Euro area business growth close to stalling at 5½ year low in January (Markit) Flash Eurozone PMI Composite Output Index at 50.7 (51.1 in December). Services PMI Activity Index at 50.8 (51.2 in December). Manufacturing PMI Output Index at 50.4 (51.0 in December). Manufacturing PMI at 50.5 (51.4 in December). The factory sector reported the weakest expansion since the current production upturn began in July 2013, while the service sector expansion was the smallest since August 2013. New orders for goods fell for a fourth successive month, declining at a rate not seen since April 2013, while inflows of new business in the service sector slipped into decline for the first time since July 2013. Trump adviser warns of zero growth if shutdown lingers this quarter (The

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

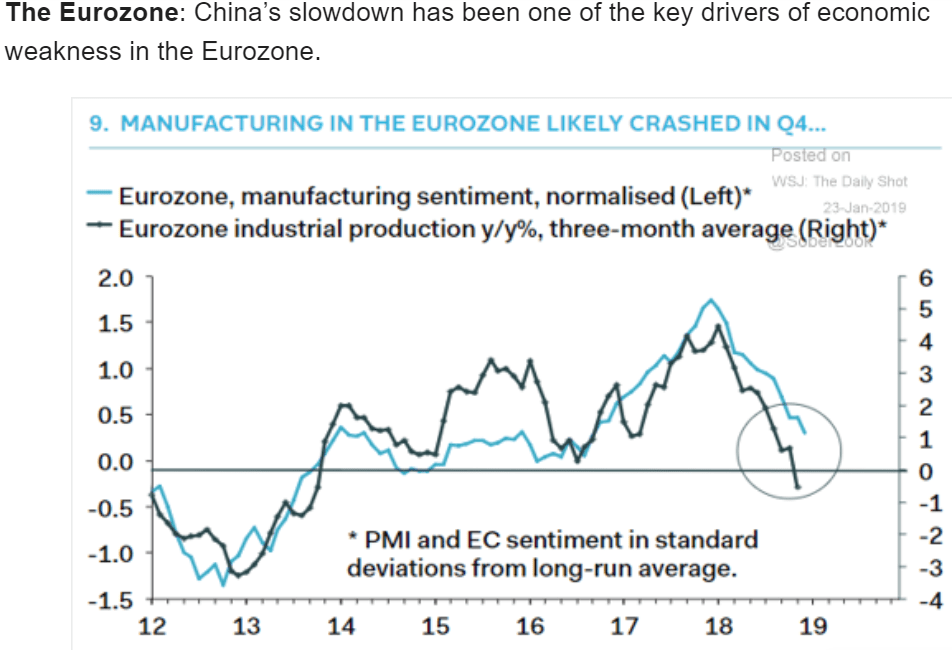

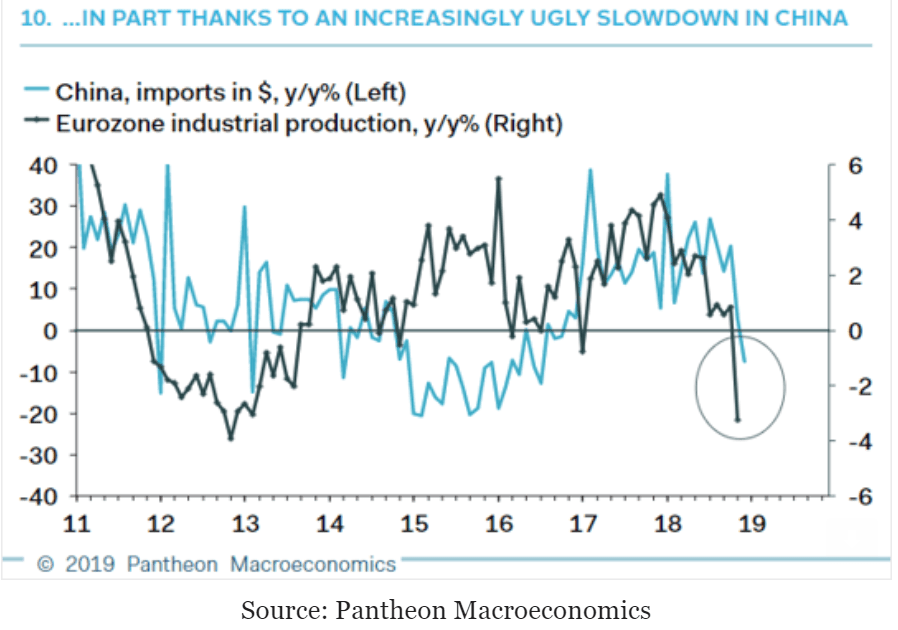

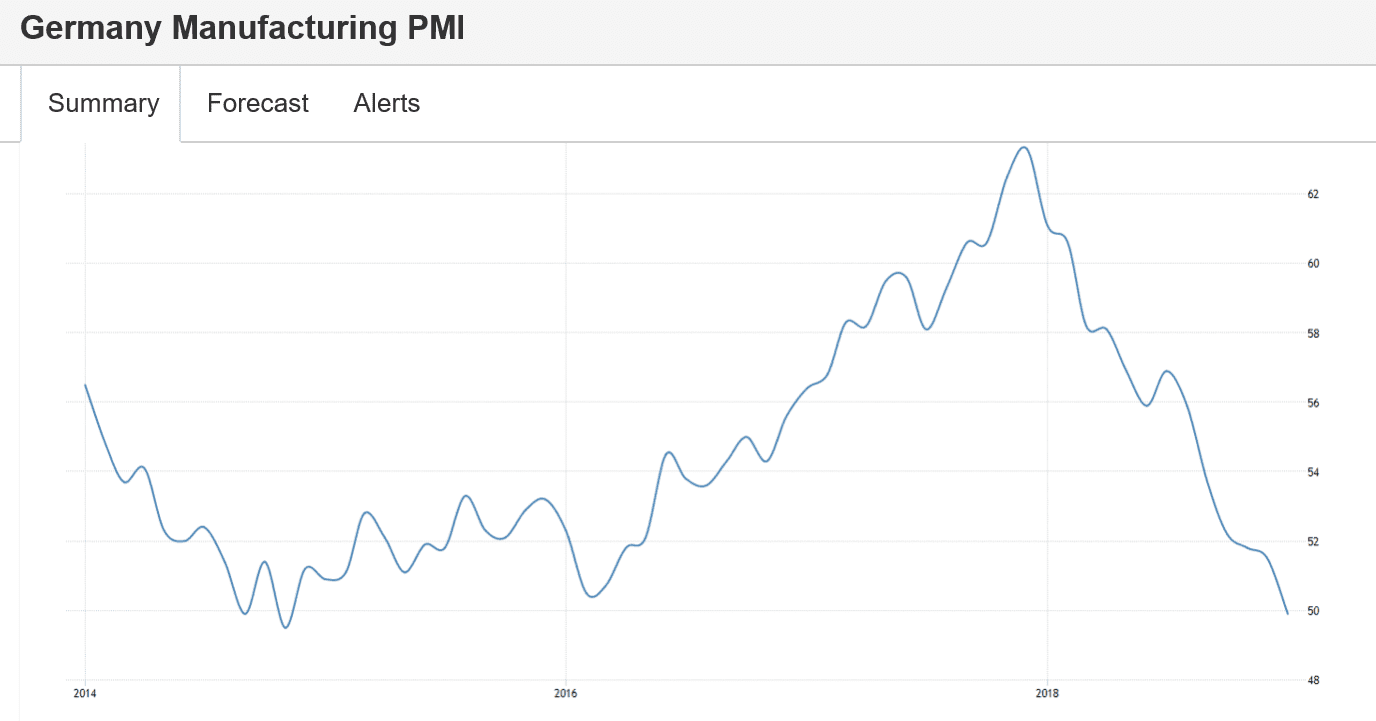

