Figure 1: The Wage as Functions of Employment by Industry1.0 Introduction This post repeats a common theme of mine. It builds on an example I have previously gone on about. I use this example to graph, given the wage, the amount of labor firms would like to employ in each industry, per unit of gross output in each industry. These graphs are derived for an economy in which three commodities are produced: iron, steel, and corn. I also graph the amount of labor firms would like to employ...

Read More »Perturbations Of Markups In Iron Industry In An Example With Produced Iron, Steel, And Corn

Figure 1: Switch Points Varying With Perturbations In Markup In Iron Industry I have created an example with three produced commodities and a choice of technique. The three produced commodities are called iron, steel, and corn. Corn is taken to be the numeraire and the only commodity purchased by households for consumption. Markups are assumed to vary among industries, even when prices of production prevail. I was able to locate various fluke switch points in that example. The fluke switch...

Read More »Variation In Switch Points With Markups

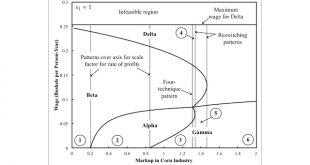

Figure 1: Variation of Switch Points with the Markup in the Steel Industry1.0 Introduction I want to continue to analyze this example. This example does not do everything I would like with a three-commodity example. Specifically, I do not have a case of triple-switching in the parameter space I explore in this post. That space of relative markups, in a model with n industries, has (n - 1) dimensions. And it is partitioned by (n - 2)-dimensional manifolds, where each manifold corresponds to...

Read More »Two Four-Technique Patterns With Markup Pricing

Figure 1: Wage Curves for the Example1.0 Introduction The Cambridge Capital Controversy (CCC) applies to models both of competitive industries and of non-competitive industries. Around a switch point exhibiting capital-reversing, a higher wage is associated with greater employment per unit of net output produced. It is not merely a question of what technology is available. It is also a matter of the power of firms among industries to extract value from their workers, their upstream...

Read More »Non-Uniform Rates Of Profits

This post presents a limited account of the history of analyzing prices of production with non-uniform rates of profits. I start from developments in post Sraffian price theory. D’Agata (2018) and Zambelli (2018b) have argued that Sraffian prices of production can still be defined when rates of profits have regular and persistent variations among industries. Barriers to entry or idiosyncratic properties of investment can result in such variations. Steedman (1981) presents the first...

Read More »Visualizing The Effects Of Markups: A Numeric Example

Figure 1: A Pattern Diagram This post illustrates the numeric example used here. The example is of an economy in which two commodities, iron and corn, are produced by workers from inputs of iron and corn. Two processes are available for each industry, leading to a choice among four techniques. I analyze stationary states. I look at prices of production, with a bushel corn as numeraire and wages paid out of the surplus at the end of the year. Prices of production are defined so as to allow...

Read More »Visualizing the Effects of Markups on the Choice of Technique

I have a working paper. Abstract: This article extends to unequal rates of profits a derivation of prices of production from a linear program. A partition of the price-wage space is illustrated in an example with two produced commodities. The variation in the solution of the LP with perturbations of relative markups is illustrated. This analysis provides an intuitive explanation of how the reswitching of techniques and of how capital reversing can emerge in non-competitive markets.

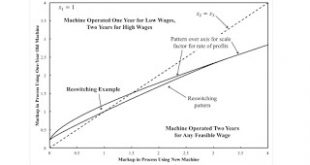

Read More »Reswitching With Markup Pricing And Fixed Capital

Figure 1: Two Dimensional Pattern Diagram1.0 Introduction This post extends an example from Bertram Schefold. It presents markup pricing in an example with a machine that can be operated for two years or junked after one year. This is a case of joint production in which, unlike in some cases, the choice of technique can still be analyzed by the construction of the wage frontier. Also, I do not think the question of requirements for use enter in here, and all matrices are square. As usual,...

Read More »Towards the Derivation of the Cambridge Equation with Expanded Reproduction and Markup Pricing

I have a new working paper. Abstract: Does the Cambridge equation, in which the rate of profits in a steady state is equal to the quotient of the rate of growth and the savings rate out of profits, hold in an economy with widespread non-competitive markets? This article presents a multiple-good model of markup pricing in an attempt to answer this question. A balance equation is derived. Given competitive conditions, this model can be used to derive the Cambridge equation. The Cambridge...

Read More »The Cambridge Equation, Expanded Reproduction, and Markup Pricing: An Example

1.0 Introduction I have sometimes set out Marx's model of expanded reproduction, only with prices of production instead of labor values. I assume two goods, a capital good and a consumption good, are produced with constant technology. If one assumes workers spend all their wages and capitalists save a constant proportion of profits, one can derive the Cambridge equation in this model. The Cambridge equation shows that, along a steady state growth path, the economy-wide rate of profits is...

Read More » Heterodox

Heterodox