In my lingo, existing home sales still down and mortgage rates for new homes still high. Builders are doing what they can do to encourage sales. New Deal democrat gives a clearer view and a hint of an outcome. Read on . . . Existing home sales try to find a bottom, while severe bifurcation with new home market continues – by New Deal democrat Existing home sales rose 3,000 on a seasonally adjusted annualized basis in November. They are likely in the process of bottoming, as they have been in the range of 3.79 million to 4.10 million for the past five months: As a reminder, though, on a longer term basis, sales are down to nearly 30 year lows: As many if not most homeowners remain frozen in place by 3% mortgages, inventory has

Topics:

NewDealdemocrat considers the following as important: Hot Topics, housing market, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

In my lingo, existing home sales still down and mortgage rates for new homes still high. Builders are doing what they can do to encourage sales. New Deal democrat gives a clearer view and a hint of an outcome. Read on . . .

Existing home sales try to find a bottom, while severe bifurcation with new home market continues

– by New Deal democrat

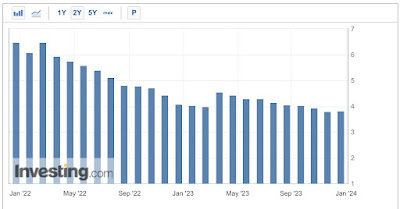

Existing home sales rose 3,000 on a seasonally adjusted annualized basis in November. They are likely in the process of bottoming, as they have been in the range of 3.79 million to 4.10 million for the past five months:

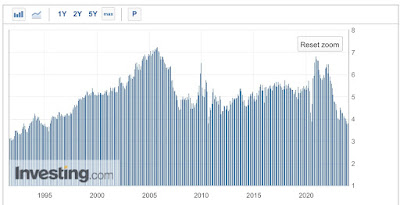

As a reminder, though, on a longer term basis, sales are down to nearly 30 year lows:

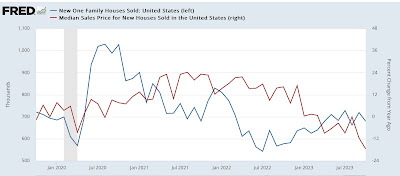

As many if not most homeowners remain frozen in place by 3% mortgages, inventory has remained very low, and this means that prices have remained at a premium, currently up 4.0% YoY (note: graph does not include this morning’s data):

YoY price growth has actually been increasing since July, when they were only up 1.7%.

This is in contrast new home sales and prices, where home builders have been aggressive with rebates, down-scaling amenities, and buying down mortgage payments. There sales have rebounded by 1/3rd from their bottom at the beginning of this year towards their 2020 highs, and YoY prices are down -17.6%:

It’s likely that we will start to see a rebalancing from here, as mortgage rates have declined by about 1% in the past month. If existing home sales stop falling and start rising, more inventory will mean more price competition. This in turn will draw some marginal buyers away from new homes (especially new condo units) towards existing homes. But if so we are just at the beginning of that process. For now the market remains severely bifurcated.