A bit of an uptic from a very low number, with last month’s data revised still lower and the outlook still looking very soft: Highlights For retail sales, no period has more seasonal extremes than the busy days of December vs the quiet days of January. This and weather make adjustment difficult and are likely part of the explanation for the extreme volatility of the December and January retail sales reports. Retail sales managed only a 0.2 percent headline gain in January after plunging a downward revised 1.6 percent in December. But when excluding autos, where sales were very weak in January, the latest month shows a very strong 0.9 percent gain that hits the top of Econoday’s consensus range. The report’s two core readings — less autos & gas and the control group — also

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

A bit of an uptic from a very low number, with last month’s data revised still lower and the outlook still looking very soft:

Highlights

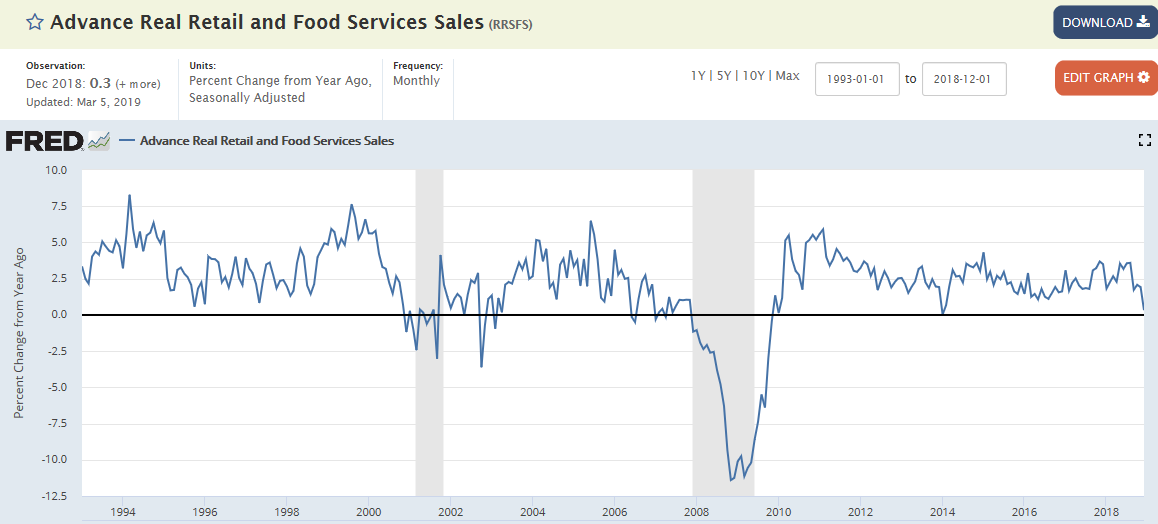

For retail sales, no period has more seasonal extremes than the busy days of December vs the quiet days of January. This and weather make adjustment difficult and are likely part of the explanation for the extreme volatility of the December and January retail sales reports.

Retail sales managed only a 0.2 percent headline gain in January after plunging a downward revised 1.6 percent in December. But when excluding autos, where sales were very weak in January, the latest month shows a very strong 0.9 percent gain that hits the top of Econoday’s consensus range. The report’s two core readings — less autos & gas and the control group — also show outstanding gains, of 1.2 and 1.1 percent respectively that reverse tremendous weakness in December at revised losses at 1.6 percent and 2.3 percent.

General merchandise is as good of place as any to find a reliable gauge to these unusual extremes and at a 0.8 percent January gain vs a 1.5 percent December loss probably puts in a nutshell the underlying message: deep and unusual weakness during the holiday season followed by a respectable bounce back. Nonstore retailers, where e-commerce is tracked, shows the same theme, at plus 2.6 percent in January vs severe contraction of minus 5.0 percent in December.

