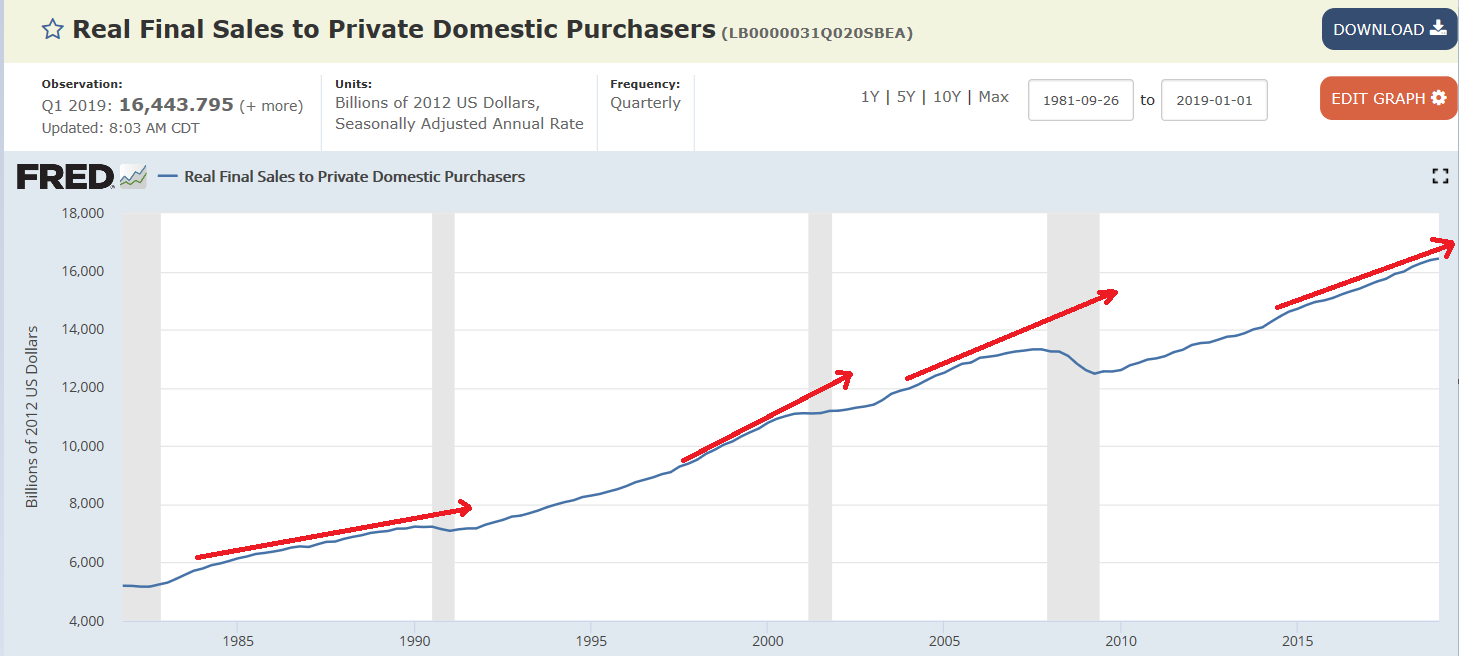

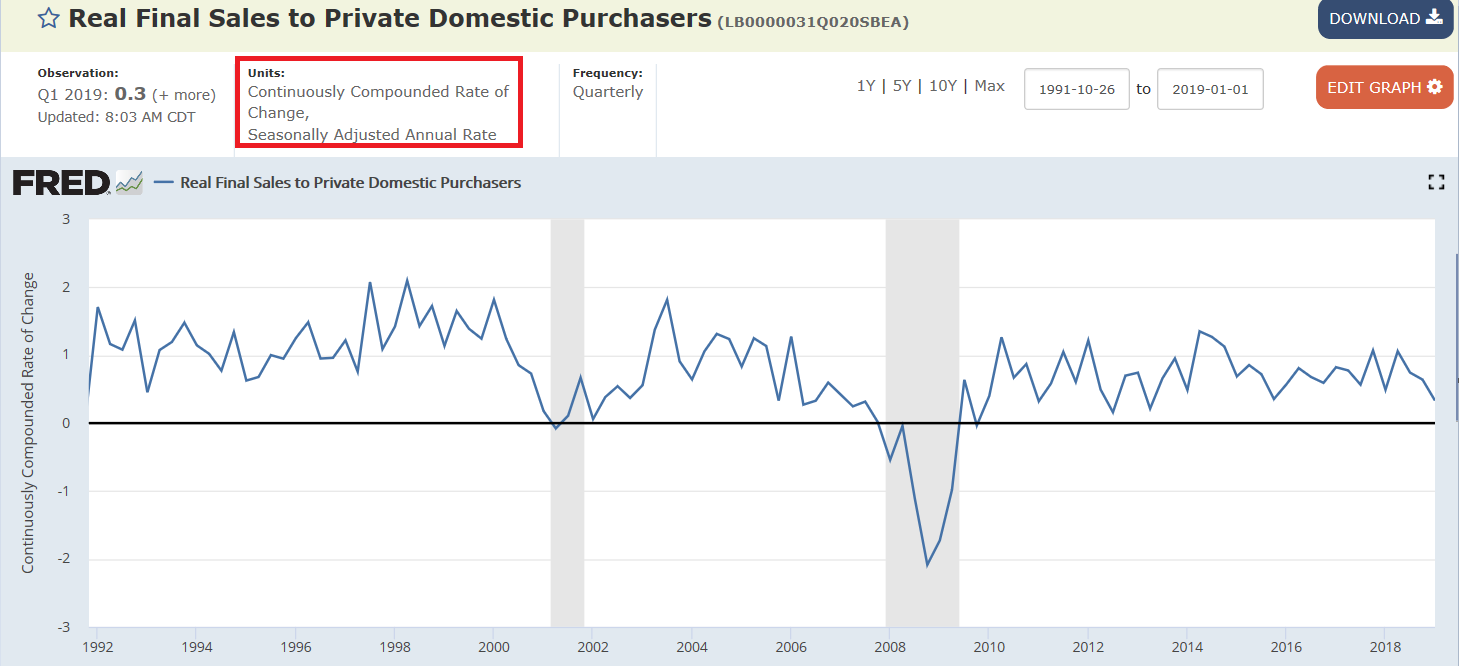

Stepping back and looking at the quarter as a whole, inventory growth (contributing 0.55 percentage points to the 3.1 percent overall rate) and especially net exports (contributing 0.94 points) skewed the quarter higher. Sharp inventory growth made up for thin levels in prior quarters but with inventories still rising so far in the second quarter raise the question, given the slowing in consumer spending, whether inventories will begin to slow and pull down GDP. Net exports so far in the second quarter are clearly negative as imports are widening vs exports. Excluding both inventories and net exports, GDP on this basis (final sales to domestic purchasers) rose only 1.6 percent in the first quarter for a 5 tenths decline from the fourth quarter.

It’s been a weak recovery for the consumer, and now it’s fading:

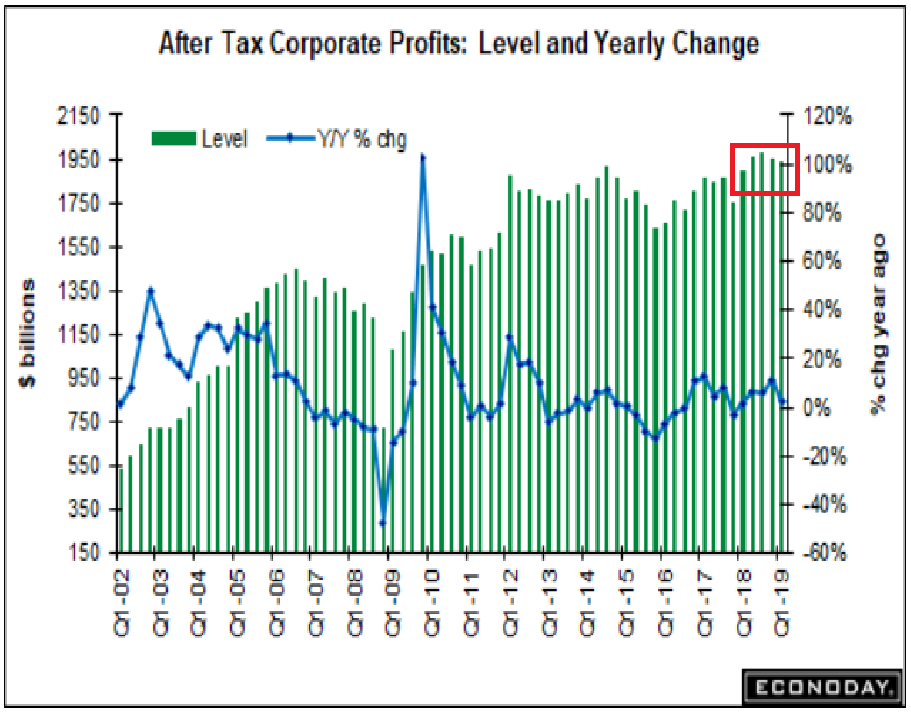

Corporate profits had ‘one time’ increase from the 2018 tax cuts, but have subsequently gotten hurt by Agent Orange’s tariffs: