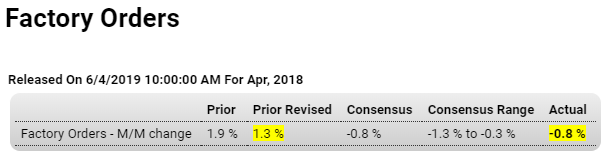

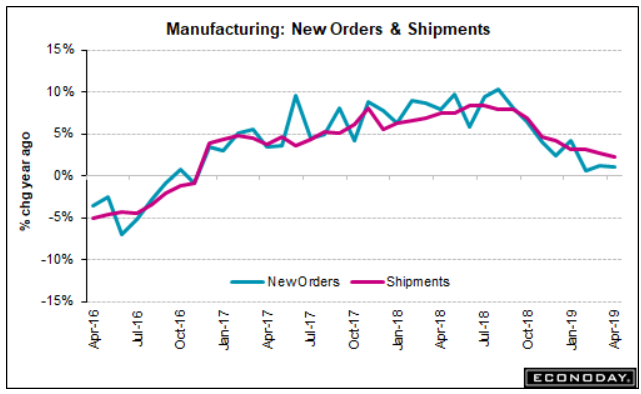

US Factory Orders Fall the Most in 6 Months New orders for US manufactured goods fell 0.8% in April, the most since October last year, due to lower demand for transportation equipment, computers and electronic orders, and primary metals. Meanwhile, shipments of manufactured goods declined 0.5% in April, the largest drop since April 2017. Highlights At an as-expected minus 0.8 percent, April’s factory orders report closes the book on what was a weak month for US manufacturing. The split between the report’s two main components shows a 0.5 percent rise for nondurable goods — the new data in today’s report where strength is tied to petroleum and coal — and a 2.1 percent dip for durable orders which is unrevised from last week’s advance reading. Core capital goods

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

US Factory Orders Fall the Most in 6 Months

New orders for US manufactured goods fell 0.8% in April, the most since October last year, due to lower demand for transportation equipment, computers and electronic orders, and primary metals. Meanwhile, shipments of manufactured goods declined 0.5% in April, the largest drop since April 2017.

Highlights

At an as-expected minus 0.8 percent, April’s factory orders report closes the book on what was a weak month for US manufacturing. The split between the report’s two main components shows a 0.5 percent rise for nondurable goods — the new data in today’s report where strength is tied to petroleum and coal — and a 2.1 percent dip for durable orders which is unrevised from last week’s advance reading.

Core capital goods (nondefense ex-aircraft) are very weak in the report, down 1.0 percent for orders and unchanged for shipments. Both readings hint at slowing for second-quarter business investment. General weakness is evident in the market breakdown with orders for primary metals, fabrications, machinery, and new vehicles all weak.

Data on civilian aircraft are always volatile month-to-month but April’s declines in new orders and unfilled orders were limited, suggesting that possible effects from the 737 grounding have yet to hit. Aside from this, however, the April factory report is consistent with a sector that continues to struggle and, unlike last year, does not look to contribute to 2019 growth.

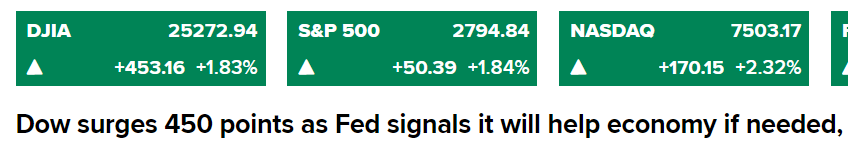

Seems the Fed Chairman and ‘the market’ still don’t know they’ve had the interest rate thing backwards. Lower rates remove interest income from the economy as the US Treasury pays less interest on its net spending, causing net spending to decrease.

This is today’s statement that is driving today’s expectations of growth:

The Fed “will act as appropriate to sustain the expansion, with a strong labor market and inflation near our symmetric 2 percent objective”, Chair Jerome H. Powell said at a conference in Chicago. The chairman also noted that the proximity of interest rates to the effective lower bound (ELB) has become “the preeminent monetary policy challenge of our time”, as it limits the central bank’s ability to support growth by cutting rates.

