Summary:

No sign of recession, and lots of indications the rate hikes that are adding to deficit spending as supporting the economy and prices, and not depressing them, and more rate hikes will only do more of same. And it doesn’t end until the Fed understands it has had it all backwards: This is about 85% of the economy. No recession yet. More and more the data is telling me debt/gdp is plenty high for rate hikes to be supportive of total spending in the economy: Housing has been weak since the rate hikes, but the declines have been diminishing and with the continuously increasing personal income from (lower but still high) government deficit spending. I’m expecting housing to show modest growth going forward, in line with the rest of the economy. Note that applications are

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

No sign of recession, and lots of indications the rate hikes that are adding to deficit spending as supporting the economy and prices, and not depressing them, and more rate hikes will only do more of same. And it doesn’t end until the Fed understands it has had it all backwards: This is about 85% of the economy. No recession yet. More and more the data is telling me debt/gdp is plenty high for rate hikes to be supportive of total spending in the economy: Housing has been weak since the rate hikes, but the declines have been diminishing and with the continuously increasing personal income from (lower but still high) government deficit spending. I’m expecting housing to show modest growth going forward, in line with the rest of the economy. Note that applications are

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

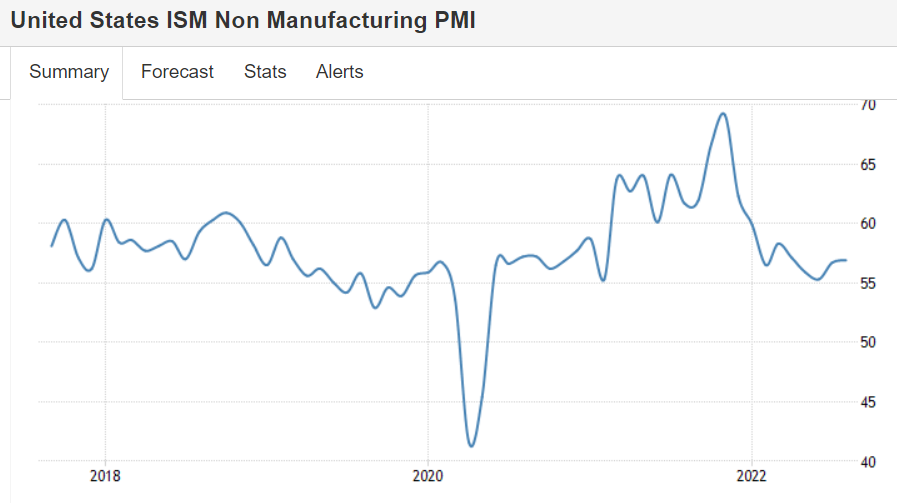

No sign of recession, and lots of indications the rate hikes that are adding to deficit spending as supporting the economy and prices, and not depressing them, and more rate hikes will only do more of same.

And it doesn’t end until the Fed understands it has had it all backwards:

This is about 85% of the economy.

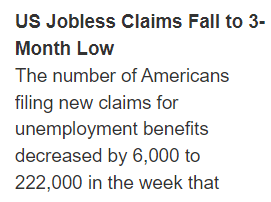

No recession yet. More and more the data is telling me debt/gdp is plenty high for rate hikes to be supportive of total spending in the economy:

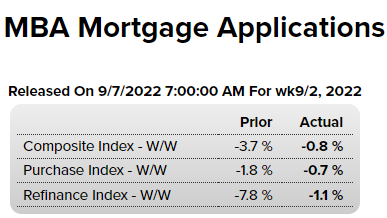

Housing has been weak since the rate hikes, but the declines have been diminishing and with the continuously increasing personal income from (lower but still high) government deficit spending.

I’m expecting housing to show modest growth going forward, in line with the rest of the economy.

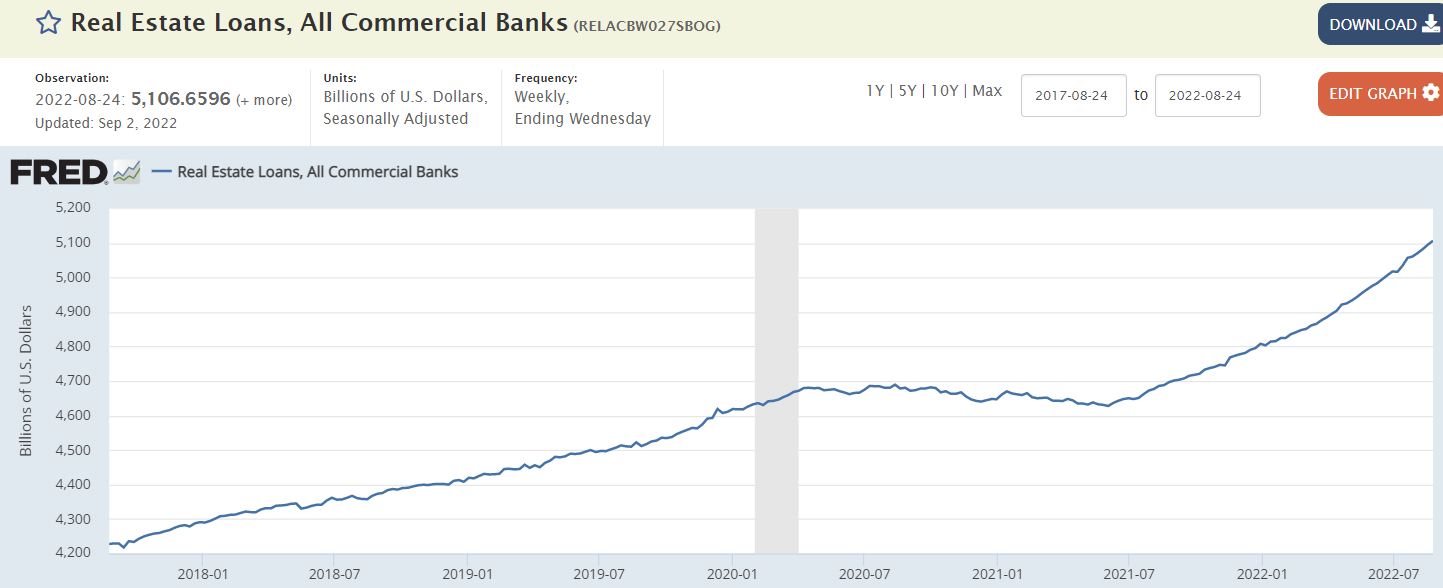

Note that applications are down but lending is still growing rapidly: