Argentina had a balance-of-payments crisis recently and required help. The IMF has agreed for a stand-by arrangement of $50 billion on the condition in the IMF’s own words: “At the core of the government’s economic plan is a rebalancing of the fiscal position. We fully support this priority and welcome the authorities’ intention to accelerate the pace at which they reduce the federal government’s deficit, restoring the primary balance by 2020. This measure will ultimately lessen the...

Read More »Matias Vernengo — A brief comment on the Argentinian Crisis

This was faster than even I expected (for my views on what Macri meant as soon as he was elected see this and for a more recent assessment go to this post). Let me first say that I don't think is quite like the 2001/02 crisis. It is unlikely that there will be a default anytime soon. The level of reserves is at about US$ 56 billion, and the IMF is happy to finance the very Neoliberal government of Macri (because the IMF has changed a lot, remember?). The economy with Macri has not...

Read More »A brief comment on the Argentinian Crisis

This was faster than even I expected (for my views on what Macri meant as soon as he was elected see this and for a more recent assessment go to this post). Let me first say that I don't think is quite like the 2001/02 crisis. It is unlikely that there will be a default anytime soon. The level of reserves is at about US$ 56 billion, and the IMF is happy to finance the very Neoliberal government of Macri (because the IMF has changed a lot, remember?).The economy with Macri has not performed...

Read More »Argentina’s President Macri Withdraws Neoliberal Reforms Due to Massive Resistance — Gregory Wilpert interviews Atilio Boron

Prof. Atilio Boron analyzes the situation in Argentina, where President Macri is pushing drastic neoliberal reforms against widespread resistance from unions and social movements. Sec. of State Rex Tillerson visits to give Macri backing and to urge anti-Venezuela sanctions.... Misleading title. The MO of the neoliberals is to push ahead as hard as possible, then pause when resistance rises, and push ahead again when it dies down. Well, you know, the Macri government is very...proxy of the...

Read More »Masters & Sindicalists: Growth, Investment and Productivity in Argentina, from Perón to Kirchner

New paper published in Ensaios FEE. In all fairness, this was the paper that should have been published in 2013 in the volume organized by Ricardo Bielschowky and available here. But the revisions took longer than expected. It is in Portuguese, however. Below the English abstract. This paper analyzes the three phases of Argentine economic development since the end of the 19th century, namely: the commodity export model, the period of state-led industrialization and the neoliberal reforms...

Read More »The wage share in Argentina

In his book, Estudios de Historia Económica Argentina, Eduardo Basualdo has several tables with the data for the share of wages in income. Sources seem to be different and not necessarily compatible (although I 'm not sure about that). He also published a paper in 2008 with additional data. The graph below adds the numbers shown here, which I think are also from Basualdo (the newspaper only cites CIFRA; I couldn't find another source in their website). To the extent that one can trust...

Read More »From Vulture Funds to 100-year bonds: Has Argentina Turned Around?

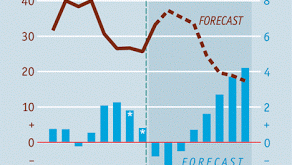

Just a couple of years ago Argentina’s left of center government was besieged by foreign investors, the hedge funds known as Vulture Funds, that demanded full payment for their bonds acquired at heavily discounted prices in the secondary markets. The New York courts ruled in favor of the Vulture Funds, and Argentina was unable to borrow in international markets, even though during the successive governments of the late Néstor Kirchner and her wife Cristina Fernández de Kirchner the country...

Read More »Neoliberalism in the Pampas

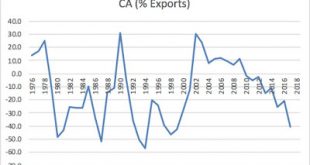

Soybean Republic As promised, here are some brief reflections on the situation in Argentina, which I think is not as bad as in Brazil economically or politically, surprisingly, since Argentina had a balance of payments problem that is completely absent in the increasingly chaotic neighbor, and the left actually lost the election, which was not the case of Dilma (a coup was required to defenestrate her). As I suggested in my talk a year ago (for non Spanish speakers go to this text), the...

Read More »Argeo Quiñones and Ian Seda on the crisis in Puerto Rico

Argeo Quiñones-Pérez and Ian Seda-Irizarry discuss the crisis in this piece. They correctly point out the neocolonialist solution being imposed by the US administration. I find the imposition of a Fiscal Control Board (FCB) particularly problematic. Back when Argentina defaulted in 2002, Rudi Dornbusch had suggested something similar. At that time I sent the letter below to the Financial Times that had published his proposal. LETTERS TO THE EDITOR: Mystery of about-turn on Argentina ...

Read More »Moody’s upgrades Argentina credit rating status

Mainly because of their "expectation that Argentina will settle holdout creditor claims which will result in a lifting of court injunctions and clear the way for Argentina to access international capital markets." Fair enough, access to capital markets would lift the balance of payments constraint, even if the agreement is a complete surrender to the Vultures demands. But the most interesting argument for the improvement in the credit rating is that it results from "economic policy...

Read More » Heterodox

Heterodox