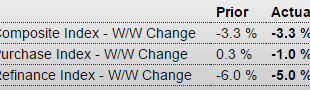

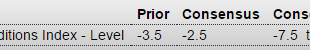

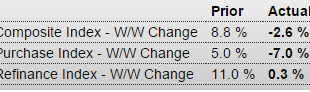

Down some, still depressed and going nowhere: MBA Mortgage ApplicationsHighlightsPurchase applications for home mortgages fell back by 1 percent in the March 18 week, bringing down the year-on-year increase to a still very strong 25 percent, though some loss of momentum in this component is evident. Refinancing applications continued in the decline of recent weeks, dropping 5 percent in the latest week despite a 1 basis point slip to 3.93 percent in the average rate for 30-year conforming...

Read More »Retail sales, Redbook retail sales, Housing index, Business inventories and sales, Empire manufacturing, MEW, Atlanta Fed

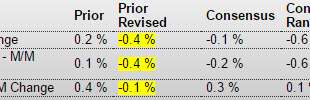

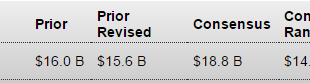

Just plain bad. Including last month’s downward revision. And, again, sales = income, and lower income means less to spend in the next period: Retail SalesHighlightsConsumer spending did not get off to a good start after all in 2016 as big downward revisions to January retail sales badly upstage respectable strength in February. January retail sales are now at minus 0.4 percent vs an initial gain of 0.2 percent. The two major sub-readings also show major downward revisions with ex-auto...

Read More »Employment, Trade

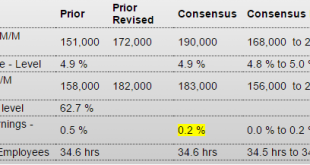

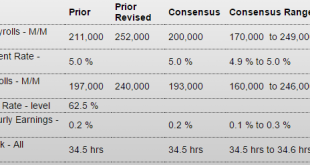

Education employment was mysteriously down big last month and up big this month, so best to average the two months, which would mean about 205,000 new jobs each month, which is about where it’s been. However, in any case hours worded and average pay were both down, which means personal income and probably output is that much less, which is not good. Additionally, the downward revision in earnings for last month and the negative print this month tell me ‘the market’ is telling us there’s...

Read More »Chicago PMI, Pending home sales, EU inflation, G20 statement, Virginia jobless claims

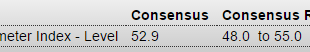

As previously suspected, last month’s higher print was just a bit of volatility on the way down, as per the chart: Chicago PMIHighlightsAnother month and another month of wild volatility for the Chicago PMI which lurched from solid expansion in January to noticeable contraction in February. At a headline 47.6, Chicago’s PMI has fallen outside Econoday’s consensus range for a third month in a row! Still, this report is closely watched and confirms other early indications of February...

Read More »Philly Fed, leading indicators, jobless claims

Another bad one, and supports the possibility of another downward revision to industrial production next month: Philadelphia Fed Business Outlook SurveyHighlightsThe Philly Fed report, much like Tuesday’s Empire State report, is pointing to continuing trouble for the nation’s factory sector. The general business conditions index came in at minus 2.8 to extend a long run of negative readings. New orders, at minus 5.3, have also been stuck in the minus column as have unfilled orders, at minus...

Read More »Euro banks, Fed’s labor market index, NFIB chart

Getting more obvious it’s ‘spreading’ much like during the sub prime days, as previously discussed? European banks face major cash crunch European banks may have to pare down assets to bolster capital reserves as cheap oil is taking a toll on portfolios of energy-exposed loans. It’s slowing, whatever it is…;) Labor Market Conditions IndexHighlightsPayroll growth slowed in Friday’s employment report as did the Fed’s labor market conditions index, to plus 0.4 in January from a downward...

Read More »Inventories, Payrolls, Trade

This is getting out of control. Sales are slowing faster than inventories are being sold.A weak print and year over year growth continues to decelerate as per the chart: Employment SituationHighlightsHeadline weakness masks an otherwise solid employment report for January. Nonfarm payrolls rose 151,000 vs expectations for 188,000. December was revised 30,000 lower to 262,000 but November was revised 28,000 higher to 280,000. Now the signs of strength as the unemployment rate fell 1 tenth to...

Read More »Mtg purchase apps, Car sales comments, ADP, ISM services, Exxon capex, BOJ comment

Up last week now back down as this sector remains in prolonged depression: MBA Mortgage ApplicationsHighlightsThe purchase index has been posting outsized gains this year but not in the January 29 week, falling 7.0 percent. The refinance index, however, did post a gain in the week, up 0.3 percent. Low interest rates have triggered strong demand for mortgage applications. The average 30-year fixed loan for conforming mortgages ($417,000 or less) fell 5 basis points and is back under 4.00...

Read More »Consumer Credit, Jobs comments

This is going nowhere: Consumer CreditHighlightsRevolving credit showed substantial life in November, up $5.7 billion and helping to boost total consumer credit by $14.0 billion. Nonrevolving credit, boosted by auto financing and student loans, has been the foundation of strength for this series during the whole recovery, but less so in November when it added only $8.3 billion for the smallest contribution since February 2012. But it’s the gain for revolving credit, growing at an annualized...

Read More »Jobs, Wholesale trade, China, Rail traffic

Anyone notice that the annual growth rate of employment continues the deterioration that began with the collapse in oil capex?Or that, once again, it looks like most all the new jobs were taken by people previously considered out of the labor force?And the anemic wage growth also contributes to the narrative of a continuously deteriorating plight for people trying to work for a living: Employment SituationHighlightsThe labor market is stronger than most assessments with December results...

Read More » Heterodox

Heterodox