On Wednesday (30 September) the Office for National Statistics published its second estimate of GDP for the second quarter of 2020, April to June. The very marginally positive news is that the fall, between Q1 and Q2, was reduced from 20.4% to 19.8%. Since this was still the largest recorded quarterly fall since records commence in 1955, this is hardly a cause for jubilation – and even less so since the Q1 drop was raised from -2.2% to -2.5%. As we discuss below, the position would arguably be still worse, save for the curious treatment of ‘imputed rent’ for houseowners, which – as a purely fictional or metaphysical element – nonetheless forms an inordinately large chunk of GDP. Looking at the path of the UK’s economic progress in recent years, we may note that the percentage rate of

Topics:

Jeremy Smith considers the following as important: Article, Economics & Ideology, GDP & Economic Activity, UK

This could be interesting, too:

Jeremy Smith writes UK workers’ pay over 6 years – just about keeping up with inflation (but one sector does much better…)

T. Sabri Öncü writes Argentina’s Economic Shock Therapy: Assessing the Impact of Milei’s Austerity Policies and the Road Ahead

T. Sabri Öncü writes The Poverty of Neo-liberal Economics: Lessons from Türkiye’s ‘Unorthodox’ Central Banking Experiment

Robert Skidelsky writes Speech in the House of Lords Conduct Committee: Code of Conduct Review – 8th of October

On Wednesday (30 September) the Office for National Statistics published its second estimate of GDP for the second quarter of 2020, April to June. The very marginally positive news is that the fall, between Q1 and Q2, was reduced from 20.4% to 19.8%. Since this was still the largest recorded quarterly fall since records commence in 1955, this is hardly a cause for jubilation – and even less so since the Q1 drop was raised from -2.2% to -2.5%.

As we discuss below, the position would arguably be still worse, save for the curious treatment of ‘imputed rent’ for houseowners, which – as a purely fictional or metaphysical element – nonetheless forms an inordinately large chunk of GDP.

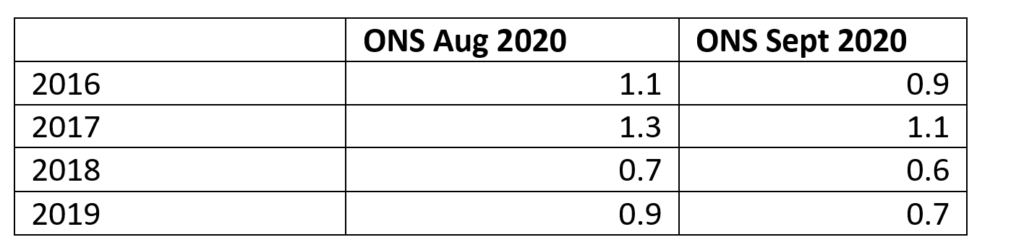

Looking at the path of the UK’s economic progress in recent years, we may note that the percentage rate of real GDP increase for three out of the four most recent years has also been lowered by ONS:

Whether this progressive decline in GDP is down to Brexit, in whole or in part, is for discussion another time – but the relevant figures for pre-Referendum years 2014 and 2015 are 2.9% and 2.4% respectively.

There is a similar impact on the rate of annual change in real GDP per head from 2016 to 2019:

But back to the latest numbers. As readers may know, GDP is calculated in three different ways, which should lead to the same overall result – via output, expenditure, and income. A quick look at the headlines for each method:

Output

Production overall (which in the UK excludes construction) fell in Q2 by 16.3% compared to Q1; of this, manufacturing fell by 21.1%. Construction fell by 35.7%.

Services fell overall by 19.2%. Of which, the greatest was in the grouping ‘distribution, hotels & restaurants’ at 34.3% (with its subset ‘accommodation & food services’ by 85.7%..), ‘government & other services’ by 23.7% while ‘business services & finance’ fell just 11%. The latter was helped by subset ‘real estate’ – curiously – falling just 2.6%. The only subset that actually gained was ‘public admin, defence, social security’ which rose by 0.6%.

Expenditure

The ‘expenditure’ method can be simply summarised: it comprises (a) ‘final household consumption’ of households, non-profits, and general government (excluding capital expenditure), plus (b) gross fixed capital formation (including business investment, new build etc.), plus (c) the trade balance, i.e. the difference between exports and imports.

In Q2, in ‘real’ terms, household consumption fell by 23.6% and investment (GFCF) by 21.6% (of which business investment by 26.5%), while government expenditure is deemed to have fallen by 14.6% (in current terms, government spending actually rose significantly – the calculation of ‘real’ government ‘consumption’ here is highly esoteric, as explained by ONS). The trade balance swung from a small negative in Q1 to a significant surplus in Q2, due to exports falling less than imports.

