“The Bank has always held itself bound to the extent of its power to render the assistance required by the Treasury in any exigency and under any condition of the Money Market.” – James Currie, Governor of Bank of England, July 1885 to Lord Salisbury, Prime MinisterThe new agreement between Government and Bank of England to make the Government’s overdraft with the Bank (the Ways and Means Facility) open-ended has been characterised as direct “monetary financing” of government. We don’t agree, at least for now. The Facility has however a long and valuable history of service, even if post-1998, with the “independence” of the Bank and establishment of the Debt Management Office, it has mainly been kept in hibernation. It has stood at £370 million for most of the last

Topics:

Jeremy Smith considers the following as important: fiscal policy, Monetary Policy, money & banking, public debt, UK

This could be interesting, too:

Jeremy Smith writes UK workers’ pay over 6 years – just about keeping up with inflation (but one sector does much better…)

T. Sabri Öncü writes The Poverty of Neo-liberal Economics: Lessons from Türkiye’s ‘Unorthodox’ Central Banking Experiment

Angry Bear writes A Fiscal Policy in a Global Context?

Matias Vernengo writes Very brief note on the Brazilian real and the fiscal package

“The Bank has always held itself bound to the extent of its power to render the assistance required by the Treasury in any exigency and under any condition of the Money Market.” – James Currie, Governor of Bank of England, July 1885 to Lord Salisbury, Prime Minister

The new agreement between Government and Bank of England to make the Government’s overdraft with the Bank (the Ways and Means Facility) open-ended has been characterised as direct “monetary financing” of government. We don’t agree, at least for now. The Facility has however a long and valuable history of service, even if post-1998, with the “independence” of the Bank and establishment of the Debt Management Office, it has mainly been kept in hibernation. It has stood at £370 million for most of the last decade.

The Facility has however been carefully protected and preserved by the Treasury over decades. Its existence was even an important issue in European-level negotiations. If we look at paragraph 10 of Protocol No.15 to the Treaty on the Functioning of the EU (TFEU), excitingly entitled “On certain provisions relating to the United Kingdom of Great Britain and Northern Ireland”, we find the following:

Notwithstanding Article 123 of the Treaty on the Functioning of the European Union and Article 21.1 of the Statute, the Government of the United Kingdom may maintain its "ways and means" facility with the Bank of England if and so long as the United Kingdom does not adopt the euro.

This provision was negotiated by the Major government in the run-up to – and as part of the trade-offs for – the Maastricht Treaty, signed in February 1992. That Treaty set in train European Monetary Union (the Euro) and its perverse monetary and fiscal rulebook. These include the rules in Article 123 against direct monetary financing of government expenditure by central banks, which would otherwise have killed off the Facility:

“Overdraft facilities or any other type of credit facility with the European Central Bank or with the central banks of the Member States… in favour of Union institutions, bodies, offices or agencies, central governments, regional, local or other public authorities… shall be prohibited, as shall the purchase directly from them by the European Central Bank or national central banks of debt instruments.”

And while Article 126 of the TFEU Treaty require Member States to “avoid excessive government deficits”, the same Protocol softens this for the UK:

“The United Kingdom shall endeavour to avoid an excessive government deficit.”

(Which means we’ll try, but we may not succeed, and there’s no penalty for having such a deficit.)

