This is an excellent review of what has helped the economy stay stable during the pandemic and some of the issues mostly centered around demand and supply chain. Spend a few minutes here and read NDd’s reasoning. A further examination of the state of the economic tailwind – by New Deal democrat With no big economic news today, I thought I would pick up where I left off Friday, when I identified three major reasons for the economic tailwind...

Read More »A “Big Picture” summary of why a recession still looks likely, even if it hasn’t occurred yet

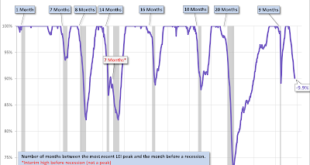

A “Big Picture” summary of why a recession still looks likely, even if it hasn’t occurred yet – by New Deal democrat The below started out as a comment somewhere else, but it is too good a “big picture” summary of where the economy is today and not to post it here. I still intend also to take a more detailed look at the housing market, but since the below lays the groundwork for that, I’ll post it later (maybe later today, maybe not). What...

Read More »Pandemic economics: the role of central banks and monetary policy

Below are the slides from my presentation at Beyond Covid on 12th June. The whole webinar can ve viewed here.The pandemic seems to me to resemble the "nuclear disaster" scenarios of my youth: hide in the bunker, then creep out when the immediate danger is over, only to find a world that is still dangerous and has fundamentally changed in unforeseeable ways. Rabbits hiding from a hawk is perhaps a kinder image, though hawks don't usually leave devastation in their wake. And I like rabbits. So...

Read More »Pandemic economics: the role of central banks and monetary policy

Below are the slides from my presentation at Beyond Covid on 12th June. The whole webinar can ve viewed here.The pandemic seems to me to resemble the "nuclear disaster" scenarios of my youth: hide in the bunker, then creep out when the immediate danger is over, only to find a world that is still dangerous and has fundamentally changed in unforeseeable ways. Rabbits hiding from a hawk is perhaps a kinder image, though hawks don't usually leave devastation in their wake. And I like rabbits. So...

Read More »July 4th May Be Over, But The Fireworks Discussions Continue…

[unable to retrieve full-text content]July 4th May Be Over, But The Fireworks Discussions Continue…: you: yay a day off let’s do some fireworks me, economist: OMG YOU’RE DOING FIREWORKS TOTALLY INEFFICIENTLY LET ME EXPLAIN

Read More »July 4th May Be Over, But The Fireworks Discussions Continue…

[unable to retrieve full-text content]July 4th May Be Over, But The Fireworks Discussions Continue…: you: yay a day off let’s do some fireworks me, economist: OMG YOU’RE DOING FIREWORKS TOTALLY INEFFICIENTLY LET ME EXPLAIN

Read More »Prakash Loungani — Links

From a new paper by Antonio Fatas: “This paper studies the negative loop created by the interaction between pessimistic estimates of potential output and the effects of fiscal policy during the 2008-2014 period in Europe. The crisis of 2008 created an overly pessimistic view on potential output among policy makers that led to a large adjustment in fiscal policy during the years that followed. Contractionary fiscal policy, via hysteresis effects, caused a reduction in potential output that...

Read More »Pedro Nicolaci da Costa — Inequality is getting so bad it’s threatening the very foundation of economic growth

Income inequality has been rising so rapidly in the United States and around the world that it threatens to make economic growth less durable, according to research from the International Monetary Fund. "While strong economic growth is necessary for economic development, it is not always sufficient," four IMF economists write in a new blog. "Inequality has risen in several advanced economies and remains stubbornly high in many that are still developing," they added. "This worries...

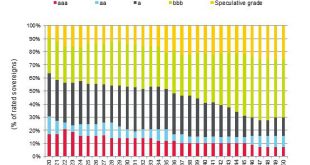

Read More »The safe asset scarcity problem, 2050 edition

This is a silly chart: Why is it silly? Just look at what it implies for government and investor behaviour - and the future of the ratings agency that issued it.S&P forecasts a serious shortage of safe assets by 2050 if the developed nations, in particular, do nothing to adjust their fiscal finances in the light of ageing populations. Clearly, therefore, the price of sovereign bonds in the three "A" categories will rise significantly. S&P doesn't indicate which nations would be the...

Read More »Bond yields and helicopters

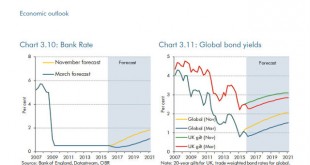

The ever-optimistic OBR has some encouraging forecasts for interest rates and global government bond yields: Well, ok, they were rather more encouraging in November than they are now. The uplift was supposed to start ANY DAY NOW, but there has been an interruption to normal service. Leaves on the line, perhaps. Or the wrong sort of snow.The trouble is, the OBR has a long record of hockey-stick forecasting. Not that it is unique in having a noticeable bias to the upside: If ever there were...

Read More » Heterodox

Heterodox