Income

The ‘income’ method is calculated only in current process, i.e. not in ‘real’ terms after allowing for inflation. It comprises: compensation of employees (including employers’ social contributions), plus gross operating surplus of corporations, plus other income. Given the positive help of the furlough programme, wages & salaries fell by a relatively modest 2.7% between Q1 and Q2, while overall corporations. Operating surplus fell by 12.5%.

So what about ‘imputed rent’ for owner-occupiers?

Amidst all the carnage, a small number of sectors survived to make gains, even if modest gains, in Q2. At Table E3, we find 12 sets of ‘household final consumption expenditure by purpose’, of which 3 show gains in Q2. The first is ‘food & drink’ (+3.5%), second ‘alcohol & tobacco’ (+2.9%) and the third is ‘housing’, which rose in Q2 by 0.1%. This is separate from ‘household goods and services.

To find out what this ‘housing’ subset consists of, we must turn to the latest issue of ONS’s dataset “Consumer trends, UK” for April to June 2020. This was also published on 30th September. This shows that (in ‘real’ or constant volume terms) of the £86.225 billion in Q2 for “housing, water, electricity, gas & other fuel”, which equates to the amount in the “housing” list at Table E3, £53.765 billion is said to be “imputed rentals for housing”, of which £50.773 billion is attributed to “imputed rentals for owner-occupiers”.

This fictional amount is what house-owners are deemed to charge themselves by way of rent, which is then deemed to be spent. I try to explain the rationale, below.

Now, that £50 billion of household “consumption” expenditure is purely notional and has no real-world basis. Imputed rents do not normally make a vast difference to the quarterly changes in GDP, but on this occasion they undoubtedly have the effect of understating the true fall in economic activity in the UK in the first half of this year. In recent years, imputed rents for owner-occupiers has comprised around 9% of GDP – and was 9.3% in Q4 of last year. But on this occasion, the ONS’s methodology leads to an actual notional increase in such ‘rent’ in Q2, by around 0.7%. As a result, the percentage of total real GDP in Q2 that is attributable to such imputed rental is now a huge 12%, given the collapse in so much of the rest of the economy! This means that the treatment of imputed rental has significantly distorted the true picture. I have therefore done the simple calculation of (a) subtracting the amount of imputed rental from GDP for Q4 2019 and for Q1 and Q2 in 2020, and (b) working out how much GDP fell by in Q1 and Q2 on this basis.

The results are as follows:

To sum up, if imputed rent – which is non-existent in the actual world – is excluded from GDP, the Q2 fall in GDP would be over two percentage points greater than is in fact shown.

The (irrational) rationale for imputed rent

ONS and other agencies responsible for GDP have tried, over the years, to explain and justify the use of imputed rent in calculating GDP. This is how they put it, in 2016:

“Owner-occupiers’ imputed rental is an estimate of the housing services consumed by households who are not actually renting their residence. It can be thought of as the amount that non-renters pay themselves for the housing services that they produce.

As such, imputed rental should represent the economic value per period to home owners of their dwellings, equivalent to if they were to rent out their properties. By definition, however, a homeowner does not receive payment on their property, and so the payment must be ‘imputed’.”

As someone who has been tenant and owner occupier, this is bizarre. As a tenant, I paid real rent that came out of my pocket into the hands of a landlord. It was a true economic transaction. But as owner occupier, it is absurd to treat me as paying myself a rent to represent the “economic value” of my home to myself. This is neoliberalism at work – the false commodification and financialisation of more and more aspects of our lives.

ONS continue:

“Measurement of imputed rental is important to ensure that, for comparisons over time and between countries, the valuation of housing services is calculated on a consistent basis. Different countries and periods will have a different composition of owner-occupied housing and rentals. For example, two home-owners would still consume the same amount of housing services as if they both rented their homes to each other, and we need to include these services in the national accounts.”

This is nonsense, since it assumes that “housing services” are being provided and “consumed”. We all need air to breathe, but we don’t (so far at least!) refer to “air services” being provided or “consumed”. But if the ONS’s logic were truly to be followed through, then there would need to be an imputed payment for the myriad other ‘services’ for which some people pay in a true market transaction, while others provide the benefit through non-economic relations.

