December real retail sales tank; industrial production also declines; consumer slowdown seems nearly certain – by New Deal democrat Two days ago, in connection with consumer inflation, I reiterated that: “we certainly are at a point where a sharp deceleration beginning with the consumer sector of the economy is more likely than not.” I didn’t expect to have it show up so soon! Retail sales, one of my favorite “real” economic indicators, took a nosedive in the month of December, declining -1.9% for the month even before inflation. After inflation, “real” retail sales declined -2.4%. Ouch! Thus real retail sales are down -5.1% from their April peak: Recall that real retail sales rose 1.8% in October. So I suspect a large

Topics:

NewDealdemocrat considers the following as important: Bonddad Blog, Hot Topics, New Deal Democrat, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

December real retail sales tank; industrial production also declines; consumer slowdown seems nearly certain

– by New Deal democrat

Two days ago, in connection with consumer inflation, I reiterated that:

“we certainly are at a point where a sharp deceleration beginning with the consumer sector of the economy is more likely than not.”

I didn’t expect to have it show up so soon! Retail sales, one of my favorite “real” economic indicators, took a nosedive in the month of December, declining -1.9% for the month even before inflation. After inflation, “real” retail sales declined -2.4%.

Ouch!

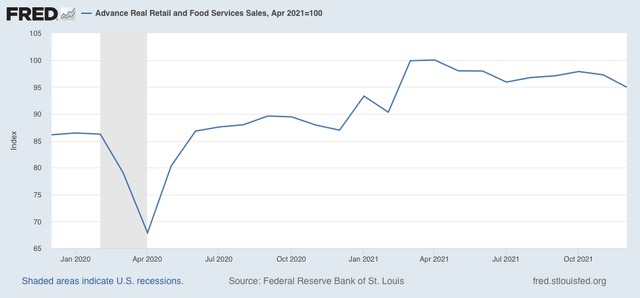

Thus real retail sales are down -5.1% from their April peak:

Recall that real retail sales rose 1.8% in October. So I suspect a large part of the decline is that, fearing shortages on the shelves at Christmastime, many consumers advanced their purchases of Christmas gifts by several months. Still, the net decline since September has been -2.2%.

Nevertheless they remain 9.2% higher than one year ago. In the past 70+ years before the pandemic hit, real retail sales were only higher YoY briefly in the early 1980s, as well as for about 16 months during the 1940s, 50s, and 60s.

Next, let’s turn to employment, because real retail sales are also a good short leading indicator for jobs.

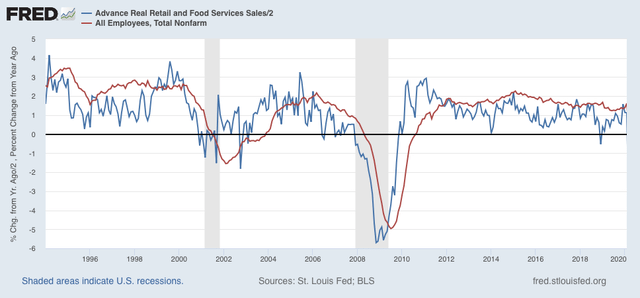

As I have written many times over the past 10+ years, real retail sales YoY/2 has a good record of leading jobs YoY with a lead time of about 3 to 6 months. That’s because demand for goods and services leads for the need to hire employees to fill that demand. The exceptions have been right after the 2001 and 2008 recessions, when it took jobs longer to catch up, as shown in the graph below, which takes us up to February 2020:

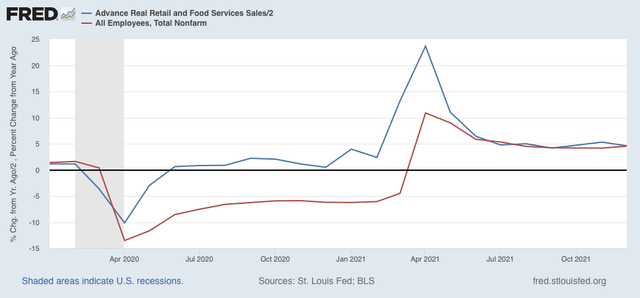

Now here is the same graph since just before the pandemic hit:

Note the two have been right in line for over half a year. I have written for the past several months that this “argues that we can expect jobs reports in the next few months to average out about even with those from one year ago, which averaged about 500,000 per month.” Although the last two jobs reports started out poor, November followed the pattern of upward revisions, and I expect more such revisions when next month’s jobs report is released. But comparisons will be very difficult YoY beginning in March, which means – to be consistent – that a big slowing of employment growth seems likely by about summer this year.

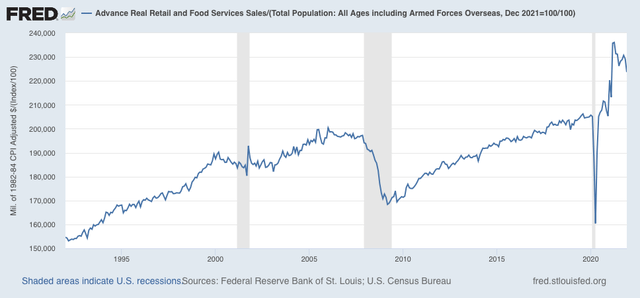

Finally, real retail sales per capita is one of my long leading indicators. Here’s what it looks like for the past 30 years:

With a -5.3% decline since April, this is a decidedly negative signal. Frankly, it’s recessionary looking out to midyear and beyond. Since it is only one indicator among the array, it isn’t a big concern yet. But it absolutely adds to the evidence that a big consumer slowdown as we go forward this year looks likely.

—-

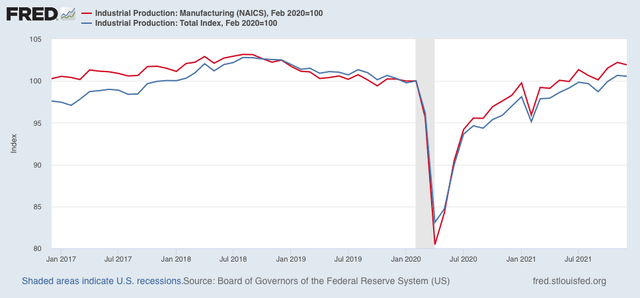

Before I go, let’s also briefly take a peek at industrial production, which also declined, by -0.1%, this morning. Manufacturing production declined -0.3%. Additionally, November was revised downward for both total and manufacturing production. Here’s the current view:

Both are still higher than they were just before the pandemic. While this isn’t good news, it is within the range of noise, but on the other hand, it is one more bit of evidence for a slowing expansion.