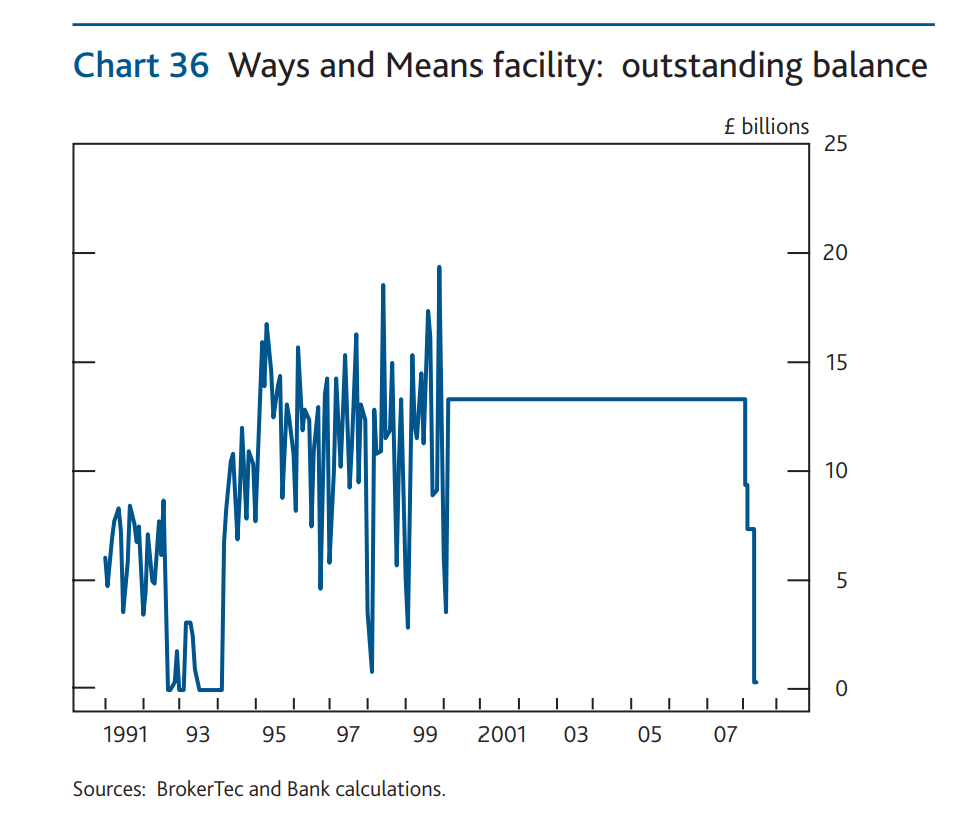

In recent years, the Facility has been limited to around £370m, but in the not-so-distant past, it played a more important role, as per this chart taken from the Bank’s Quarterly Bulletin 2008 Q2:

That is, the advances via the Facility were often (in terms of £s) the equivalent of around 1% of GDP.

But even after the change-over, the Facility has remained there to be used at difficult moments, as we can see from this next chart, taken from the Bank’s database, showing the “Weekly amounts outstanding of Central Government sterling ways and means advances total (in sterling millions) not seasonally adjusted”:

The explanation for the sudden surge to £20 billion at the start of 2009, according to J P Koning’s informative June 2013 blog post here, is that the Treasury briefly borrowed from the Bank to refinance loans that the Bank had earlier made to the Financial Services Compensation Scheme and to failed and bailed-out Bradford & Bingley. (“From intimate to distant: the relationship between Her Majesty's Treasury and the Bank of England”). As Koning remarks,

“Just as Ways and Means mechanism provides the government with the ability to meet sudden spending requirements during war, it provided the same during a period of financial crisis.”

Moreover, the Treasury had in 2000 clarified the strange double role played by the Facility:

“[D]uring 2000-01 the Government planned to bring the balance on the Ways and Means facility back to £17 billion in a limited series of transactions agreed in advance with the Bank of England. Prior to the transfer of cash management from the Bank of England to the Debt Management Office the Ways and Means facility had two functions. It was an overdraft facility for the Government's cash management function. But it was also an asset backing the Bank's note issue. The Bank still require assets to back the note issue and would replace a shortfall below £17 billion in the Ways and Means facility with other assets.”

In my view, the Ways and Means Facility - at this point into the COVID crisis - is aimed not (or rather, not yet) as permanent direct financing in a longer term way, but as being a convenient and uncapped means for government to pay the many urgent bills it is now committed to. It thus gives time to the Debt Management Office to issue gilts in the normal way to cover the spending. It still remains a cashflow facility rather than a true means of financing for the duration.

Today’s FT however argues (“Bank of England to directly finance UK government’s extra spending” by Chris Giles and Philip Georgiadis ) that it is a means of ‘bypassing’ the bond market during the crisis:

The UK has become the first country to embrace the monetary financing of government to fund the immediate cost of fighting coronavirus, with the Bank of England agreeing to a Treasury demand to directly finance the state’s spending needs on a temporary basis. The move allows the government to bypass the bond market until the Covid-19 pandemic subsides…

To date, the bond market is still operating and demand for gilts remains high, with yields low, as this week’s gilt auctions show. (Two auctions were ‘covered’ 3 times and 2.5 times respectively, with e.g. a yield of 0.8% on an issue of £2,000 million of 1¼% Treasury Gilt 2041).

But this may change, possibly rapidly if the crisis worsens yet further. If the gilt market proves too difficult or too slow, then it is conceivable that we may reach a point when the Ways and Means Facility is indeed a bond market “bypass”, and once again becomes a Way and a Means to provide longer-term direct financing of government’s growing commitments. But we are not there today, and we should still pray that we don’t need to be.