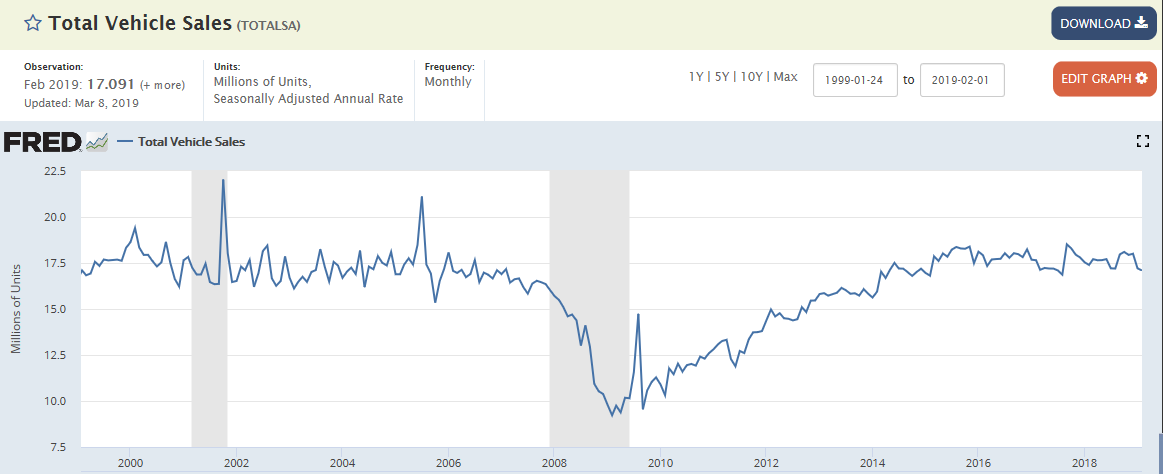

Vast swings are apparent through all readings which will have the Census Bureau double checking their adjustments. But it’s not all about adjustments. The government shutdown started late last year and proved a negative not only for consumer confidence readings which plunged but for consumer spending as well. How much has the consumer bounced back? Judging by January’s results the word “somewhat” comes to mind. But advance readings for February have not been favorable whether continued and deep weakness for auto sales or slowing growth in Redbook’s same-store sales tally.

For the first-quarter GDP outlook, today’s report is positive as it shows acceleration. For the Federal Reserve, the report is right in line with their move toward caution, waiting to see how events are unfolding.

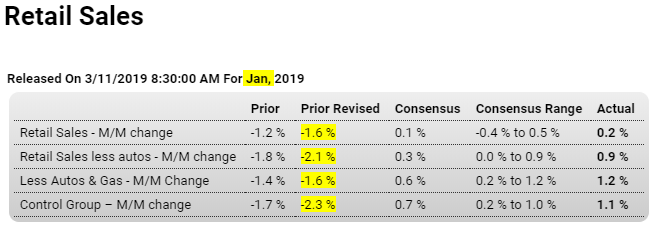

Deceleration:

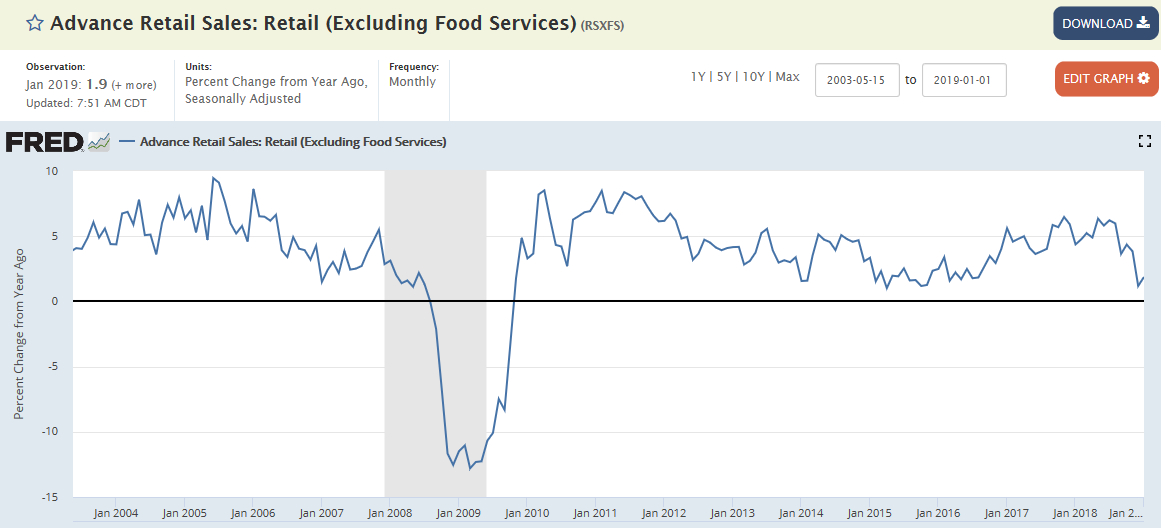

This is adjusted for inflation, and only through December:

