Gross domestic income was just revised higher. The blue bars are the previously reported levels and the red bars are the revised levels. This further meant that the savings rate unspent income) was higher as previously discussed. And an increasing savings rate generally reflects a deceleration in borrowing: Lack of aggregate demand- desires to not spend income not being sufficiently ‘offset’ by’ private or public sector net (deficit) spending: I see deceleration in both, just less so in services: Highlights Texas manufacturing activity bounced back but not as much expected in July, with the general business activity index rebounding by 5.8 points from June’s three-year low though remaining in contraction at minus 6.3. The production index also improved slightly, rising

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

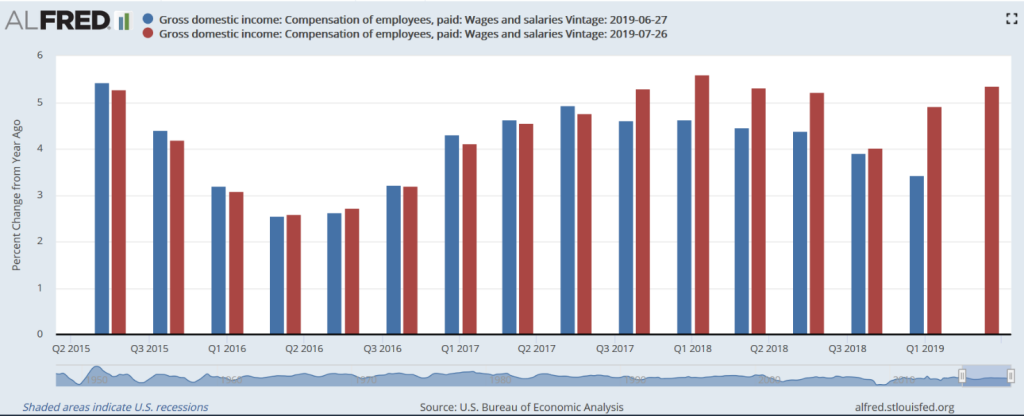

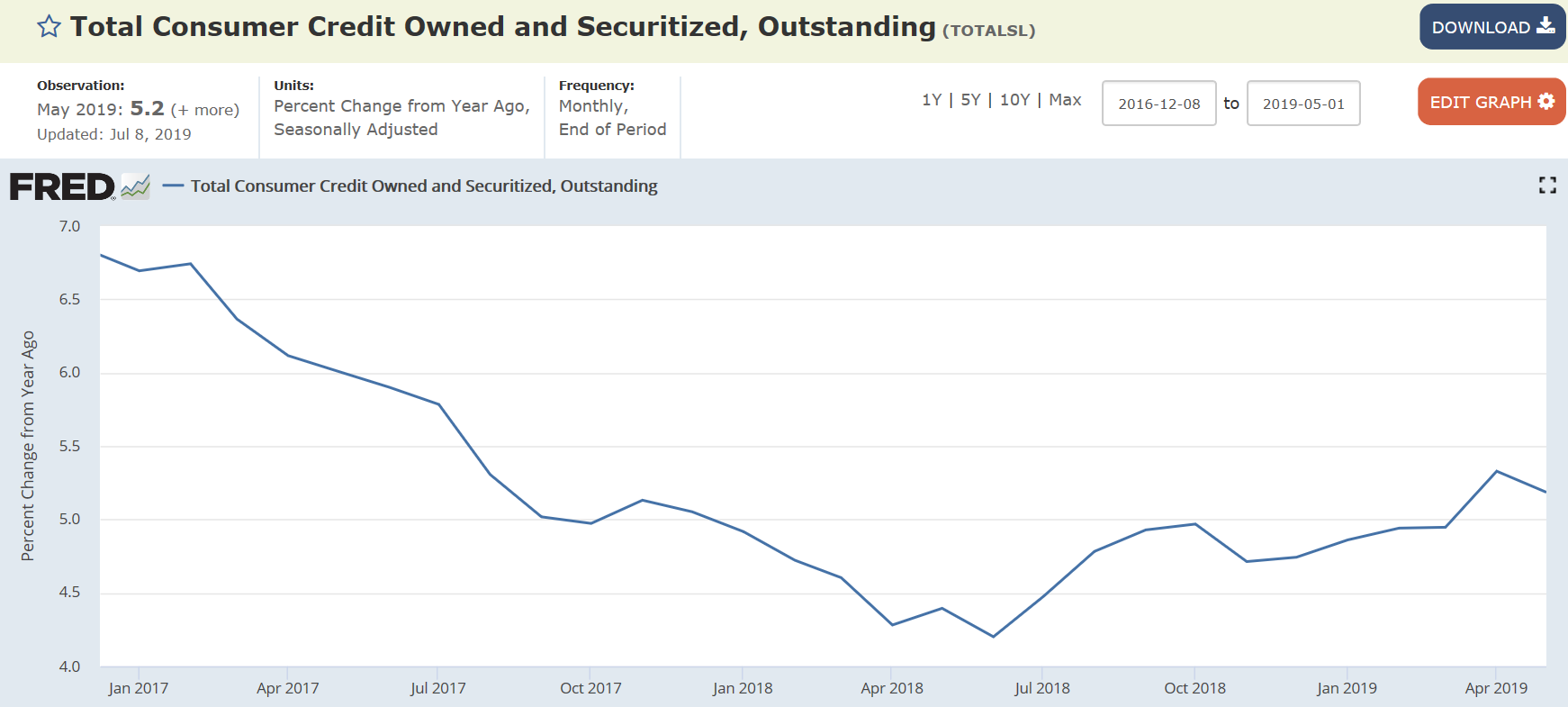

Gross domestic income was just revised higher. The blue bars are the previously reported levels and the red bars are the revised levels. This further meant that the savings rate unspent income) was higher as previously discussed. And an increasing savings rate generally reflects a deceleration in borrowing:

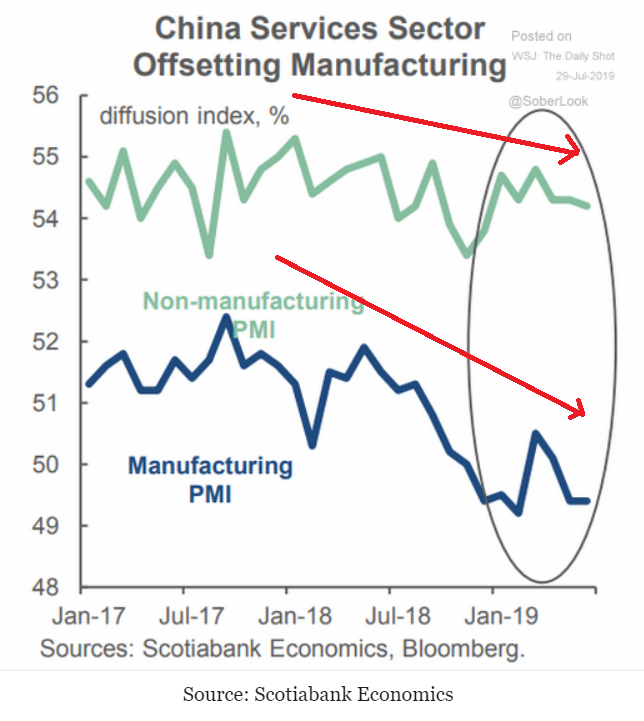