Euro area business growth close to stalling at 5½ year low in January

(Markit) Flash Eurozone PMI Composite Output Index at 50.7 (51.1 in December). Services PMI Activity Index at 50.8 (51.2 in December). Manufacturing PMI Output Index at 50.4 (51.0 in December). Manufacturing PMI at 50.5 (51.4 in December). The factory sector reported the weakest expansion since the current production upturn began in July 2013, while the service sector expansion was the smallest since August 2013. New orders for goods fell for a fourth successive month, declining at a rate not seen since April 2013, while inflows of new business in the service sector slipped into decline for the first time since July 2013.

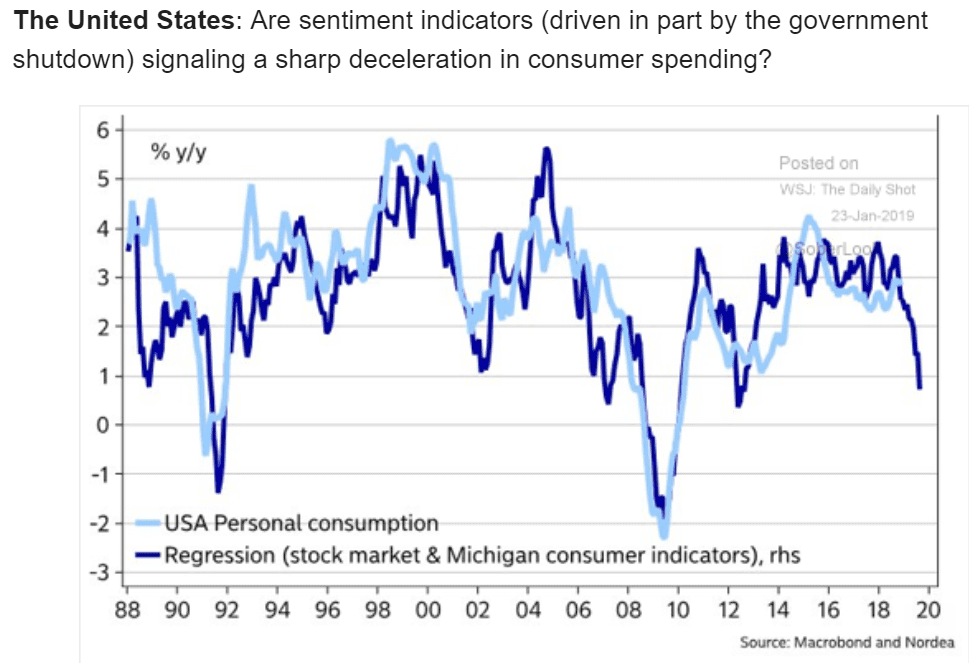

Trump adviser warns of zero growth if shutdown lingers this quarter

(The Hill) Kevin Hassett, chairman of the White House Council of Economic Advisers, said Wednesday that the partial government shutdown could wipe out an entire quarter of gross domestic product (GDP) growth if it lasts until the end of March. “It is true that if we get a typically weak first quarter and then have an extended shutdown that we could end up with a number that’s very, very low,” Hassett said. When asked if the U.S. could see no growth at all in the first quarter, Hassett said, “Yes, we could,” if the shutdown lasted until the end of March.

Truckers See Momentum Slowing Heading Into 2019

(WSJ) J.B. Hunt Transport Services on Thursday reported $2.32 billion in revenue for the fourth quarter, a 16% year-over-year increase. An index of U.S. domestic freight volumes slipped 0.8% last month compared with December 2017, the first annual decline in two years, according toCass Information Systems Inc., which processes freight bills. The average price to hire the most common type of big rig dipped to $2.07 per mile, a penny lower than the prior month and 5 cents below the level in December 2017, according to online freight marketplace DAT Solutions LLC.