It will take another few months to know if this is just ‘noise’ or it’s about to go negative. If you average the last two months, for example, it’s about 165,000 each: Highlights Averaging extremes is good advice to find an underlying path and February and January payrolls are an immediate example. Nonfarm payrolls rose by only 20,000 last month vs a revised 311,000 rise in January with the average at a very healthy 166,000. Payrolls are part of the establishment survey of businesses while the unemployment rate is based on the household survey which includes those who are working but not on payrolls. Here February’s story is much more positive showing a sharp rise in the number of those employed (up 255,000) and a sharp fall in the number of unemployed (down 300,000) that

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

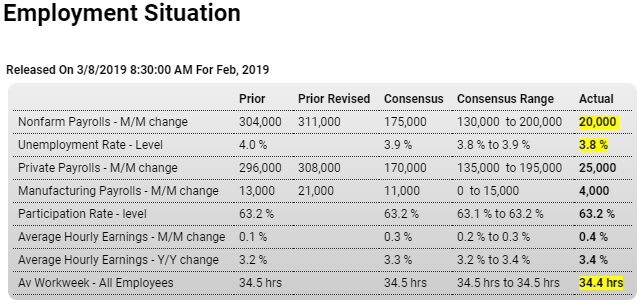

It will take another few months to know if this is just ‘noise’ or it’s about to go negative. If you average the last two months, for example, it’s about 165,000 each:

Highlights

Averaging extremes is good advice to find an underlying path and February and January payrolls are an immediate example. Nonfarm payrolls rose by only 20,000 last month vs a revised 311,000 rise in January with the average at a very healthy 166,000.

Payrolls are part of the establishment survey of businesses while the unemployment rate is based on the household survey which includes those who are working but not on payrolls. Here February’s story is much more positive showing a sharp rise in the number of those employed (up 255,000) and a sharp fall in the number of unemployed (down 300,000) that make for an unexpected 2 tenths dip in the unemployment rate to 3.8 percent.

And wages in today’s report are another indication of labor market strength, jumping 0.4 percent in the month which is outside expectations for a year-on-year rate of 3.4 percent that is at the high end of expectations.

But payrolls are definitely weak with construction down 31,000 and ending a run of gains while retail, down 6,000, extended its mostly weak performance. One positive sign of labor market demand comes from professional & business services where payrolls jumped 42,000 and include a 6,000 rise for temporary workers in readings that continue to confirm employers are scrambling to build up their staffs.

Winter is traditionally the most difficult period to seasonally adjust data and related questions are certain to come up to help explain away the volatility in payrolls so far this young year. Though the drop in February may well be cited at the coming FOMC this month as a reason for caution, there is still little question that strong demand for labor, underscored by the rise in average hourly earnings, is the central strength of the U.S. economy.

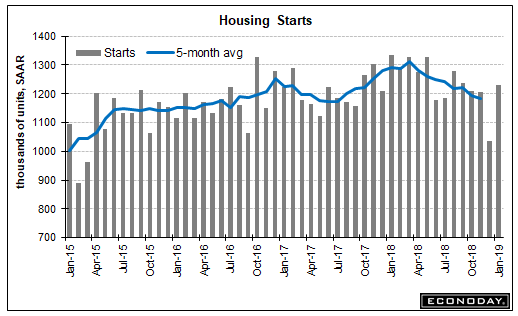

Up from last month, but, again, looking at the two months together it’s still trending down:

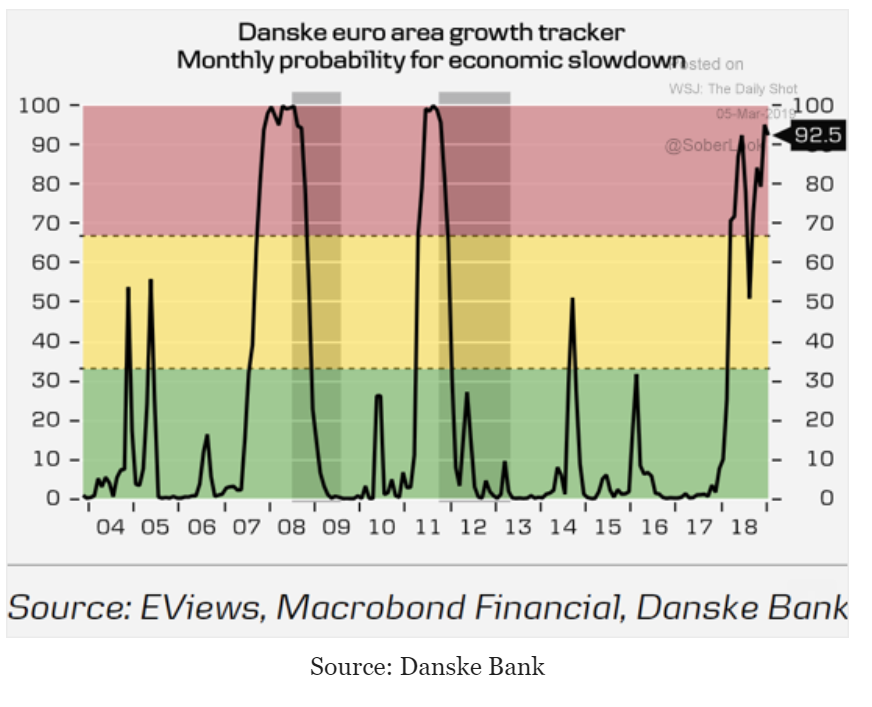

This is a small step but in the right direction:

China to raise fiscal deficit target

(China Daily) China will raise its fiscal deficit target to 2.76 trillion yuan, or 2.8 percent of GDP, this year from 2.6 percent in 2018. The measure is being taken to stabilize economic growth by enlarging government spending, according to the annual Government Work Report. As a major measure to tackle economic risks, the proactive fiscal policy in 2019 will become stronger and more efficient, Premier Li Keqiang said. Total government expenditure is budgeted at over 23 trillion yuan, up by 6.5 percent from last year. “We will refrain from using a deluge of stimulus policies,” Li told participants of the opening of the session.

Global semiconductor market dips for first time in 30 months

(Nikkei) Worldwide semiconductor sales receded 5.7% on the year to $35.5 billion in January, according to World Semiconductor Trade Statistics, the first decline in 30 months. A market that had previously expanded at a 20%-plus clip started losing steam in the second half of 2018. Flash memory prices plunged more than 40% in a year. Chinese semiconductor sales between November 2018 and January 2019 crashed by nearly 20% by value compared with August to October, according to WSTS. China accounts for 30-40% of a global semiconductor market that amounted to $469 billion last year.