Lack of aggregate demand- desires to not spend income not being sufficiently ‘offset’ by’ private or public sector net (deficit) spending:

I see deceleration in both, just less so in services:

Highlights

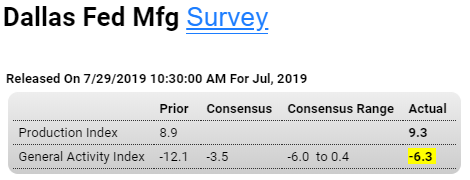

Texas manufacturing activity bounced back but not as much expected in July, with the general business activity index rebounding by 5.8 points from June’s three-year low though remaining in contraction at minus 6.3. The production index also improved slightly, rising 0.4 points to 9.3, indicating factory output growth at roughly the same pace as in June.

The survey’s demand indicators were mixed but mostly stronger, however. Showing acceleration were new orders, which rose 1.8 points to 5.5 in an extension of June’s improvement, and moving out of contraction the growth rate of orders rose 8 points to 2.7. Shipments rebounded strongly by 8.5 points to 10.2, and capacity utilization rose to 1.6 points to 11.2. But unfilled orders did fall 6.2 points to minus 2.8 and delivery times fell 4.3 points to minus 4.8. Inventories of finished goods fell another 4.5 points to minus 10.6.

employment measures bounced back strongly after slipping previously, with the employment index rising 7.2 points to 16.0, well above the long-term average. Hours worked rose 1.9 points to 6.6, while wages slightly dipped by 1.6 points to a still strong 20.1.

