Agent Orange, AKA Tariff Man, taking down the global economy: Intel Projects Slower Revenue Growth This Year (WSJ) Intel Corp. reported a 9% gain in revenue. Customers’ robust appetite for server chips boosted data-center businesses by 45% through the first nine months of 2018, but now those buyers need to digest those purchases, finance chief and interim chief executive Bob Swan said. That slowdown will hit the next two quarters as well, he said. The company now expects total revenue growth of about 1% in the year ahead to .5 billion, a much more conservative pace than the nearly 13% growth in 2018. Mr. Swan told analysts Thursday that “our outlook is a little more cautious than it was a few months ago.” Global shipping rates slump in latest sign of economic

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

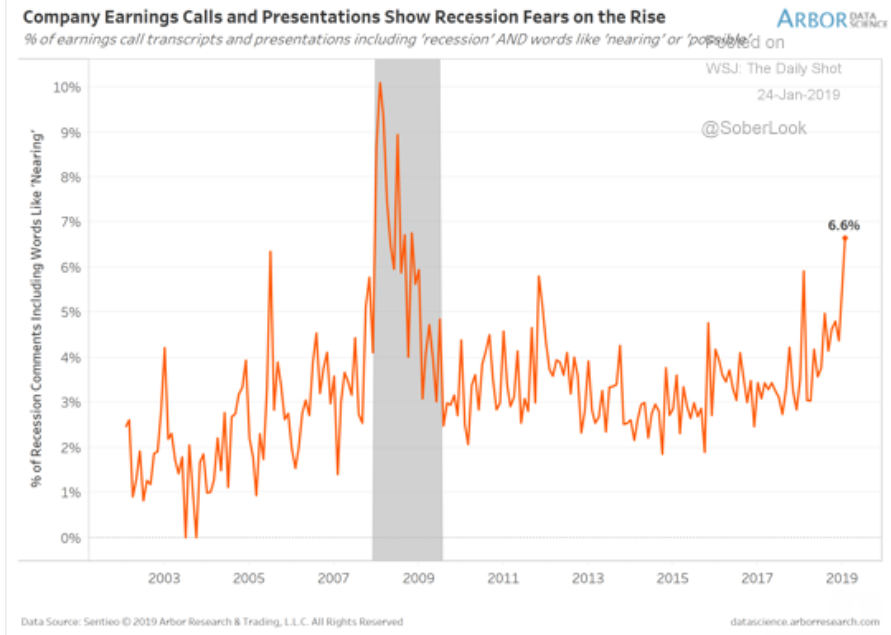

Agent Orange, AKA Tariff Man, taking down the global economy:

Intel Projects Slower Revenue Growth This Year

(WSJ) Intel Corp. reported a 9% gain in revenue. Customers’ robust appetite for server chips boosted data-center businesses by 45% through the first nine months of 2018, but now those buyers need to digest those purchases, finance chief and interim chief executive Bob Swan said. That slowdown will hit the next two quarters as well, he said. The company now expects total revenue growth of about 1% in the year ahead to $71.5 billion, a much more conservative pace than the nearly 13% growth in 2018. Mr. Swan told analysts Thursday that “our outlook is a little more cautious than it was a few months ago.”

Global shipping rates slump in latest sign of economic slowdown

(Reuters) The Baltic Dry Index, measure of ship transport costs for materials like iron ore and coal, has fallen by 47 percent since mid-2018. The Baltic index has lost a quarter of its value since the start of the year, and dry-bulk is not the only shipping market under pressure. The Harpex Shipping Index, which tracks container rates, has dropped by 30 percent since June 2018. As a measure of the demand for shipping manufactured goods from producers to consumers, container rates are also seen as a leading economic indicator.