[unable to retrieve full-text content]– by New Deal democrat Yesterday we got the existing home sales portion of the rebalancing of the housing market, showing sales down further, and price growth attenuation. This morning, we got the new home slice, which was a virtual mirror image. As per usual, while new home sales are only about 10% of the […] The post Rebalancing of the housing market, new home sales edition: sales increase, prices firm appeared first on Angry Bear.

Read More »Rebalancing of housing market continues: existing home sales down, inventory up, price growth moderates further

[unable to retrieve full-text content] – by New Deal democrat In the past number of months, I have been looking for a rebalancing of new vs. existing home sales. The sharp increase in mortgage rates beginning in 2022 locked many existing homeowners into their houses, since they could not afford the concomitant increase in mortgage payments that would accrue from […] The post Rebalancing of housing market continues: existing home sales down, inventory up, price growth...

Read More »Existing home sales try to find a bottom, while severe bifurcation with new home market continues

In my lingo, existing home sales still down and mortgage rates for new homes still high. Builders are doing what they can do to encourage sales. New Deal democrat gives a clearer view and a hint of an outcome. Read on . . . Existing home sales try to find a bottom, while severe bifurcation with new home market continues – by New Deal democrat Existing home sales rose 3,000 on a seasonally adjusted annualized basis in November. They are...

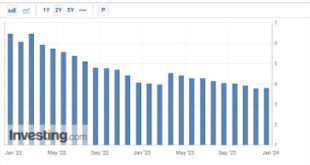

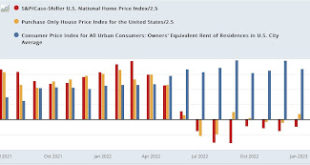

Read More »House prices on track to go negative YoY by summer, despite monthly increase in February

House prices on track to go negative YoY by summer, despite monthly increase in February – by New Deal democrat House prices through February as measured by both the FHFA (gold in the graphs below) and Case Shiller (red) Indexes rose, the former by 0.5% (after a downwardly revised 0.1% in January), and the latter by 0.2% (after a -0.2% decline in January). Here’s what the monthly changes look like for each, as compared with Owners’ Equivalent...

Read More »The housing market’s downward turn begins

The housing market’s downward turn begins: new home sales in February, plus a comment about affordability As of this morning Mortgage News Daily shows the 30 year mortgage rate up to 4.72%, 1.9% higher than their lows 15 months ago, and the highest in four years. That means the housing market is in some serious trouble. Let’s take a look at that via this morning’s new home sales report for January. First, a reminder, that new home sales:...

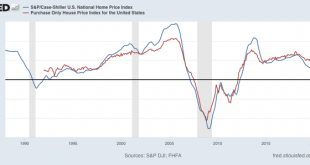

Read More »While house price gains continue to go nuts, housing remains much more affordable than at the peak of the bubble

While house price gains continue to go nuts, housing remains much more affordable than at the peak of the bubble The boom – and maybe insanity – in house price gains continued in February, as both the Case Shiller and FHFA house price indexes increased roughly 1% just since January! The YoY increase for both was almost exactly 12%, as shown in the graph below: While the YoY increase in house prices matches those of the bubble peak, and are,...

Read More »New home sales rise m/m, but signal caution for housing market going forward

New home sales rise m/m, but signal caution for housing market going forward New home sales increased to a three month annualized high of 923,000 in January. This is of a piece with the positive news last week on housing permits. At the same time, the pace remains below the recent high of 979,000 annualized set six months ago in July. The below graph compares housing starts (blue) with the much less volatile single family permits (red) and the...

Read More »Housing and Recessions — Bill McBride

Now that new home sales have reached a new cycle high (in June), I'd like to update a couple of graphs in a previous post (most of this from an earlier post). For the economy, what we should be focused on are single family starts and new home sales. As I noted in Investment and Recessions "New Home Sales appears to be an excellent leading indicator, and currently new home sales (and housing starts) are up solidly year-over-year, and this suggests there is no recession in sight."… Although...

Read More »Brian Romanchuk — Real Estate And The Cycle

Real estate -- particularly residential real estate -- is an extremely important factor when discussing recessions in the modern era. To a certain extent, real estate is where economic theory goes to die. One possibility is that the theory was largely developed when the norms in real estate investment were conservative, so attention was moved to the industrial sector. However, the herd tendencies in the housing market may now overwhelm the industrial cycle. (This article is a set of notes...

Read More » Heterodox

Heterodox