The most obvious example is child care – there is a ‘market’ (whether via public or private sector) in which parents pay for childcare, or receive financial support to do so, but there is also a vast unpaid ‘provision’ of childcare by, for example, grandparents, and “consumed” by the household comprising children and parents.

Age UK found in 2017 that around 5 million (out of 14 million) grandparents have provided significant childcare – 30% of them for between 4 to 7 days a week, for a period of years. If (for example) we assume 2 million grandparents providing 10 hours a week on average for 50 weeks a year, and that the going rate would be £10 per hour, this would amount to an “imputed cost” of £10 billion, or a little under 0.5% of GDP… less than the imputed rent, of course, but far from negligible.

Taking ONS’s logic, childcare may be provided in Country A far more via the ‘market’, and in Country B far more via grandparents. Surely, the valuation of childcare services should either be “calculated on a consistent basis” with imputed charges where no market exists, or else we drop the whole charade of imputed rents and charges – whether for housing or for childcare.

It is also to note that in a paper for the Bank of England’s Quarterly Bulletin (2006 Q4) “Measuring market sector activity in the United Kingdom” the authors (including our long-standing PRIME contributor, Geoff Tily) consider the issue of imputed rental:

“Fourth, the role of housing services in market sector activity needs to be carefully considered. Both consumption spending and GDP in the National Accounts include household spending on the renting of dwellings and an imputed amount of ‘rental spending’ by owner-occupiers. Actual expenditure on rentals represents payments on marketed housing services, so in the SNA93 it is treated as market sector activity. However, owner-occupiers are assumed to consume their own output of housing services that they ‘produce’ from their ownership of dwellings. So imputed rentals might be excluded from the definition of market sector output, given that this is a form of output for ‘own consumption’.”

They go on to give the ONS’s rationale (cross-country comparisons on housing services etc.), but add that

“the Bank also looks at a measure of market sector output that excludes both actual and imputed rental spending to give a measure of market sector gross value added excluding all housing services.”

There is a footnote that adds:

“There are also some other reasons why the Bank of England looks at a measure that removes both actual and imputed rental spending. One issue is that flows of housing services arguably do not represent a claim on scarce resources since they require little or no primary factor inputs (ie non-housing capital and labour inputs) to produce, but are rather the flow of services arising from the existing stock of dwellings. This is the approach taken in the Bank’s quarterly forecasting model, where output is defined to exclude housing services, see Harrison et al (2005).”

Now, the authors are looking at “market sector activity” here, which is not all that is included in GDP. But GDP is supposed to look at “economic activity”, and the argument that family households “consume” housing services provided by the owner (i.e. member of the family, in most cases) is simply ideological. The responsibility (I nearly wrote ‘fault’) is not that of the ONS in isolation, as the practice presently derives from The System of National Accounts 2008 (2008 SNA) which self-describes as

“a statistical framework that provides a comprehensive, consistent and flexible set of macroeconomic accounts for policymaking, analysis and research purposes. It has been produced and is released under the auspices of the United Nations, the European Commission, the Organisation for Economic Co-operation and Development, the International Monetary Fund and the World Bank Group”.

In Chapter 9 (p.187), we read:

“Persons who own the dwellings in which they live are treated as owning unincorporated enterprises that produce housing services that are consumed by the household to which the owner belongs. The housing services produced are deemed to be equal in value to the rentals that would be paid on the market for accommodation of the same size, quality and type. Care must be taken in respect of any taxes paid on housing. Taxes such as value added tax are rarely paid on housing services, but if they are payable, they should be excluded from the value of owner-occupied housing if the owner-occupier is exempt from payment. The imputed values of the housing services are recorded as final consumption expenditures of the owners.”

Thus, we see that the fiction is not simply that a household pays rent unto itself, but that “the owner” constitutes “an unincorporated enterprise” producing market-equivalent housing services consumed by “the household”. This means that the children of a family owned by the parents are deemed to be paying rent to their parents. But if granny comes in to care for them, they are not deemed to pay her anything for her skilled services.

There may be a logic here. But I confess, I can’t see it. And I can’t see why – for the purpose of measuring “the size and health of a country’s economy over a period of time” (as the Bank of England describes GDP) we need a definition of ‘housing services’ that creates the fiction of an unincorporated association within every owner-occupied home that runs an enterprise of renting out the house to the members of the family unit.

And in our present pandemic, the fiction is even less credible, and serves only to mislead us.

Note

Readers may also like to read Shaun Richards’ take on imputed rent, in similar vein to mine here, and dating back to 23 May 2016. Here’s his article on his blogsite: “The problem that is Imputed Rent and hence GDP”.