Initial claims: nobody is getting laid off, but slight weakness in continuing claims compared with 2022 – by New Deal democrat Initial claims remained below 200,000 at 195,000, while the 4 week average increased very slightly to 189,500. Continuing claims increased to 1,696,000, the third highest number in over a year: Holiday seasonality has ended. It continues to be the case that almost nobody is getting laid off. Very slightly on the...

Read More »New Deal democrat’s weekly indicators

Weekly Indicators for February 6 – 10 at Seeking Alpha I neglected to post the link to this yesterday, so let me do it today. My Weekly Indicators post is up at Seeking Alpha. We continue to see a slow drip, drip, drip of ever so slightly more negative coincident data, without it crossing over into firm recessionary territory. I have a feeling I know what the crucial reason why is, and that metric will be updated this coming week (that’s...

Read More »New Deal democrat’s weekly indicators for January 23 – 27

Weekly Indicators for January 23 – 27 at Seeking Alpha – by New Deal democrat “Slowly I turn. Step by step . . .” That old Vaudeville bit comes to mind in watching the coincident indicators creep towards a recessionary downturn on a weekly basis. Also, some of the long leading indicators are also creeping in the direction of no longer being negative. Which is a longer way to say, my Weekly Indicators post is up at Seeking Alpha. As...

Read More »Three most quickly reported measures of coincident indicators – all of which are close to turning negative

Three most quickly reported measures of coincident indicators – all of which are close to turning negative – by New Deal democrat While we await tomorrow morning’s deluge of Almost Every Economic Series Imaginable, I have posted over at Seeking Alpha a detailed look at one measure of consumer spending and two of employment which will give us extremely timely warnings as to whether a recession has started. I explain their trajectory in the past...

Read More »New Deal democrat’s weekly indicators for January 16 – 20

Weekly Indicators for January 16 – 20 at Seeking Alpha – by New Deal democrat I forgot to post this yesterday, so here you go today . . . My “Weekly Indicators” post is up at Seeking Alpha. Every now and then you get a contratrend week, when a bunch of metrics move in the opposite direction as the overall recent trend. This past week was just such a week, primarily among financial indicators. As usual, clicking over and reading will...

Read More »How Long Before This Wears Off, Doc?

Some history and knowledge about the House by Weldon @ Bad Crow Review. Known Weldon for a while now. He writes some good words. And this topic fits right in his wheelhouse of knowledge. Enjoy . . . “How Long Before This Wears Off, Doc?” Weldon Berger, Bad Crow Review, “Could be a year, could be a lifetime . . .” Links are at the end. I’m pretty sure some of the fireworks which look white to me are actually some feeble shade of green....

Read More »The Fed appears determined to cause a Volcker-like recession

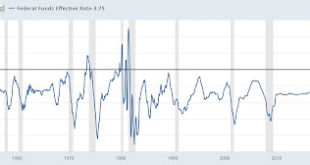

The Fed appears determined to cause a Volcker-like recession – by New Deal democrat Yesterday the Fed raised rates another 0.75%. In the past 8 months, the Fed has raised rates a total of 3.75%. This is one of the steepest increases in interest rates ever, only exceeded by the pace of the two 1970s oil shocks (1974 and 1979) and Volcker’s inflation jihad of 1981, as shown in the below graph of the YoY% change in the Fed funds rate. Note...

Read More » Heterodox

Heterodox