The status of the coincident indicators – by New Deal democrat In addition to real GDP, which is only updated quarterly and with a lag, the NBER has indicated that it relies upon four other datapoints in determining the onset month of a recession: payrolls, industrial production, real income less transfer payments, and real manufacturing, wholesale, and retail sales. The below shows all four, with the exception that, because real manufacturing and trade sales lag the publication of real retail sales by two months, I show the latter. Since real retail sales are the largest component of manufacturing and trade sales, and usually turn before the manufacturing and wholesale components, this is a little more leading anyway: Real income peaked

Topics:

NewDealdemocrat considers the following as important: Bonddad Blog, Hot Topics, New Deal Democrat, politics, Taxes/regulation, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

The status of the coincident indicators

– by New Deal democrat

In addition to real GDP, which is only updated quarterly and with a lag, the NBER has indicated that it relies upon four other datapoints in determining the onset month of a recession: payrolls, industrial production, real income less transfer payments, and real manufacturing, wholesale, and retail sales.

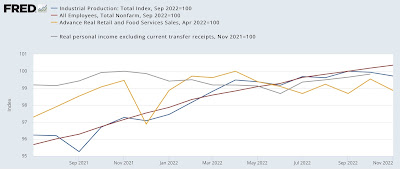

The below shows all four, with the exception that, because real manufacturing and trade sales lag the publication of real retail sales by two months, I show the latter. Since real retail sales are the largest component of manufacturing and trade sales, and usually turn before the manufacturing and wholesale components, this is a little more leading anyway:

Real income peaked last November, real retail sales in April, and industrial production may have peaked in September. With the decline in gas prices, real sales and income have rebounded somewhat since June, but are still below their peaks. Only payrolls have continued to increase throughout the time period, and their growth continues to decelerate.

I suspect the actual recession will not begin until gas prices make a bottom; and we probably won’t know about payrolls until at least the yearly revisions kick in next March. But with the Fed hiking interest rates another 0.50% on Wednesday, my best guess is that there is a 95% chance we will be in a recession by the middle of 2023.