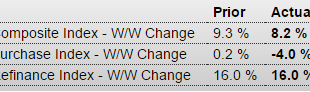

Purchase apps down again: MBA Mortgage ApplicationsHighlightsFalling mortgage rates continue to drive refinancing applications sharply higher, up 16 percent for a second straight week. Purchase applications, up 30 percent year-on-year, are also being driven higher though they declined 4 percent in the latest week. The average rate for 30-year conforming loans ($417,000 or less) fell 8 basis points in the week to 3.83 percent. Again, so much for what’s been forecast to be the ‘driver’ of...

Read More »NY Mfg survey, Home builder’s index, oil losses, Japan, China trade, euro trade

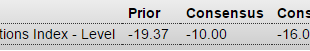

A lot worse than expected and still deep in contraction: Empire State Mfg SurveyHighlightsFor the seventh straight month, the Empire State report is signaling significant contraction for the manufacturing sector. The general business conditions index for February came in below low-end expectations, at minus 16.64 vs even deeper contraction of minus 19.37 in January. New orders, at minus 11.63, are in contraction for a ninth month in a row while employment, though improving to minus 0.99...

Read More »Mtg purchase apps, Car sales comments, ADP, ISM services, Exxon capex, BOJ comment

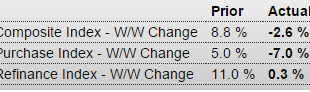

Up last week now back down as this sector remains in prolonged depression: MBA Mortgage ApplicationsHighlightsThe purchase index has been posting outsized gains this year but not in the January 29 week, falling 7.0 percent. The refinance index, however, did post a gain in the week, up 0.3 percent. Low interest rates have triggered strong demand for mortgage applications. The average 30-year fixed loan for conforming mortgages ($417,000 or less) fell 5 basis points and is back under 4.00...

Read More »Mtg purchase apps, Vehicle sales, Oil capex, Business equipment borrowing, Equipment sales, New home sales

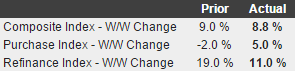

Inching up a bit but still seriously depressed: MBA Mortgage ApplicationsHighlightsWeekly mortgage applications have been very volatile so far this year but mostly to the upside. Purchase applications jumped 5.0 percent in the January 22 week with refinancing applications up 11.0 percent. Low mortgage rates are driving the activity, down 4 basis points in the week to an average 4.02 percent for 30-year conforming loans ($417,000 or less). Looks like Wards is forecasting no improvement in...

Read More »Chicago Fed, existing home sales

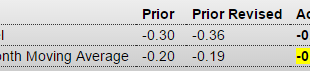

Still negative: Chicago Fed National Activity IndexHighlightsDecember was a weak month for the U.S. economy but a little less weak than November, based on the national activity index which improved to minus 0.22 from minus 0.36 (revised lower from minus 0.30). The improvement is centered in the production component as contraction in industrial production eased to minus 0.4 percent from November’s very deep minus 0.9 percent. Other components were steady with sales/orders/inventories and...

Read More »Housing starts, Mtg purch apps

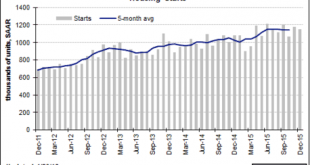

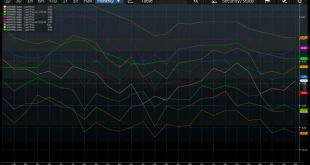

Looks to have stopped growing about 10 months ago:Remains seriously depressed: MBA Mortgage Applications

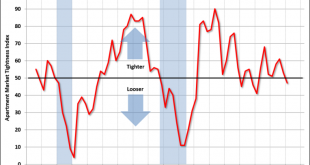

Read More »Apartment market tightness, Euro area trade surplus, Spain

This just keeps going up, which fundamentally tends to drive up the euro which tends to continue to be subject to said upward pressure until the trade picture reverses: Euro Area Balance of TradeThe Eurozone trade surplus increased to €23.6 billion in November of 2015 compared to a €20.2 billion surplus a year earlier. Exports recorded the highest annual gain in four months and imports rebounded. Potential showdown that could drive up Spanish rates: Guindos Ditches Pledge on Spain...

Read More »Mtg purchase apps, China trade

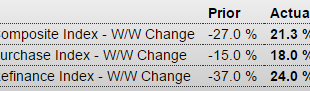

Lots of up and down right now. The chart indicates purchase apps may be up a bit but still depressed historically. MBA Mortgage ApplicationsHighlightsThe new year is seeing a surge in mortgage activity reflecting a strong jobs market and low rates, according to the Mortgage Bankers Association’s weekly report. Purchase applications surged 18 percent in the January 8 week with refinancing applications up 24 percent. These gains, however, also reflect volatility in weekly measures and largely...

Read More »Saudi pricing, Mtg purchase apps, ADP, Trade, Factory orders, ISM non manufacturing

Saudi discounts for February. Some reduced, some increased, so probably more same- prices fall until Saudi output hits its capacity:Zig zagging a lot recently, now back down to where they’ve been for a while: MBA Mortgage ApplicationsHighlightsMortgage application activity fell sharply in the two weeks ended January 1, down 15 percent for home purchases and down 37 percent for refinancing. Rates were steady in the period with the average 30-year mortgage for conforming balances ($417,000 or...

Read More »Mtg purchase apps, Durable goods orders, New home sales, Personal income and outlays, Chemicals Activity Barometer

Up some this week. Been bouncing around a lot with looming Fed hike, regulation changes, etc. but mtg apps and home sales remain depressed:More bad here: Durable Goods OrdersHighlightsOctober was a rare good month for the factory sector, not November where manufacturing production in the industrial production report was no better than unchanged and now new orders were also unchanged. Excluding transportation, orders dipped into the minus column though just barely at minus 0.1...

Read More » Heterodox

Heterodox