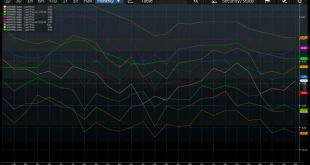

Saudi discounts for February. Some reduced, some increased, so probably more same- prices fall until Saudi output hits its capacity:Zig zagging a lot recently, now back down to where they’ve been for a while: MBA Mortgage ApplicationsHighlightsMortgage application activity fell sharply in the two weeks ended January 1, down 15 percent for home purchases and down 37 percent for refinancing. Rates were steady in the period with the average 30-year mortgage for conforming balances ($417,000 or...

Read More »Rate hike comment, Container traffic, Employment comment

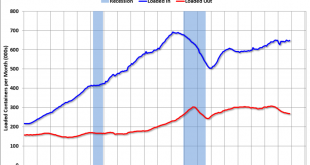

So a Fed rate hike is nothing more than the federal government deciding to pay more interest on what’s called ‘the public debt’. By immediately paying more interest on balances in reserve accounts at the Fed the cost of funds to the banking system is supported at that higher level, all of which influences the interest paid on securities accounts at the Fed as well, which influences the term structure of rates. Imports up, exports down:Seems to me there’s a substantial number of people who...

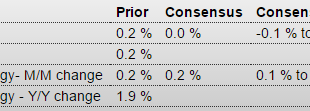

Read More »CPI, Empire survey, Redbook retail sales, Housing index

One of the Fed’s mandates. The ‘headline’ number is below target due to the energy impulse, but the ‘core’ rate, led by services, is on target. The question is whether energy prices, if they remain at current levels, will ‘pull down’ other prices. And the comparisons with last year are now vs the lower numbers that were released after the oil price collapse. And not to forget that the Fed uses futures prices as indications of future spot prices, even for non perishables, which technically...

Read More »Rail traffic, Credit check, Employment flows, State and local taxes and expenditures

Rail Week Ending 28 November 2015: Contraction Growing Faster. Rail Traffic in November Down 10.4%. Week 47 of 2015 shows same week total rail traffic (from same week one year ago) declined according to the Association of American Railroads (AAR) traffic data. Intermodal traffic contracted year-over-year, which accounts for approximately half of movements and weekly railcar counts continued in contraction. The 52 week rolling average contraction is continuing to grow. Rail counts for the...

Read More »Payrolls, Trade

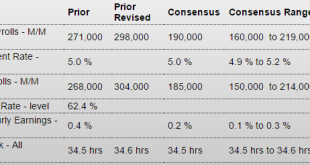

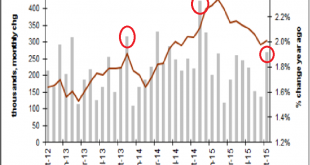

The growth rate continues to decelerate (see chart): NFP HighlightsPayroll growth is solid and, though wages aren’t building steam, today’s employment report fully cements expectations for December liftoff. Nonfarm payrolls rose a very solid 211,000 in November which is safely above expectations for 190,000. And there’s 35,000 in upward revisions to the two prior months with October now standing at a very impressive 298,000. The unemployment rate is steady and low at 5.0 percent with the...

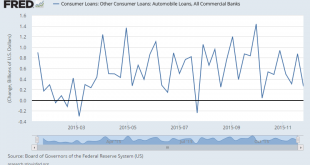

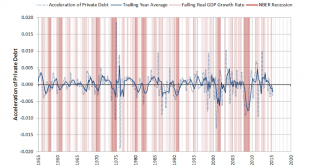

Read More »Debt and Recession, Jolts

This shows how private sector credit deceleration is associated with recessions. It’s about the need for those spending more than their incomes to offset those spending less than their incomes. And most often private sector deficit spending decelerates some time after public sector deficit spending decelerates and fails to provide the income and net financial assets that supports private sector deficit spending. United States : JOLTSHighlightsIn a positive sign for labor demand, job...

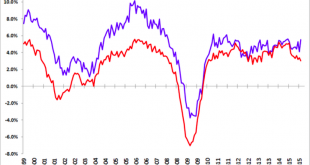

Read More »Employment chart, China trade, SNB

The red line tends to drag down the blue line, often when deficit spending gets too low: Exports drop again, imports drop more, so the trade surplus grows, and the US should see more imports and fewer exports, while euro zone imports are down which adds to their trade surplus: China’s Trade Drop Means More Stimulus Measures Are Coming Exports drop for a fourth month, import declines match recordTrade surplus to help ease currency depreciation pressureChina’s exports fell for a fourth...

Read More »Full time employment finally above previous peak!

By the way, if you count workers employed full time only in August this year we surpassed the December 2007 peak, and after a fall in September, we're over again now. So it took only about 8 years to get back were we were. Yes, the economy is peachy.

Read More »Payrolls

Much higher than expected, so unless next month’s number settles back down the Fed will be expected to hike rates some. Note from the chart that the last few November releases showed similar spikes followed by much lower prints: Employment SituationHighlightsBring on that rate hike! Nonfarm payrolls surged 271,000 in October vs expectations for 190,000 and against Econoday’s top-end forecast for 240,000. Revisions in prior months are not a factor. The unemployment is down 1 tenth at 5.0...

Read More »The economy is performing well; good to know

New Employment Situation Report is out. Not bad, given the last couple of months. In October, total nonfarm payroll employment increased by 271,000 and the unemployment rate is at 5%. The employment-population ratio, which seemed to start to inch up last year, however, now looks again stagnant. Even though it seems markets are happy with job creation above 200k per month, we need something more like 400 for a healthy recovery, and to bring the employment-population ratio up. Earnings have...

Read More » Heterodox

Heterodox