No growth here:

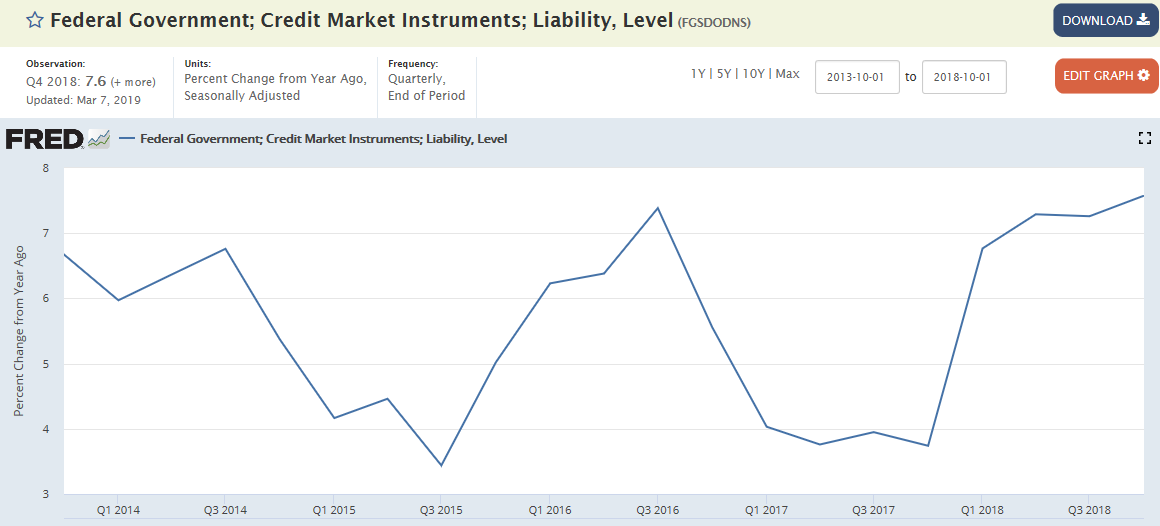

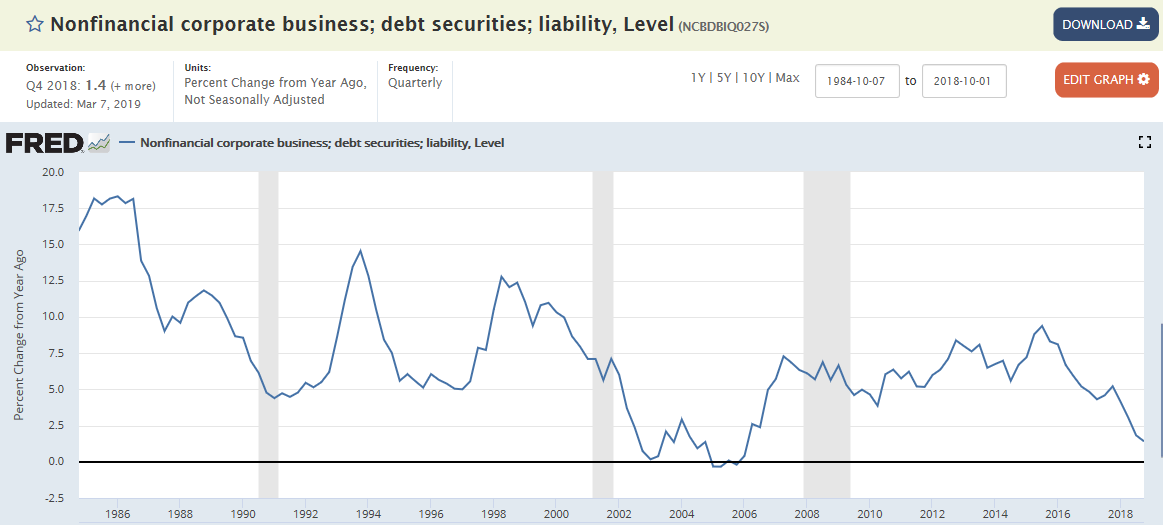

Decelerating corporate deficit spending:

Federal govt. deficit spending has been growing: