Year over year in contraction. And the chart is not adjusted for inflation: Negative: Lower rates don’t seem to be helping: Highlights The purchase index continues to pull back in what is an unfavorable indication for underlying home sales. After falling 4.0 percent in the prior week, the index fell 2.0 percent in the July 19 week to pull down year-on-year growth to 6.0 percent. Refinancing activity has also been coming down, 2.0 percent lower in the week. Rates fell back in the week, down 4 basis points to 4.08 percent for conventional 30-year loans. Still rolling over from what are already historically depressed levels, with tariffs now widely mentioned: Highlights The housing trend is visibly fading at the half-way point, opening the year on a solid rise before

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

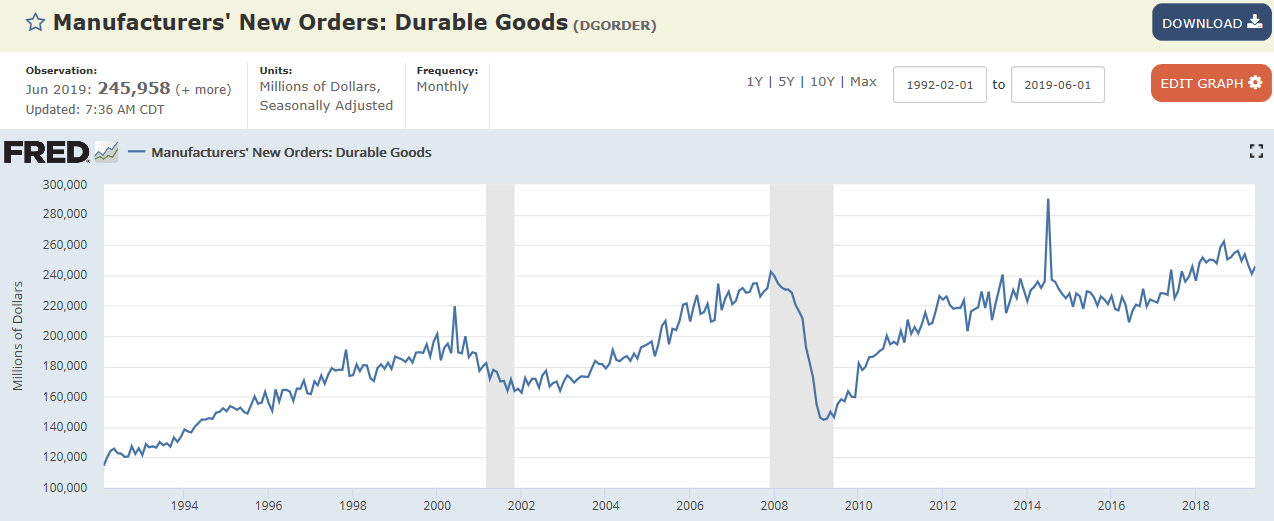

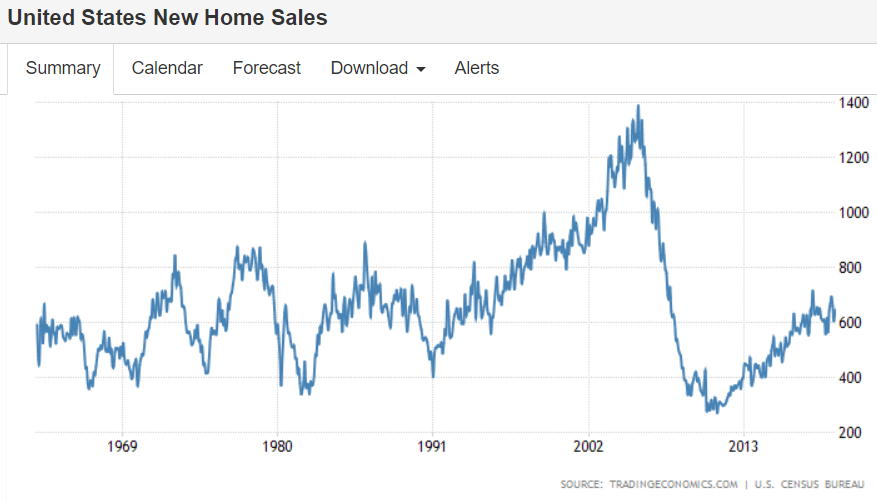

Year over year in contraction. And the chart is not adjusted for inflation:

