Lots of headlines pointing to corporate weakness: Amazon sales outlook falls short after record holiday quarter (Reuters) Fast and free shipping helped the world’s largest online retailer boost revenue by 20 percent. Net income jumped 63 percent to billion for the fourth quarter. Its international operating loss shrunk to 2 million in the quarter from 9 million a year earlier. The company forecast net sales of between billion and billion for the first quarter. Overall, net sales for the fourth quarter were .38 billion and beat analysts’ average estimate of .87 billion on the back of a strong holiday season, which includes the major U.S. shopping event Black Friday. Seems to be holding up as the rest of the global economy is fading fast. The

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

Lots of headlines pointing to corporate weakness:

Amazon sales outlook falls short after record holiday quarter

(Reuters) Fast and free shipping helped the world’s largest online retailer boost revenue by 20 percent. Net income jumped 63 percent to $3 billion for the fourth quarter. Its international operating loss shrunk to $642 million in the quarter from $919 million a year earlier. The company forecast net sales of between $56 billion and $60 billion for the first quarter. Overall, net sales for the fourth quarter were $72.38 billion and beat analysts’ average estimate of $71.87 billion on the back of a strong holiday season, which includes the major U.S. shopping event Black Friday.

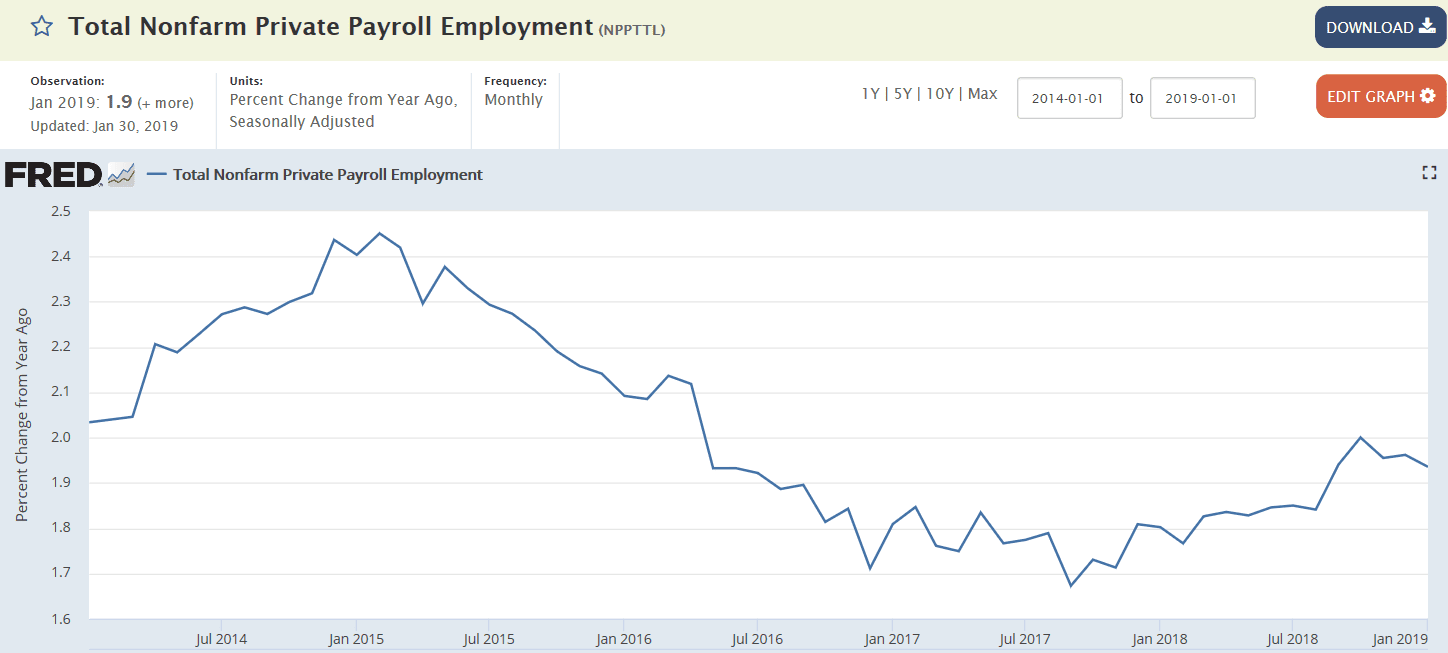

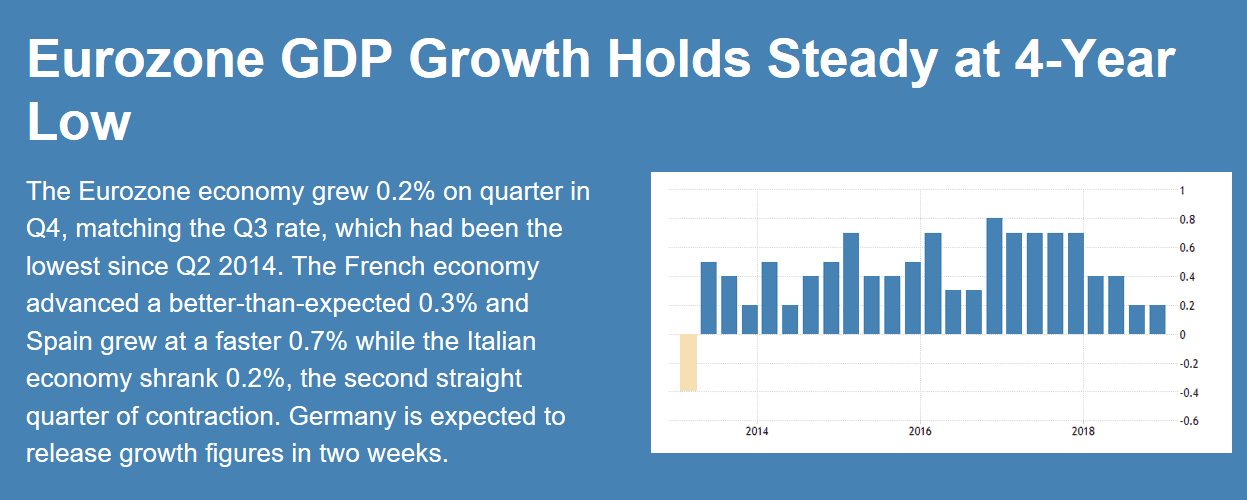

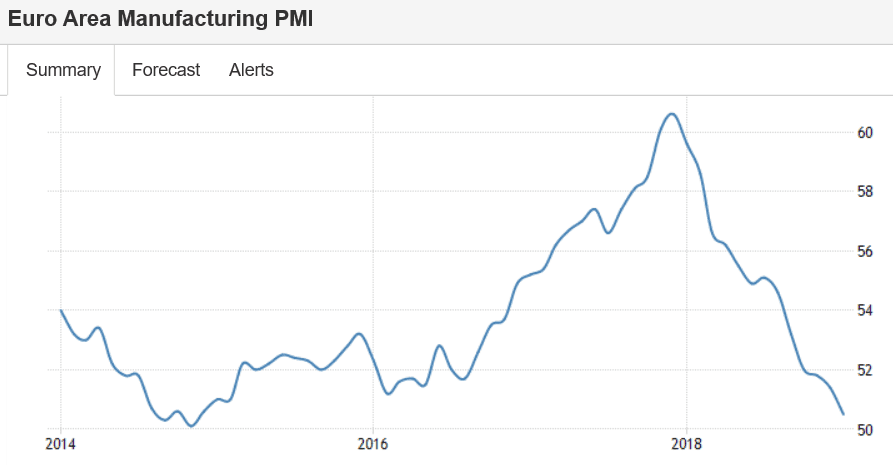

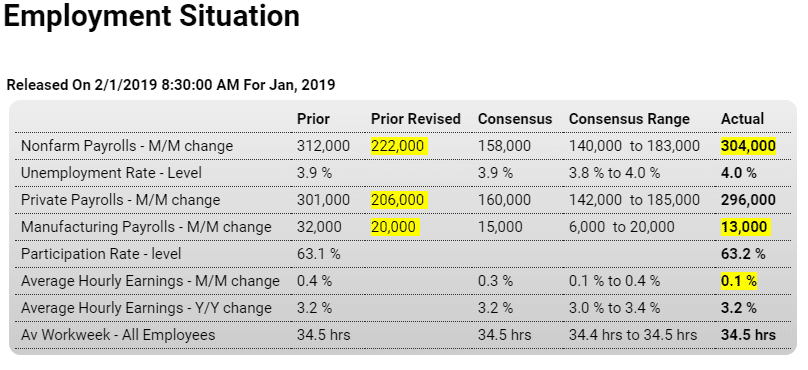

Seems to be holding up as the rest of the global economy is fading fast. The revisions are interesting, best not to judge a number until it’s at least a month old:

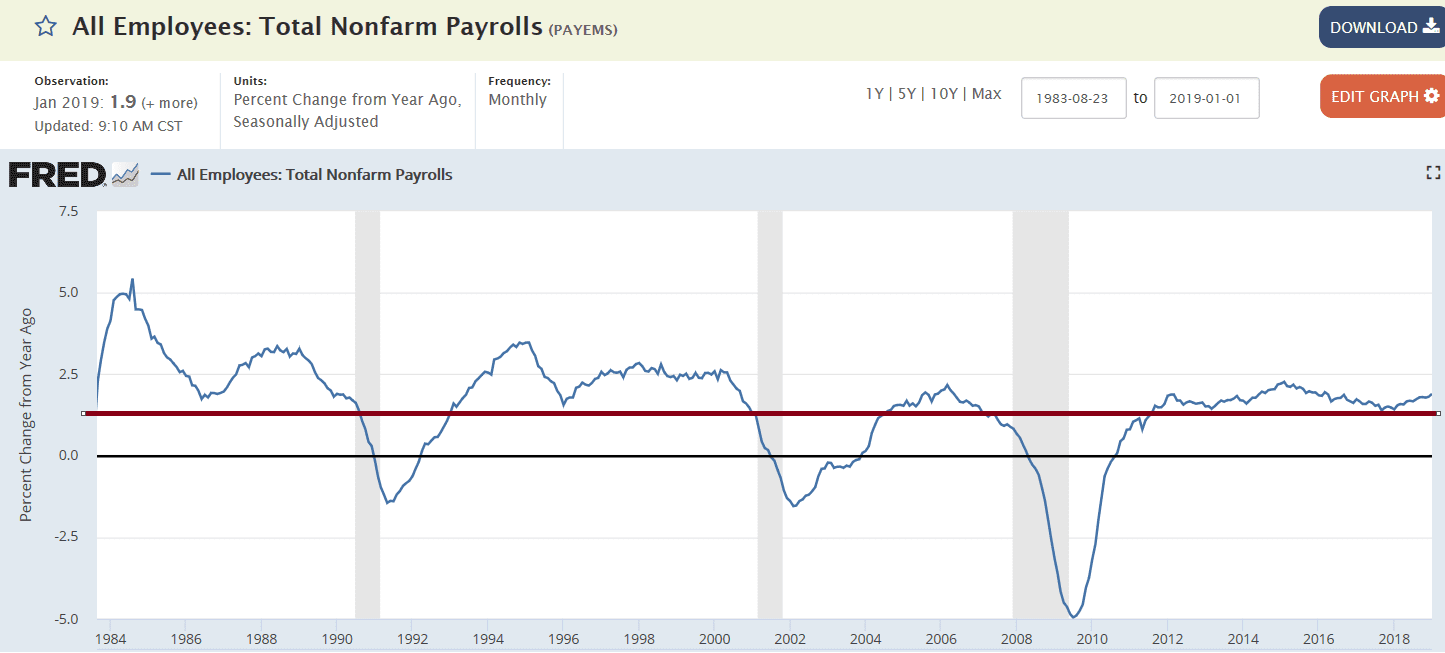

Seems to be nudging back up since the tax cuts, or maybe it all gets revised down next month to make it look more like the other indicators?

Private payrolls alone tell a somewhat different story: