Should Greece leave the Euro? That was the title of the Oxford debate at the Prague Summit in which I had the pleasure of participating yesterday.But this is the wrong question. Unless there is a considerable shift in Eurozone politics, Greece WILL leave the Euro - eventually. The question is when, and how.To see this, we need to look at the motivations of all the players involved in the negotiations. The Greek negotiations resemble a "prisoner's dilemma", in which the best outcome for...

Read More »The safe asset scarcity problem, 2050 edition

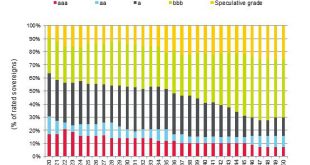

This is a silly chart: Why is it silly? Just look at what it implies for government and investor behaviour - and the future of the ratings agency that issued it.S&P forecasts a serious shortage of safe assets by 2050 if the developed nations, in particular, do nothing to adjust their fiscal finances in the light of ageing populations. Clearly, therefore, the price of sovereign bonds in the three "A" categories will rise significantly. S&P doesn't indicate which nations would be the...

Read More »Kalecki’s Fable

By Jan Toporowski (Full paper published by ROKE here)Following the death, in 1935, of the Polish military dictator Józef Piłsudski, his regime continued under a group of his military cronies, known as the ‘colonels’, who increasingly modeled their regime on that of Mussolini in Italy. One of the colonels, who was responsible for economic development, wanted to understand the economic principles behind government stabilization. He called in Kalecki's colleague from the Institute for the Study...

Read More »Bond yields and helicopters

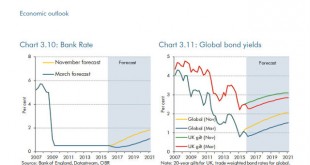

The ever-optimistic OBR has some encouraging forecasts for interest rates and global government bond yields: Well, ok, they were rather more encouraging in November than they are now. The uplift was supposed to start ANY DAY NOW, but there has been an interruption to normal service. Leaves on the line, perhaps. Or the wrong sort of snow.The trouble is, the OBR has a long record of hockey-stick forecasting. Not that it is unique in having a noticeable bias to the upside: If ever there were...

Read More »The Slough of Despond

I'm bored.Bored with this crisis. Bored with endless calls for bank reforms. Bored with never-ending stories of inadequate bank resolution and legal battles which benefit no-one but lawyers. Bored with ineffectual monetary policy and fiscal gridlock. Bored with seeing the same things proposed over and over again, even things we know don't work and will never happen.Today, Mike Konczal wrote a piece on why restoring Glass-Steagall wouldn't solve anything. He's right, of course. But it is now...

Read More »Jensen: How long bonds could actually outperform equities

In-depth analysis on Credit Writedowns Pro. Editor’s note: This was originally published by Absolute Return Partners in late August. So we are a little late in releasing it. Apologies. It is still good reading. The Absolute Return Letter, August/September 2015: Doodles from an eventful summer “There is something deeply troubling when the unthinkable threatens to become routine.” Bank for International Settlements Incidents of the summer 2015 This month’s Absolute Return Letter is a...

Read More »Everything’s under control, China edition

Daiwa Securities has forecast Armageddon. They say that over-investment in China in recent years has created a debt bubble so great that Chinese authorities would not able to manage its collapse, resulting in a debt deflationary spiral which would make 2008 look like a walk in the park. Such a meltdown would, in their words, "send the global economy into a tailspin".But they also outline another scenario, in which China's economy undergoes a nasty, possibly prolonged recession, from which...

Read More »If we don’t understand both sides of China’s balance sheet, we understand neither

In-depth analysis on Credit Writedowns Pro. By Michael Pettis originally published on 1 September 2015. With so much happening in China in the past month it seems that there are a number of very specific topics that any essay on China should focus. I worry, however, that we get so caught up staring at strange clumps of trees that we risk losing sight of the forest. What happened in July this year, and again in August, or in June 2013, or a number of other times, were not unexpected shocks...

Read More »Never mind Greece, look at Venezuela

Via Business Insider comes this colourful map and chart of CDS spreads worldwide: Those who thought Greek bonds would be the most expensive to insure, since everyone knows it can't pay its debts, need to think again. Venezuela is the most expensive, by a long way. Related to that is this: The yield curve has been deeply inverted all year, but yields at all maturities are now rising: When even the yield on long-dated bonds is heading for 30%, the public finances are completely...

Read More »Lies, damned lies, and Greek statistics

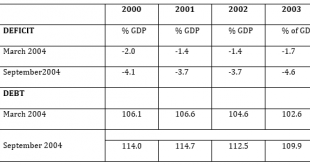

Guest post by Sigrún DavídsdóttirThe word “trust” has been mentioned time and again in reports on the tortuous negotiations on Greece. One reason is the persistent deceit in reporting on debt and deficit statistics, including lying about an off market swap with Goldman Sachs: not a one-off deceit but a political interference through concerted action among several public institutions for more then ten years.As late as in the July 12 Euro Summit statement "safeguarding of the full legal...

Read More » Heterodox

Heterodox