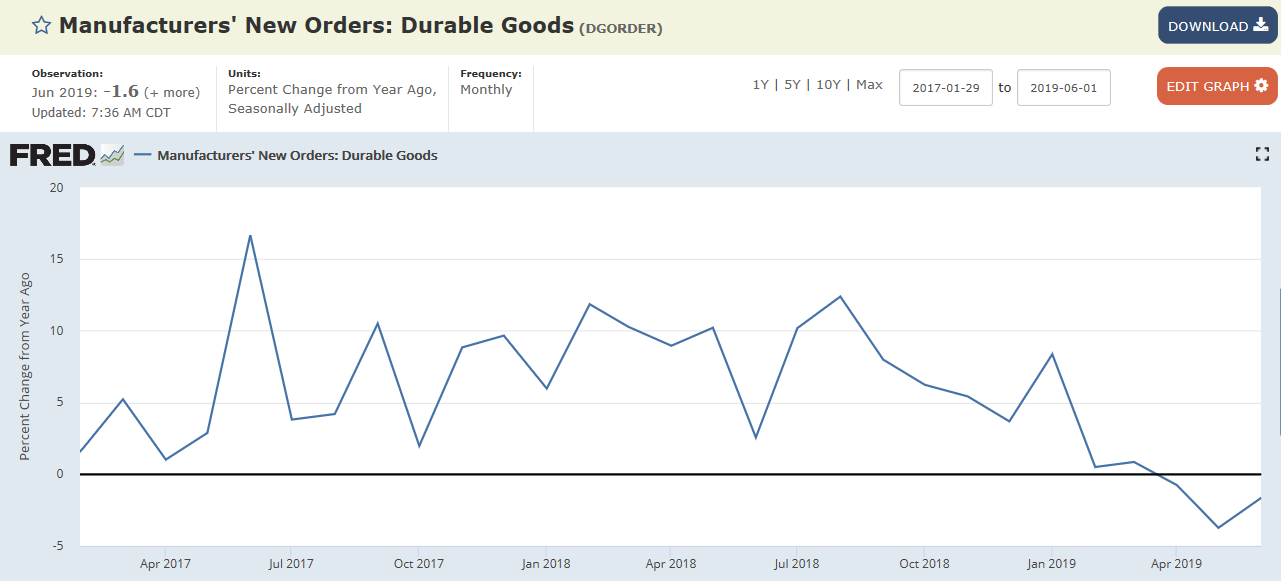

Negative:

Lower rates don’t seem to be helping:

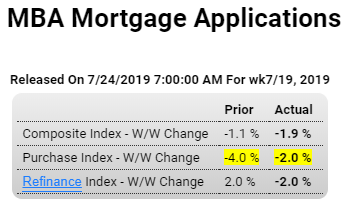

Highlights

The purchase index continues to pull back in what is an unfavorable indication for underlying home sales. After falling 4.0 percent in the prior week, the index fell 2.0 percent in the July 19 week to pull down year-on-year growth to 6.0 percent. Refinancing activity has also been coming down, 2.0 percent lower in the week. Rates fell back in the week, down 4 basis points to 4.08 percent for conventional 30-year loans.

