March consumer inflation part 1: real wages decline sharply The March consumer inflation report was particularly important, and particularly bad. So much so that I am going to divide my comments into two separate posts. First, the news on real wages was terrible. While nominally nonsupervisory wages rose 0.4% in March, since inflation rose 1.2%, “real” wages declined -0.8% in March alone. On a YoY basis, real wages were down -1.8%: Aside from the outset of the pandemic during April and May 2020, this is the worst number since 2011, and one of the 4 worst months since 1991. Further, on an absolute scale, real wages were the lowest since March 2020; they were also down -1.6% since July 2020: Finally, real aggregate payrolls

Topics:

NewDealdemocrat considers the following as important: consumer inflation, Real Wages, US EConomics, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

March consumer inflation part 1: real wages decline sharply

The March consumer inflation report was particularly important, and particularly bad. So much so that I am going to divide my comments into two separate posts.

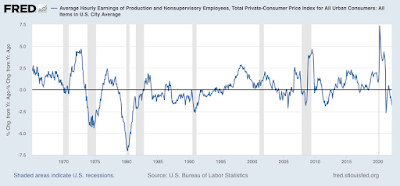

First, the news on real wages was terrible. While nominally nonsupervisory wages rose 0.4% in March, since inflation rose 1.2%, “real” wages declined -0.8% in March alone. On a YoY basis, real wages were down -1.8%:

Aside from the outset of the pandemic during April and May 2020, this is the worst number since 2011, and one of the 4 worst months since 1991.

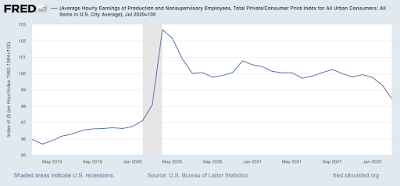

Further, on an absolute scale, real wages were the lowest since March 2020; they were also down -1.6% since July 2020:

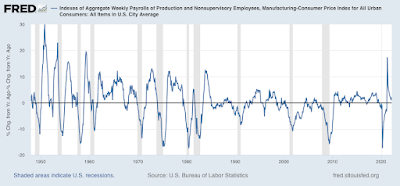

Finally, real aggregate payrolls are only up 1.5% YoY, and only up 0.3% in the past 7 months. Since real aggregate payrolls turning negative YoY is frequently something that happens shortly before recessions (and likely is a causative agent), although there are some false positives, this is also not good news:

We really need real wages to turn up. But the signs are not good that inflation may abate in the absence of the Fed slamming on the brakes. I’ll discuss that separately in part 2 of this update.