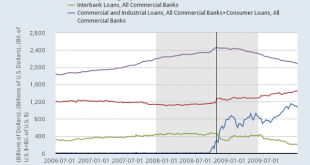

Courtesy of Dr. George Selgin comes this chart from FRED: Dr. Selgin has added a vertical line to indicate when the Fed imposed interest on excess reserves. I don't propose to discuss that here, since I have engaged in an interesting and spirited discussion with Dr. Selgin and others about it on both Forbes and Twitter. I am more interested in what else this chart shows. It is truly fascinating.The first thing to note is the fast rise in bank reserves from the latter part of 2008 onwards...

Read More »Germany’s Sparkassen: banking on capital exports

My latest post at Forbes takes a close look at Germany's much-praised Sparkassen and their odd relationship with other German banks. It's not quite as it seems.... The German Sparkassen (public savings banks) are widely praised for their stability and their service to German savers and small businesses. They survived the 2008 crisis largely unscathed; the few failures were handled within the network, and depositors were compensated from a fully-funded deposit insurance scheme, with no...

Read More »Unreasonable expectations and unpalatable truths

At the ICAEW's conference "Do Banks Work?" last week, there was a fascinating interchange between Ian Gorham of Hargreaves Lansdowne and RBS's Ross McEwan. Apparently RBS had refused a large deposit from Hargreaves Lansdowne, to the irritation of the asset manager. "There is a problem placing client money", said Gorham. And he went on: "Banks don't need people's savings, because they now have much more capital to support lending. This means that savers receive much lower interest rates on...

Read More »Grexit, Brexit and financial stability

On October 30th 2015, I gave a keynote speech at Birmingham University's Finance Forum on the implications of Grexit and Brexit for financial stability. I've now written this up as a paper.I start by outlining the purpose of financial stability. Since the 2007-8 financial crisis, “financial stability” has been all the rage. We must prevent another crisis: we must solve the problems that make our financial system “unstable”. But what exactly do we mean by “financial stability”? Most people...

Read More »Eurodespair

In my last post, I warned about "siren voices" calling for tighter monetary policy while the Eurozone economy is stuck in a toxic equilibrium of low growth, zero inflation and intractably high unemployment. Specifically, the so-called "German Council of Economic Experts (GCEE)" has called for the ECB to reduce or unwind QE: ...the European Central Bank should slow down the expansion of its balance sheet or even phase it out earlier than announced. Of course, the GCEE is only concerned...

Read More »The European Union must reform before it’s too late

At the Bank of England's Open Forum in London's Guildhall on Wednesday 11th November, an increasingly desperate-sounding Mario Draghi said this: As the majority of money is issued by private banks - bank deposits - there can only be a single currency if there is a single banking system. For money to be truly one, it has to be truly fungible, independent of its form and independent of its function. This is far from being the first time that Signor Draghi has pushed the case for common...

Read More »The Slough of Despond

I'm bored.Bored with this crisis. Bored with endless calls for bank reforms. Bored with never-ending stories of inadequate bank resolution and legal battles which benefit no-one but lawyers. Bored with ineffectual monetary policy and fiscal gridlock. Bored with seeing the same things proposed over and over again, even things we know don't work and will never happen.Today, Mike Konczal wrote a piece on why restoring Glass-Steagall wouldn't solve anything. He's right, of course. But it is now...

Read More »Capital, liquidity and the countercyclical buffer, in plain English

The FT reports that due to “modest but rising credit growth”, the Bank of England’s Financial Policy Committee (FPC) considered raising banks’ countercyclical capital buffer. According to the FT's Caroline Bingham: This measure requires lenders to build up capital in good times to draw down in more challenging times. And she goes on to say this: The prospect of yet more capital that banks must set aside would come on top of capital rules on a European and global basis that lenders must...

Read More »The Fed’s IOER policy is not “paying banks not to lend”

Mainstream media get this wrong all the time. The latest to go down the "paying banks not to lend" rabbit hole is Binyamin Appelbaum in the New York Times. Because he didn't understand how IOER works, he didn't understand the Fed's strategy, and wrote a post that gets it quite seriously wrong. So I've written a Forbes post attempting to set things straight. Here's a taster: The FOMC has decided not to raise interest rates – for now. But it’s still widely expected that rate rises will come...

Read More » Heterodox

Heterodox