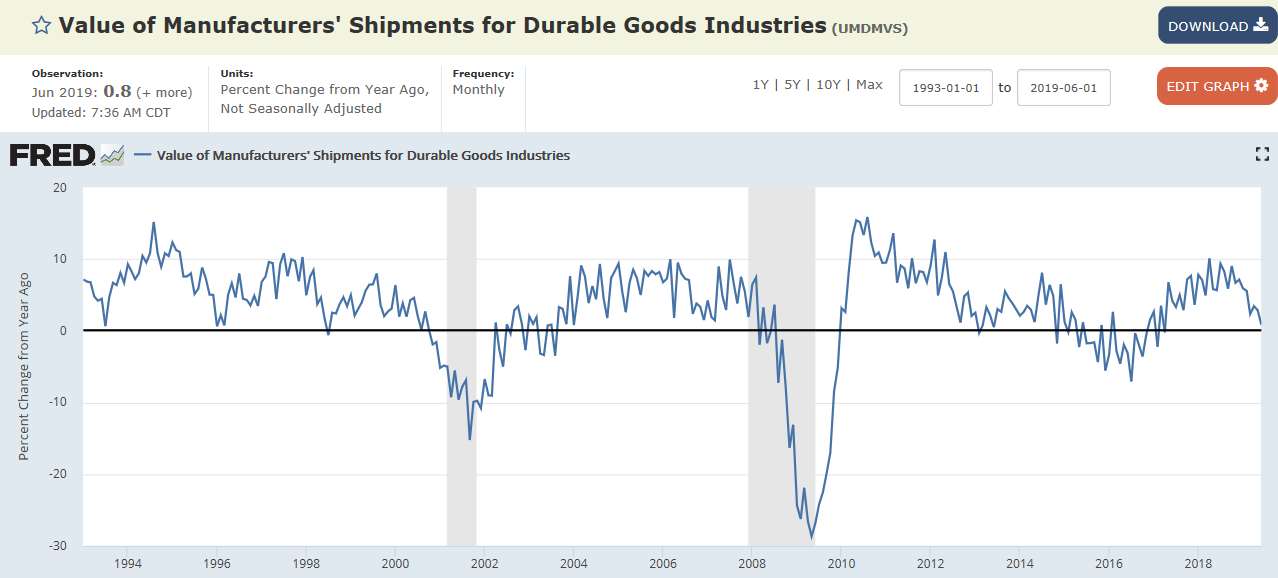

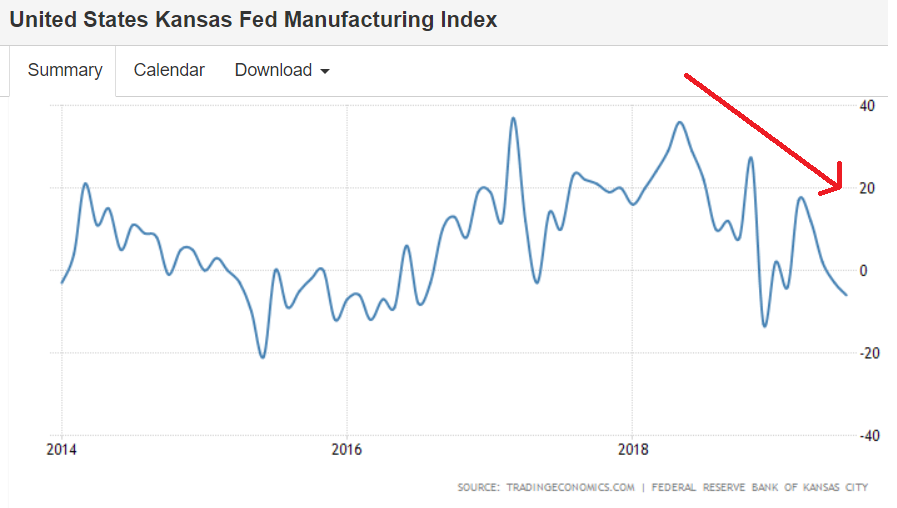

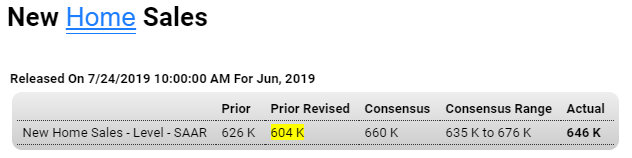

Still rolling over from what are already historically depressed levels, with tariffs now widely mentioned:

Highlights

The housing trend is visibly fading at the half-way point, opening the year on a solid rise before flattening out and slowing in May and June. This is true of existing home sales which were reported yesterday and is especially true with today’s report on new home sales which came in at a lower-than-expected 646,000 annual rate. The 3-month average is at 636,000 which compares unfavorably against a 673,000 peak in April.

The median price firmed in June to $310,400 but is no better than dead flat versus June last year. Supply edged higher to 338,000 new homes on the market and on a sales basis is at an ample 6.3 months. Sales jumped in the West, edged higher in the South, and slipped in the South and Northeast.