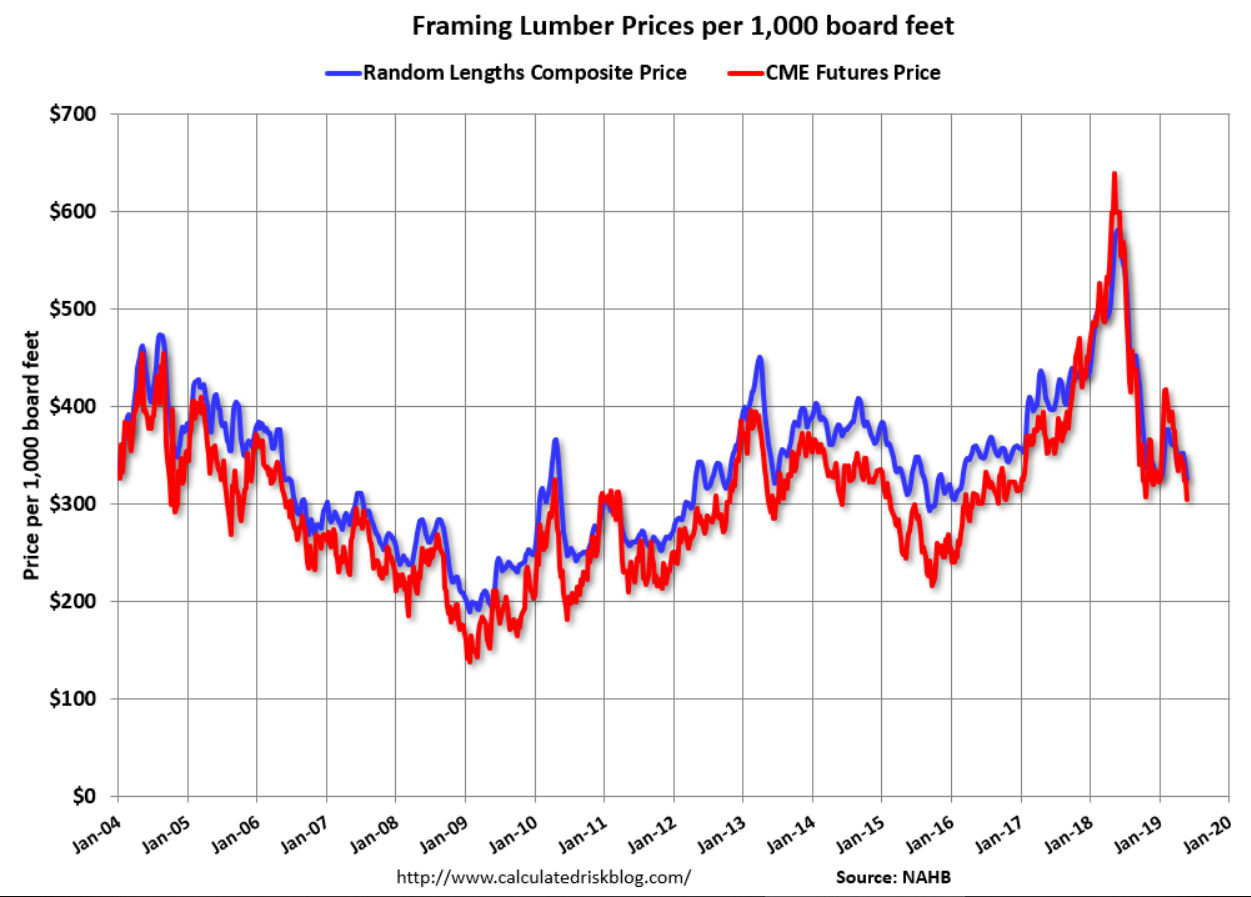

This hasn't been a bad housing indicator in past cycles: