I bet you've never heard of Slovenia. It's the northernmost Balkan state, squeezed between Austria, Italy and Croatia on the Adriatic coast. It's small, peaceful (by Balkan standards) and prosperous compared to the rest of the Balkans, though that isn't saying much. It is also stunningly beautiful, in a mountains-and-lakes sort of way. It is in many ways rather like Austria.But at the moment, Slovenia is famous not for its lovely scenery, or its important history, or its rich culture. No,...

Read More »Have we done enough to prevent another financial crisis?

Notes from a talk given at Trinity Business School, Dublin, on 26th May 20164 Well, it depends what sort of crisis you mean. Have we done enough to prevent a crisis like the last one? Yes. We have scared ourselves so much about the dangers of disorderly bank failure that no way are we going to allow that to happen again – at least, not until we who lived through the crisis, and our children and grandchildren whom we tell about the crisis, are long gone and our legacy forgotten. No-one...

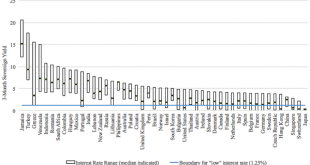

Read More »Low interest rates and banks’ net interest margins

In-depth analysis on Credit Writedowns Pro. You are here: Financial Institutions » Low interest rates and banks’ net interest margins By Stijn Claessens, Nicholas Coleman, Michael Donnelly, 18 May 2016 This post was first published at Vox Since the Global Crisis, interest rates in many advanced economies have been low and, in many cases, are expected to remain low for some time. Low interest rates help economies recover and can enhance banks’ balance sheets and...

Read More »Paul Krugman and Holman Jenkins Shill for the Giant Banks

By William K. Black April 20, 2016 Bloomington, MN Holman Jenkins, the ultra-conservative Wall Street Journal columnist who specializes in global climate change denial and elite financial fraud denial, has written recently to join Paul Krugman in defending the systemically dangerous banks. Jenkins is a member of the WSJ’s loopy editorial board. Jenkins’ title was “Big Banks Aren’t the Problem.” Jenkins’ thesis raises obvious and vital questions – he ignores each of them because...

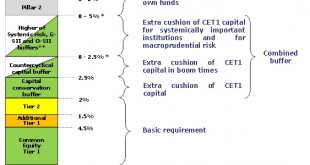

Read More »Cocos and bank capital: a belated explainer

A few weeks ago, in a piece about Deutsche Bank's recent difficulties, I commented about its use of so-called "coco bonds" - contingent convertible bonds. I had over-simplified my description, and was promptly taken to task for doing so by @creditmacro on Twitter. He provided me with a detailed explanation of what coco bonds are and how they work. This piece draws heavily on his input. All of the quotations are from him unless otherwise stated. His full write-up can be found in Related...

Read More »Negative rates and bank profitability

Banks are complaining. "Negative interest rates hurt our margins," they moan. Here's Commerzbank, for example, in its recent results announcement (my emphasis): Mittelstandsbank attained a solid result in a challenging market environment. The operating profit declined in the 2015 financial year to EUR 1,062 million (2014: EUR 1,224 million), yet remains at a high level. The fourth quarter accounted for EUR 212 million (Q4 2014: EUR 251 million). The full year revenues before loan loss...

Read More »Robert Skidelsky: Lecture 4: Banking Reform

Here Skidelsky gives lecture 4 of a series at the University of Warwick on economics. This lecture concerns banks and banking reform.[embedded content]

Read More »Robert Skidelsky on the State of Economics, Banks, and Inequality

Robert Skidelsky, author of Keynes: The Return of the Master (London, rev. edn. 2010), speaks below in an interview on the state of neoclassical economics, banks, and inequality. Unfortunately, I don’t think Skidelsky sees the how rotten the current EU is and the merits of a possible Brexit, but apart from this there is much of interest here.[embedded content]

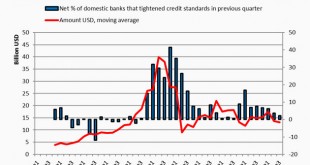

Read More »A countercyclical credit bubble?

Over at VoxEU, Philippe Bachetta and Ouarda Merrouche have a surprising take on "countercyclical" lending. They show that lending by US and European banks in US dollars to European non-financial corporates massively increased from 2007-2009, and that this helped to soften the effect of the European credit crunch on employment: Over the period 2004 to 2009, we find that foreign credit denominated in dollar to non-financial corporates is countercyclical – it increased sharply (relative to...

Read More »The untimely end of a flamboyant dictator

At Forbes, I have posted the latest episode in the long-running saga of the failure of Hypo Alpe Adria: The story of the failed Austrian bank Hypo Alpe Adria (HAA), and its transformation into the world’s worst “bad bank” – the insolvent HETA – resembles a Hollywood blockbuster. Complete with a cast of thousands, colorful principal characters, an extraordinary range of special (legal) effects and a reach far beyond its national borders, the HETA saga is long, staggeringly expensive,...

Read More » Heterodox

Heterodox