Also pointing to strength ahead, capital expenditures rose sharply after falling to two-year lows previously, rising 8.3 points to 15.2.

On the inflation front, manufacturers saw upward pressures remaining about the same for raw materials input costs, with the index edging up 0.6 points 17.0, much stronger than for prices received, where price growth was down 2.9 points to minus 1.7.

Expectations for future business conditions improved, though remaining well below average, with expected general activity returning into positive territory by rising 8.7 points to 6.0 and the company outlook rising 5.5 points to 9.1.

Today’s report shows Texas manufacturing recovering in July from June’s slide more strongly than the headline suggests, and will probably not strengthen the case for more accommodation by the Fed.

Dallas Fed: “Texas Manufacturing Continues Moderate Expansion”

The general business activity index rose six points but remained in negative territory for a third month in a row, coming in at -6.3. The company outlook index rose five points to -0.9, with the near-zero reading indicating that the share of firms noting a worsened outlook roughly equaled the share noting an improved outlook. The index measuring uncertainty regarding companies’ outlooks retreated 12 points from its June peak, coming in at 9.7.

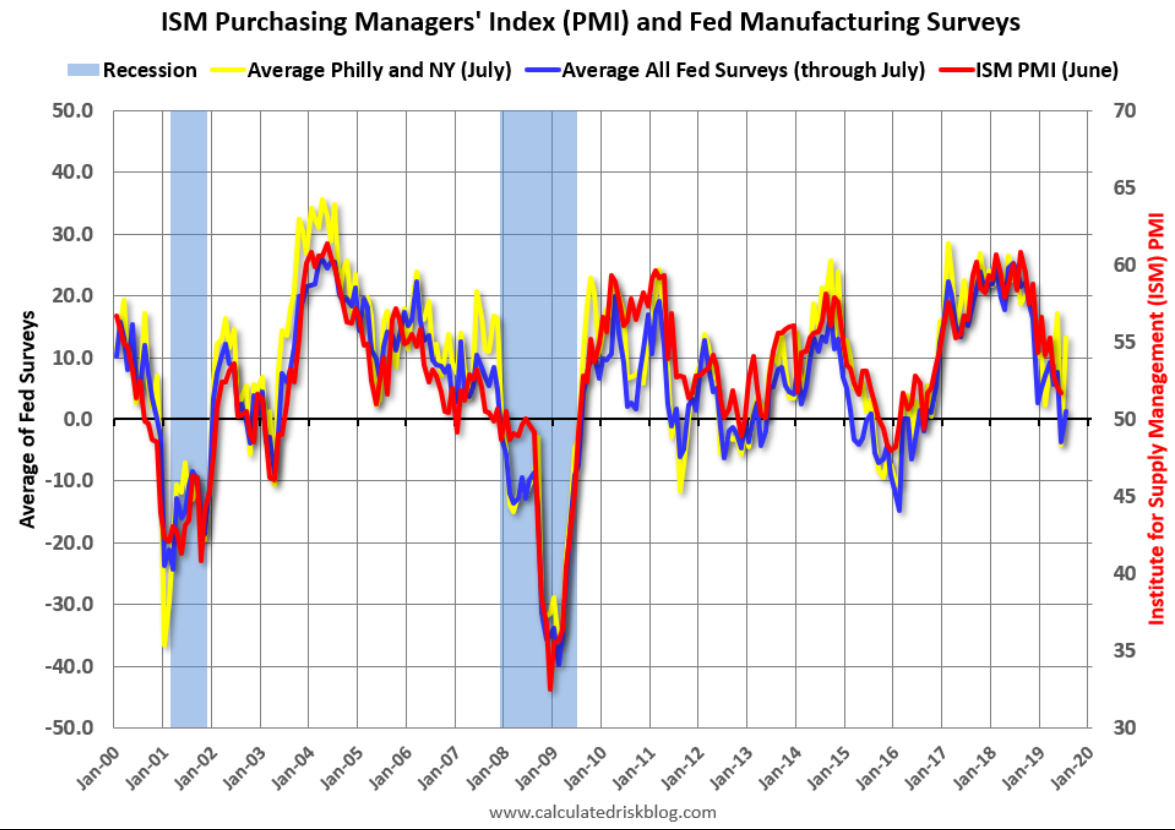

This is what the Fed is looking at- a steep deceleration after tariffs were announced: