Apple says China sales fell 27% last quarter (Nikkei) Apple’s net sales in greater China, including the mainland, Hong Kong and Taiwan, fell 27% on the year to .17 billion for the three months ended Dec. 29 in results announced Tuesday. This marked the first downturn there in six quarters. Combined sales elsewhere, including the U.S., Europe and Japan, grew 1% to .1 billion, pointing to China as the central cause of the sluggish quarterly results. Greater China as a share of Apple’s sales shrank to 16% from 20%. Total sales for the quarter dropped 5% to .3 billion. 3M Lowers Profit Outlook for 2019 (WSJ) “Some of the things that we were expecting on tariffs haven’t turned out quite as bad as what we were estimating,” Financial Chief Nick Gangestad said. 3M now

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

Apple says China sales fell 27% last quarter

(Nikkei) Apple’s net sales in greater China, including the mainland, Hong Kong and Taiwan, fell 27% on the year to $13.17 billion for the three months ended Dec. 29 in results announced Tuesday. This marked the first downturn there in six quarters. Combined sales elsewhere, including the U.S., Europe and Japan, grew 1% to $71.1 billion, pointing to China as the central cause of the sluggish quarterly results. Greater China as a share of Apple’s sales shrank to 16% from 20%. Total sales for the quarter dropped 5% to $84.3 billion.

3M Lowers Profit Outlook for 2019

(WSJ) “Some of the things that we were expecting on tariffs haven’t turned out quite as bad as what we were estimating,” Financial Chief Nick Gangestad said. 3M now expects $70 million in higher raw material costs this year, including the effect of tariffs, compared with $100 million previously. But 3M said it was seeing a slowdown in some important markets including China and weaker demand globally in industries such as car and electronics production. The company expects potentially lower revenue growth and earnings of $10.45 to $10.90 a share this year, compared with its prior goal of $10.60 to $11.05 a share.

U.S. auto sales seen down in January: J.D. Power, LMC

(Reuters) U.S. auto sales in January are expected to fall about 1 percent from the same month in 2018, partly due to uncertainty around government shutdown causing some customers to delay purchases, according to industry consultants J.D. Power and LMC Automotive. Total vehicle sales in January are estimated to be about 1,141,300 vehicles, the consultancies said on Tuesday. Retail sales are expected to fall 2.4 percent to 864,300 vehicles in January, while the overall total seasonally adjusted annualized rate for vehicles is expected to be about 16.8 million vehicles, down 2.3 percent from a year ago.

Highlights

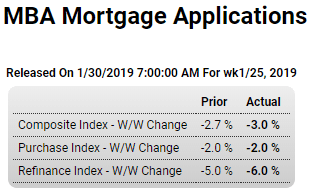

Purchase applications for home mortgages fell a seasonally adjusted 2 percent in the January 25 week, continuing the prior week’s cooling from the highest volume since 2010 seen at the start of the year. Year-on-year, unadjusted purchase applications gave up a 13 percent gain recorded in the prior week and plunged back into negative territory to a level 7 percent lower than a year ago. Applications for refinancing fell 6 percent from the prior week, pulling down the refinance share of mortgage activity by 2.5 percentage points to 42.0 percent. The average interest rate for 30-year fixed rate conforming mortgages ($484,350 or less) rose 1 basis point from the prior week to 4.75 percent. Note that results for the week were affected by the Martin Luther King Jr. Holiday, for which adjustments were made but which may still have distorted some comparisons. Despite the cooling in the last 2 weeks, purchase applications remain about 6 percent above the long term average and could give a boost to the housing market in the upcoming spring buying and selling season.

Way below expectations:

NAR: Pending Home Sales Index Decreased 2.2% in December

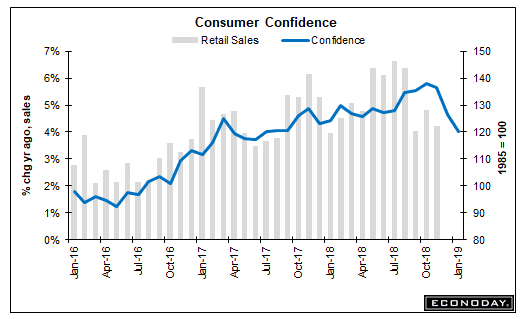

Still high but softening rapidly:

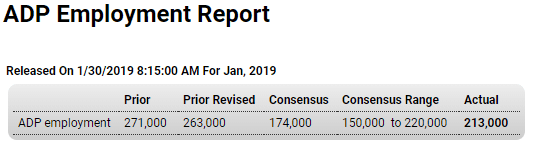

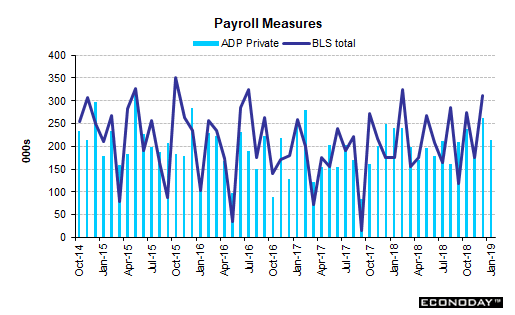

This forecast for Friday’s employment report is down from last month but still reasonably strong:

Highlights

ADP estimates that private payroll growth in Friday’s employment report for January will rise a higher-than-expected 213,000. Forecasters pegged ADP’s January estimate at 174,000 and see Friday’s private payrolls coming in at 160,000 vs 301,000 in December.

These seem to be popping up everywhere, with none of them getting it right… ;)

The Flamboyant Absurdity of ‘Modern Monetary Theory’

Modern Monetary Theory: A Cargo Cult

MMT Or Bust – A Big Government Fantasy For Leftists