The Co-Op Bank has revealed its 2015 half-year results. And they are not pleasant reading. It has made a statutory loss before taxation of £204m, considerably worse than the £77m loss reported in the 2014 half-year accounts. And the Board advises that the bank will not return to profit for another couple of years.The background to this horrible report is the Bank of England's stress tests last autumn. I didn't bother to look at the results at the time, since it was always obvious that the...

Read More »In defence of the (conflicted) ECB

Everyone has been so transfixed by Yanis Varoufakis's "Plan B" revelations that his defence of the ECB's Mario Draghi passed unnoticed. Here it is, transcribed from the Lamont tape by Peter Spiegel at the FT:Mario Draghi has handled himself as well as he could, and he tried to stay out of this mire, the political mire, impressively. I have always held him in high regard. I hold him in even higher regard now, having experienced him over the last six months. Having said that, the European...

Read More »The coming Greek bank nationalization, bail-in and privatization

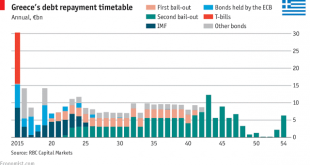

In-depth analysis on Credit Writedowns Pro. By Frances Coppola The banks are re-opening, though just for transactions, so people can pay their bills and their taxes, pay in cheques, that kind of thing. The cash withdrawal limit has been changed to a weekly limit of 420 EUR per card per person, enabling households to manage their cash flow better. But the capital controls remain: money cannot leave the country without the agreement of the Finance Ministry. And the banks remain short of...

Read More »The Great Greek Bank Drama, Act II: The Heist

The banks are re-opening, though just for transactions, so people can pay their bills and their taxes, pay in cheques, that kind of thing. The cash withdrawal limit has been changed to a weekly limit of 420 EUR per card per person, enabling households to manage their cash flow better. But the capital controls remain: money cannot leave the country without the agreement of the Finance Ministry. And the banks remain short of cash: although the ECB has raised the funding limit by 900m EUR, that...

Read More »The Great Greek Bank Drama, Act I: Schaeuble’s Sin Bin

Greece's banks have been closed since 29th June. The closure followed the ECB's decision not to increase ELA funding after talks broke down between the Greek government and the Eurogroup.The closure is doing immense economic damage. The cash withdrawal limit of 60 euros per bank card per day is restricting spending in the Greek economy to a trickle. Media generally focus more on the hardship that the cash limit causes for households: but far worse is the inability of businesses to...

Read More »There are controls, and then there are controls….

Guest post by Sigrún DavídsdóttirNow that Greece has controls on outtake from banks, capital controls, many commentators are comparing Greece to Iceland. There is little to compare regarding the nature of capital controls in these two countries. The controls are different in every respect except in the name. Iceland had, what I would call, real capital controls – Greece has control on outtake from banks. With the names changed, the difference is clear.Iceland – capital controlsThe controls in...

Read More »Goldilocks and the Griffin

The UK is forcing universal banks like HSBC to ring-fence their retail operations from their global and investment banking businesses – a sort of watered-down Glass-Steagall arrangement. The ring-fence will come into force in 2019, and banks are currently working out how to implement it. HSBC is creating a completely separate UK retail entity with its own capital, management and head office. As part of this process, it conducted a review of possible locations for the unit's new head...

Read More »Oh dear, Professor Sinn……

Hans Werner Sinn has apost on Project Syndicate which purports to explain why the plans of Greek finance minister Yanis Varoufakis are much cleverer than anyone has realised. I don’t disagree that Mr. Varoufakis’s plans are clever: indeed I have written several posts on Forbes explaining just how clever they are. But Professor Sinn’s explanation, sadly, is very wide of the mark. Here is Professor Sinn’s description of Mr. Varofakis’s strategy: Plan B comprises two key elements. First, there...

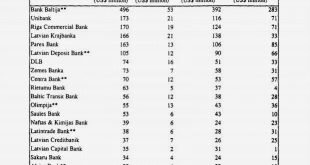

Read More »How do you say "dead cat" in Latvian?

This, my third post on Latvia, looks at its recovery from the 2008-9 recession.Latvia is often held up as the "poster child" for harsh austerity measures as the means of returning to strong economic growth. In order to hold its currency peg to the Euro, it embarked on a brutal front-loaded fiscal consolidation in 2009, sacking public sector workers, slashing public sector salaries, cutting benefits and raising taxes. Between 2010 and 2013 it cut its fiscal deficit from 10% of GDP to a...

Read More »The Latvian financial crisis

This is not what you think it is. And it is not what I intended to write about, either. I was going to write about Latvia as it is now, after the deepest recession in the world in 2008-9 and an excruciatingly painful front-loaded fiscal consolidation. Has it really recovered, or is it just marking time?But in looking at Latvia now, I find myself drawn to its history. Latvia's unusual response to the kicking it got in 2008 was because of its history. It had a deep recession 1991-3 and a severe...

Read More » Heterodox

Heterodox