The Left rises again after the neoliberal president blows it. Naked Keynesianism — Hemlock for economics studentsThe return of populism or Argentina on the verge of collapseMatias Vernengo | Associate Professor of Economics, Bucknell University

Read More »The return of populism or Argentina on the verge of collapse

The Argentinean primary elections, which are very peculiar and take place all at once with all parties, were last Sunday. The primaries made some sense when the Peronist party was all divided and that allowed the main candidate to proceed, but with the move of Cristina Kirchner to the vice-presidential spot next to Alberto Fernández, and the unification of a good part of Peronism (in particular Sergio Massa), the primaries become essentially an anticipated election. And Peronism won...

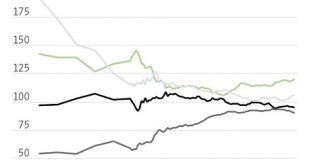

Read More »Catching up and falling behind in historical perspective

The figure below, from a recent piece in the Wall Street Journal, shows the catching up of the South. Note that most occurs after the New Deal, and up to the 1980s. The piece emphasizes the reversal, with divergence since the last recession. This suggests that the New Deal and the period in which the segregationist policies were eliminated were a period of prosperity for the South. The catching up story is one associated mostly to State action, since the New Deal in many ways was a sort...

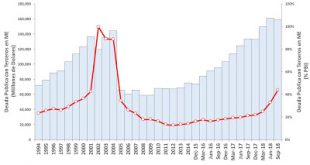

Read More »Argentina, Financial Times and the next default

It's been a while since I wrote about Argentina. In all fairness, because it is difficult given all the mistakes of the last few years since Macri's victory. I discussed the prospects of what to expect back then. Since then I posted here and here on the supposed improvement in 2017, and the beginning of the still unfolding crisis in 2018. And this could simply be an "I told you so post," since I did warn about most things that would happen. But there are important and interesting news about...

Read More »Interview on Central Bank’s exchange rate policy in Argentina

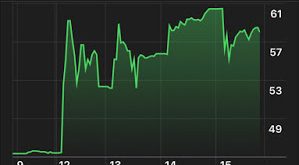

My interview with Nicolás Fiorentino and Cecilia Camarano from Led.fm yesterday (in Spanish) on the Argentinian situation and the new central bank policy. [embedded content] I basically suggest that the new policy to control exchange rates using the IMF loans (with IMF authorization) might control the exchange rate, but will finance essentially capital flight, and tries to interfere with the elections later this year.

Read More »Pepe Escobar — On The Road to a Post-G20 World

The ascendence of China and multilateral trading blocks could eventually spell the doom of the G20 and U.S. global dominance, as Pepe Escobar explains. Consortium News On The Road to a Post-G20 World Pepe Escobar See also by Pepe Escobar at Consortium News Future of Western Democracy Being Played Out in Brazil (9 Oct 2018) Welcome to the Jungle (29 Oct 2018)See also Reminiscence of the FutureA Teaser Andrei Martyanov

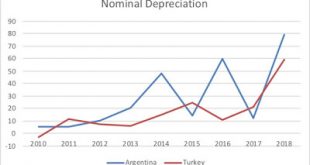

Read More »A Tale of Two Currency Crises: A Short Comment

So the Turkish foreign exchange crisis is all over the news. But the Argentine one is less conspicuous in the international media. Turkey's economy has had many similarities with Latin American economies over the years, in terms of the incomplete process of industrialization, and the types of crises associated with neoliberal reforms over the last three decades. Note, however, that the Argentine nominal depreciation has been larger than the Turkish (the same is true if you go back to the...

Read More »Le Sei lezioni nella Pampa

Le Sei lezioni di economia sono state tradotte in spagnolo dagli amici argentini e verranno presto pubblicate. Sperabilmente seguirà un'edizione per la Spagna. Pubblichiamo l'introduzione all'edizione argentina che fa il punto della situazione economico-politica a due anni dall'uscita del libro. Introduzione all’edizione argentina Sergio Cesaratto Questo libro è nato in un particolare momento storico per l’Italia. L’elevato tasso di sviluppo economico del secondo dopoguerra è...

Read More »What is the Central Bank of Argentina Actually Doing?

Brief note in Spanish (no translation, sorry) on the long history of central banks and the current policies of the Argentinean central bank (BCRA). The gist of the argument is that while central banks where created to finance developmental states in the nascent merchant capitalist societies, in the periphery they tended to follow the Victorian model (implemented later) emphasizing inflation control as the main official goal. However, often, as in the recent case of the BCRA, they are used...

Read More »Michael Hudson — Argentina back on the debt train

Must-read. Michael Hudson gives the background on Argentina's fall in terms of neoliberal capitalism. Michael Hudson: What really is at issue is whether all debts should be paid, or not? I think that there should be an international rule that no country should be obliged to pay its debts to the wealthy One Percent, especially to a creditor class that prefers to hold its domestic wealth offshore in foreign currencies. No country should be obliged to pay its bondholders if the price of...

Read More » Heterodox

Heterodox