In my last post, I warned about "siren voices" calling for tighter monetary policy while the Eurozone economy is stuck in a toxic equilibrium of low growth, zero inflation and intractably high unemployment. Specifically, the so-called "German Council of Economic Experts (GCEE)" has called for the ECB to reduce or unwind QE: ...the European Central Bank should slow down the expansion of its balance sheet or even phase it out earlier than announced. Of course, the GCEE is only concerned with Germany. Perhaps, given that their focus is entirely national, they are justified in expressing concern about the continuation of monetary stimulus if the German economy doesn't need it?Well, no, they aren't. The ECB's concern is the Eurozone as a whole, not one particular bit of it. If the Eurozone's overall economic performance justifies QE, then the ECB should do QE, and if that means Germans have to tolerate higher inflation and lower interest on their savings, well tough, frankly. That's what being a member of a monetary union means.But actually, it is by no means clear that Germany's economic performance justifies reduction or unwinding of QE (i.e. raising interest rates) anyway. Here are the key indicators for Germany according to the GCEE: The GCEE's own projection for HICP inflation (listed here as "consumer prices") is 0.3% in 2015 and 1.

Topics:

Frances Coppola considers the following as important: banks, ECB, Eurozone, fiscal policy, Germany, Interest rates, Monetary Policy, QE

This could be interesting, too:

Angry Bear writes A Fiscal Policy in a Global Context?

Matias Vernengo writes Very brief note on the Brazilian real and the fiscal package

Merijn T. Knibbe writes Monetary developments in the Euro Area, september 2024. Quiet.

Lars Pålsson Syll writes Central bank independence — a convenient illusion

In my last post, I warned about "siren voices" calling for tighter monetary policy while the Eurozone economy is stuck in a toxic equilibrium of low growth, zero inflation and intractably high unemployment. Specifically, the so-called "German Council of Economic Experts (GCEE)" has called for the ECB to reduce or unwind QE:

Of course, the GCEE is only concerned with Germany. Perhaps, given that their focus is entirely national, they are justified in expressing concern about the continuation of monetary stimulus if the German economy doesn't need it?...the European Central Bank should slow down the expansion of its balance sheet or even phase it out earlier than announced.

Well, no, they aren't. The ECB's concern is the Eurozone as a whole, not one particular bit of it. If the Eurozone's overall economic performance justifies QE, then the ECB should do QE, and if that means Germans have to tolerate higher inflation and lower interest on their savings, well tough, frankly. That's what being a member of a monetary union means.

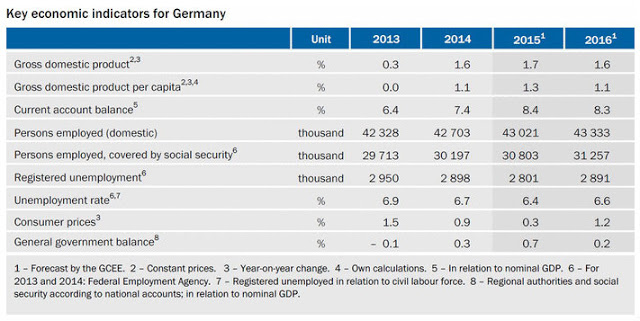

But actually, it is by no means clear that Germany's economic performance justifies reduction or unwinding of QE (i.e. raising interest rates) anyway. Here are the key indicators for Germany according to the GCEE:

The GCEE's own projection for HICP inflation (listed here as "consumer prices") is 0.3% in 2015 and 1.2% in 2016 - both far below the ECB's target of "below but close to 2%". On this measure - and remembering that the ECB's only mandate is price stability - monetary tightening is not justified. Nor do the GCEE's projections for growth and unemployment suggest an overheating economy: both are stable, GDP growth is low and unemployment appears slightly elevated compared to historical averages. In short, although Germany doesn't have the zero-growth, double-digit unemployment of say Italy, its economic performance is not exactly scintillating.

There appears to be no justification for monetary tightening in Germany. So why are a group of German "economic experts" calling not only for the ending of QE, but for its reversal? The clue is in the preceding sentences: :

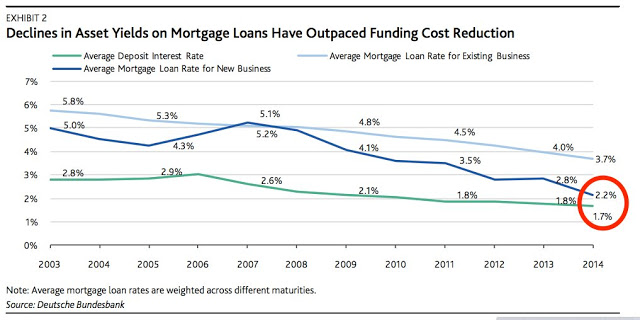

Yes, as usual it is all about banks. Back in February 2015, my friend Tomas Hirst wrote an interesting post for Business Insider in which he highlighted the difficulties that low interest rates cause for Germany's little banks, particularly the public sector Sparkassen. This chart from his post (originally from the ratings agency Moody's) shows how net interest margins are being squeezed:Low interest rates pose risks for financial stability and erode the business models of banks and insurers over the medium term. Relying only on macroprudential regulation cannot solve these problems.

Things haven't got any better since then: in fact QE makes things even worse. In August 2015, Fitch Ratings discussed the problems that the ECB's QE causes for the Sparkassen (my emphasis):

...performance ratios at the Sparkassen are likely to fall in 2015 as their ability to sustain net interest margins, which drive overall profitability, is becoming increasingly strained. This is because competitors are encroaching on their traditional retail mortgage and deposit businesses. In addition, higher-margin loans and higher-yielding securities are maturing and being replaced by ultra-low-yielding German and foreign public sector bonds and newer, less profitable, lending in a highly competitive environment.

So small banks in Germany's retail banking sector are becoming increasingly unprofitable because of ECB monetary policy and competitive pressures. Normally we would expect such a situation to force consolidation in the sector, with weaker members either going out of business or merging with stronger ones. But the Sparkassen collectively have enormous political power. When they lobby, they expect to get what they want. And right now, they want the pressure taken off their net interest margins - and that means higher interest rates and an end to QE. Hence the considerable pressure being placed on the ECB by influential German voices including - but not limited to - the GCEE.Sparkassen Finanzgruppe Hessen Thueringen (SFHT) and Sparkassen in Baden-Wuerttemberg and Lower Saxony all expect 2015 profits to fall short of those reported in 2014. We believe the groups will find it difficult to reverse dwindling net interest income. Greater lending volumes are failing to fully offset a squeeze in net interest margins, which SFHT believes could fall by as much as 5% in 2015. We do not expect this situation to improve in the near term as we see no immediate relaxation of the ECB's quantitative easing programme or any let-up in competitive pressures.

It is true that persistently low interest rates do reduce banks' net interest margins. So do the flat yield curves created by QE. But against that should be set the benefit for businesses who can obtain credit both from banks and from markets at much lower interest rates than would otherwise be the case. The ECB's bank lending survey somewhat surprisingly suggests that QE has had a significantly positive effect on credit conditions in the Eurozone. Yet even with QE, lending to businesses is still on the floor and lending to households only slightly positive. Without QE, lending could still be falling, to the further detriment of the Eurozone economy. Why should the problems of German banks dictate the direction of Eurozone monetary policy?

But embedded in the paragraph I quoted above is an even more poisonous script.* Not only does the GCEE want tighter monetary policy, it wants tighter fiscal policy too:

Nor is this confined to the Eurozone periphery. The GCEE thinks Germany still has plenty of room for improvement:Further fiscal consolidation and structural reforms are essential to create a self-sustaining economic recovery.

But why does Germany need further reform? After all, it is already running a fiscal surplus and a very large trade surplus.Germany can only strengthen productivity growth if it focuses again on improving economic conditions.There is considerable scope for efficiency-enhancing economic policy, especially in areas like the labour market, education and training, competitiveness, energy, and taxation.

Why, because of refugees:

And what specific reforms will be needed because of refugees? Not investment, of course (apart from education and training). Dear me, no. Labour market reforms, of course:Given strong public finances and broad scope for efficiency-enhancing economic policy, foreseeable additional refugee-related expenditures appear manageable......

So the GCEE's recipe for integrating refugees is repression of wages for German workers, coupled with further fiscal consolidation to offset the "additional direct public outlays" arising from the inflow of refugees. Yes, this will really make refugees welcome among Bild readers, won't it?In addition to accelerating the processing of asylum applications, the barriers to entering the job market should be lowered. Recognised refugees looking for work should be treated like long-term unemployed, who are temporarily exempt from the minimum wage. In addition, any increase in the minimum wage should be avoided.

The German establishment seems hellbent on steering the Eurozone ship on to the rocks. I despair, I really do.

Related reading:

Eurodesperation

Euro depression, charted

Preposterous: Germany's demanding an end to Eurozone QE despite the slow growth - Forbes

*I am indebted to Andrew Duff for pointing this out.

Image: The Lorelei, 1900. Photo credit: Wikipedia. In Heinrich Heine's poem "Die Lorelei" (1824), the Lorelei rock is the lair of a beautiful witch whose singing lured sailors to their deaths - the German equivalent of the Greek Sirens.