Nigel Doggett and Mike Davis of The Chartist magazine spoke to Ann Pettifor about why a Green New Deal is central to our recovery Published 20 September, 2020. How do you see the GND playing out against the Covid crisis? There are two roads to travel. One is the progressive one in which our leaders wake up to the scale of the climate threat and decide they are going to prepare. There are signs of that happening: little things like the French deciding to abolish burners in Paris streets. But...

Read More »Radically Transforming the EU Economy – and how to finance it

The following article appeared on Progressive Post, the website of the Foundation of Progressive European Studies (FEPS) Today’s capitalism cannot tackle climate breakdown and cannot prevent the loss of biodiversity. It considers work as a cost to be minimised, to the detriment of the economy and the social meaning of work. High rates of return on capital (interest) require ever-rising extraction of the earth’s finite assets and the felling of its biodiverse ecosystem. Nature is crowded out...

Read More »Commercial property: * Prêt a Payer *, or Prêt-à-Fermer?

The government wants us to return to our office workplaces in the cities. The FT tells us: “The government will [this] week launch a media campaign to encourage more employees back to their workplaces amid growing concern in Downing Street over the rising number of job losses at service businesses in city centres that are reeling from a lack of customers. And from Sky News (Aug 20): “Just one in six workers have gone back to work in cities this summer after companies and staff ignored...

Read More »The Wealth of Corporations: Why Firms Have Zero Net Worth, and Why It Matters

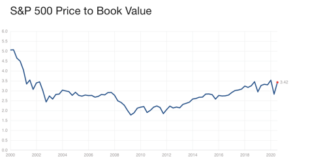

“Financial Assets = Liabilities.” It’s one of the great accounting-identity truisms of economic understanding — both among traditional, mainstream economists, and even (especially) among many heterodox, “accounting based” practitioners. It seems obvious: When a company issues and sells bonds, it posts a liability to its balance sheet; the bond buyers hold financial assets on theirs.[1] The problem is, that truism isn’t even close to true. The most obvious example is corporate...

Read More »Remembering John Weeks

Late last month, pioneering socialist economist John Weeks passed away. Ann Pettifor remembers her colleague and friend – and his contributions to left-wing politics. This piece first appeared in Tribune magazine on 08 August, 2020. Please note correction at the end of this piece. John Weeks, brilliant Left economist and public intellectual, would have been well pleased that three days after his death the Financial Times published a letter he had signed attacking the Office for Budget...

Read More »Green shoots: the best books to inspire hope for the planet

This review of books to inspire a green transformation appeared in The Guardian on 18 July, 2020. Everyday life has been upended by the pandemic, but the Arctic heatwave is a reminder that the climate crisis still poses an urgent threat to humanity. We will need resolve, ambition and optimism as we emerge from lockdown, so we can forge the green recovery that is so crucial. One book that has sustained my faith in the future is Herman E Daly and John B Cobb’s hopeful vision, For the Common...

Read More »The duel: Should we aim to get the economy back to “business as usual”?

The following debate between Paul Wallace and Ann Pettifor appeared in Prospect magazine on 10 July, 2020. Is our capitalist economy an unparalleled engine of prosperity, or a human and ecological disaster? Two contributors debate whether the system is worth saving Yes—Paul Wallace It is tempting, when living through a once-in-a-century event such as the coronavirus pandemic, to say everything must change: that it’s time to tear up the rulebook and to create a completely new kind of economy....

Read More »Inequality and Morbid Symptoms of a Financialised System

This article appeared in a special, June 2020 edition of the Real-World Economics Review that majored on The Inequality Crisis. Today as the world endures the crisis of a global pandemic, “an old order is ending in convulsions”. So writes Rebecca Spang, historian of the French revolution in The Atlantic (Spang, 2020). In the 1790s, money, debt and the non-payment of taxes by France’s rentiers, played a critical role in revolutionizing France. Today purveyors of money and debt – creditors,...

Read More »Put Fairness at the Heart of Finance

This article appeared in the UK-based Church Times on 26 June, 2020 The coronavirus pandemic is a moment of reckoning for globalisation and our international financial system. The pandemic has shown how unjust the international system is towards low income countries; given us the opportunity to imagine another economy; and served as a warning. If we do not fix the system to prepare for the coming, graver crisis of earth systems breakdown, the survival of humanity is at risk. Just as it was...

Read More »Rebuild the ramshackle global financial system

The following appeared in Nature magazine on 17 June, 2020 Economic researchers neglect the role of financialization in global existential crises. Riddled with comorbidities, the current global monetary and financial set-up precipitates crises with increasing frequency. At first, these were on the fringes of the global economy; in 2007–09 they moved to its very core. Since 1971, national economies, and all our lives, have been shaped by this ‘system’, which can be described only as...

Read More » Heterodox

Heterodox