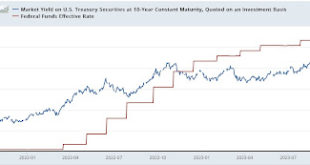

So both the (inverted) yield curve and the Sahm rule indicate a recession. This together with two months of slower employment creation, and the slightly higher unemployment rate, has many wondering whether the economy will crash soon. I discussed before -- a while ago, before the pandemic recession, that had nothing to do with the yield curve -- why an inverted yield curve doesn't necessarily mean a forthcoming recession. The Sahm rule, like the inverted yield curve has an impressive track...

Read More »The “bearish steepening” and the death of refinancing

The “bearish steepening” and the death of refinancing – by New Deal democrat If you’ve paid much attention to the financial press in recent days, you have probably read stories that the yield curve – the line that traces the difference in rates in different length bond maturities – has moved towards un-inverting. That is, the situation whereby short term rates are higher than long term rates is moving in the direction of reversing towards a...

Read More »Fed should control yield curve.

This* is what #MMT has been arguing all along. It shouldn't just be for crises, and it's weird that anyone in favor of "central bank independence" doesn't think a central bank should have more tools.https://t.co/c6qSo4omNY — Scott Fullwiler (@stf18) March 27, 2020 *FT Opinion (Registration required)Why the Fed should put the Treasuries market on a war footing Colby Smiththers

Read More »Breaking Market Trends — Brian Romanchuk

The secular bull market in U.S. Treasury bonds has once again resumed in full force, probably driven by short-covering. Meanwhile, risk markets are in disarray. The main question for markets is predicting when these trends will be broken. Since I do not give market forecasts, I will keep this article short, as I will just outline what I think what needs to be kept in mind.... Bond EconomicsBreaking Market TrendsBrian Romanchuk

Read More »Why Rate Expectations Dominates Bond Yield Fair Value Estimates — Brian Romanchuk

Although there are various attempts to downplay rate expectations as an explanation for bond yields. the reality is that they dominate any other attempt to generate a fair value estimate by using "fundamental data". (Since we cannot hope to explain every last wiggle of bond yields without having a largely content-free model, we need to look at fair value estimates.) The reasoning is rather straightforward: so long as the risk free curve slope is related to the state of the economy, bond...

Read More »The inverted yield curve and the recession

The inverted yield curve, as it is well-known, indicates a forthcoming recession. I used it last year to suggest that the recession was not in the near horizon. The conventional explanation follows Wicksellian ideas (see this old post). In the Wicksellian story, one can think of the 10 year bond rate as a proxy for the natural rate of interest, and the Fed Funds for the monetary or banking rate. Hence, whenever the short-term rate (Fed Funds) is above the long-term one, it would be...

Read More »Bill Mitchell — Inverted yield curves signalling a total failure of the dominant mainstream macroeconomics

At different times, the manias spread through the world’s financial and economic commentariat. We have had regular predictions that Japan was about to collapse, with a mix of hyperinflation, government insolvency, Bank of Japan negative capital and more. During the GFC, the mainstream economists were out in force predicting accelerating inflation (because of QE and rising fiscal deficits), rising bond yields and government insolvency issues (because of rising deficits and debt ratios) and...

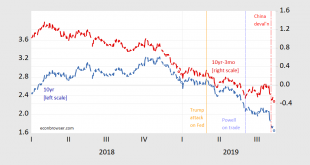

Read More »Term Spreads Plumb New Depths as Long Yield Drops — Menzie Chinn

EconbrowserTerm Spreads Plumb New Depths as Long Yield Drops Menzie Chinn | Professor of Public Affairs and Economics, Robert M. La Follette School of Public Affairs, University of Wisconsin–Madison, co-editor of the Journal of International Money and Finance, and a Research Associate of the National Bureau of Economic Research International Finance and Macroeconomics

Read More »Greg Robb — The Fed is dusting off a QE replacement, last used during World War II

MMT economists have been saying that the government acting through its central bank has this power as currency monopolist to manage the yield curve in addition to setting the policy rate, if it chooses to use it. What difference does this make? The 5 and 10 year rates serve as benchmarks for commercial lending. Since housing is such an integral part of the economy, mortgage rates are especially influential and it has been argued that central bank interest setting acts primarily through...

Read More »Brian Romanchuk — When Can Yield Curves Fail As Indicators?

Although yield curve slopes are very effective indicators for forecasting recessions, they are not infallible. This article discusses some of the reasons why a yield curve inversion can be a misleading recession signal.... Bond Economics When Can Yield Curves Fail As Indicators?Brian Romanchuk

Read More » Heterodox

Heterodox

-310x165.png)