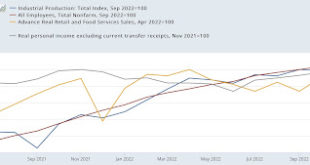

The status of the coincident indicators – by New Deal democrat In addition to real GDP, which is only updated quarterly and with a lag, the NBER has indicated that it relies upon four other datapoints in determining the onset month of a recession: payrolls, industrial production, real income less transfer payments, and real manufacturing, wholesale, and retail sales. The below shows all four, with the exception that, because real...

Read More »Weekly Indicators for August 15 – 19 at Seeking Alpha

Weekly Indicators for August 15 – 19 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. The continued decline in gas prices has been doing some nice things to other indicators as well. Meanwhile, manufacturing as measured by the regional Feds is getting worse. As usual, clicking over and reading will bring you fully up to date, and reward me just a little bit for my efforts. ...

Read More »Industrial production continues to show excellent growth

Industrial production continues to show excellent growth I call industrial production the King of Coincident Indicators, because it speaks volumes about where the economy is at any particular moment, and empirically is the indicator whose peaks and troughs coincide most definitively with NBER recession dates. In April the story told by industrial production continued to be very positive, as total production rose by 1.1%, and manufacturing...

Read More »Real retail sales signal further expansion, but also continue to suggest slower payrolls growth ahead

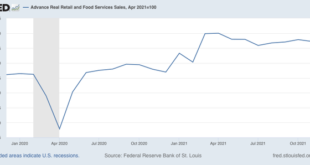

Real retail sales signal further expansion, but also continue to suggest slower payrolls growth ahead Nominal retail sales for the month of April were up 0.9%, and previous months were revised higher. That means that, after inflation, real retail sales for April were up 0.6%, a very positive number. Yesterday I wrote that, rather than a YoY comparison with last April, during the stimulus spending spree, the more important comparison was...

Read More »A historical note on US Treasury interest rates and stock prices

New Deal democrat, “Historical Note on US Treasury Interest Rates and Stock Prices“ Over the weekend I was asked by two people what is going on in the markets. That’s usually a sign that there has been a sudden downside move, and people are getting emotional. Back 5 and 10 years ago, when I was doing perpetual battle with the DOOOMers, several times I was able to call a market bottom to the day – and once within an hour in real time – by how...

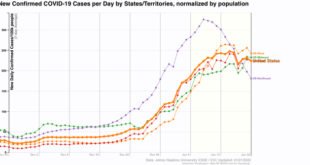

Read More »Omicron has Peaked, Now What?

Coronavirus dashboard: Omicron has peaked; now what?, New Deal Democrat – by New Deal democratLet’s start out with the good, or at least less catastrophic news: it’s almost certain that the Omicron wave has peaked in the US. In fact, the only Census region it is still up week over week is in the Midwest: In almost all of the areas hit hard early – Puerto Rico, and the NYC and DC metro areas – cases are down sharply since peaking....

Read More »Weekly Indicators for January 10 – 14 at Seeking Alpha

Weekly Indicators for January 10 – 14 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. In addition to Omicron, commodity prices and interest rates are having an impact across the board on the long and short term forecasts and the nowcast. (Just for spite, two weeks ago some RW nut jobs had a fit about my including a meteor as the image for the article, so this week I including an even more graphic...

Read More »Real Retail Sales tank; Industrial Production declines; Consumer slowdown?

December real retail sales tank; industrial production also declines; consumer slowdown seems nearly certain – by New Deal democrat Two days ago, in connection with consumer inflation, I reiterated that: “we certainly are at a point where a sharp deceleration beginning with the consumer sector of the economy is more likely than not.” I didn’t expect to have it show up so soon! Retail sales, one of my favorite “real” economic indicators,...

Read More »Continuing Unemployment Claims Make New 45+ Year Low

Continuing unemployment claims make new 45+ year low – by New Deal democrat New claims increased 23,000 last week to 230,000. The 4 week average of new claims increased 6,250 to 210,750: The big increase is likely affected by seasonality. It’ll be another week or two before we can tell if there is any real change in trend. If there is, it is likely to be a flattening in new claims rather than any significant increase. Continuing claims...

Read More » Heterodox

Heterodox