Market fundamentals should be pointing to better results for new home sales: there’s plenty of homes on the market, prices are soft, employment is strong, and mortgage rates have come down sharply. Yet today’s report is consistent with anecdotal reports that foreign buyers, due to trade tensions, have been scaling back US home buying. In any case, these results do fit in with arguments for a rate cut, a cut that would likely pull mortgage rates even lower in what couldn’t but help housing.

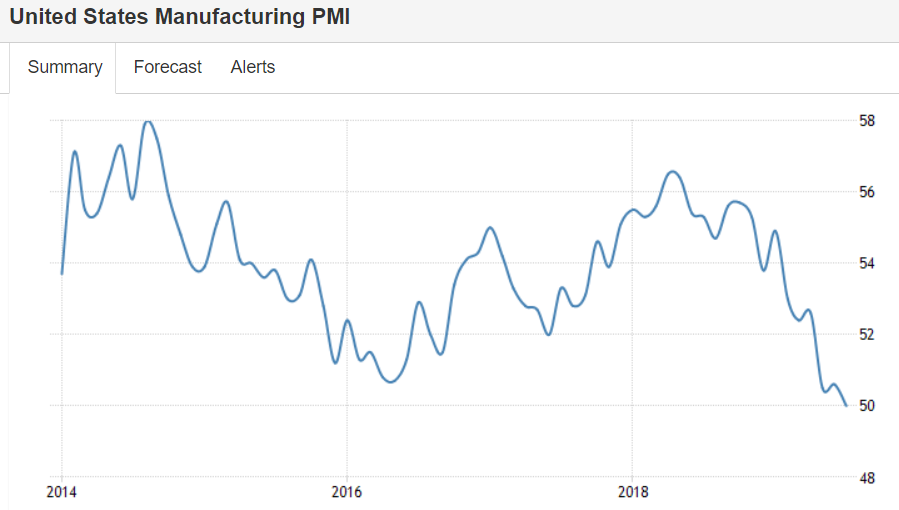

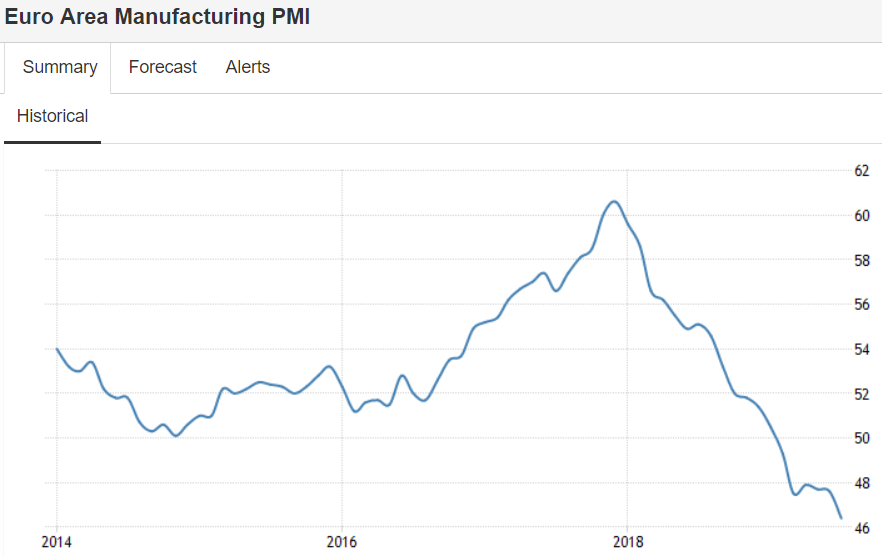

US industry continues its deceleration into contraction, like most of the rest of the world:

US Factory Activity Stalls in July

The IHS Markit US Manufacturing PMI fell to 50.0 in July 2019, the lowest since September 2009 and below market expectations of 51.0, a preliminary estimate showed. Output contracted the most since August 2009 and new work from abroad declined at the fastest pace since April 2016 while employment dropped for the first time in six years.

***President Donald Trump asked teenagers at the Turning Point USA conference Tuesday to “imagine” a world without “fake news” media in which he would have “100 percent” approval ratings.