Your access to this site has been limited Your access to this service has been temporarily limited. Please try again in a few minutes. (HTTP response code 503) Reason: Exceeded the maximum number of page requests per minute for humans. Important note for site admins: If you are the administrator of this website note that your access has been limited because you broke one of the Wordfence blocking rules. The reason your access was limited is: "Exceeded the maximum number of page requests per...

Read More »Social Housing in BC, AB and QC (1975-2015)

Your access to this site has been limited Your access to this service has been temporarily limited. Please try again in a few minutes. (HTTP response code 503) Reason: Exceeded the maximum number of page requests per minute for humans. Important note for site admins: If you are the administrator of this website note that your access has been limited because you broke one of the Wordfence blocking rules. The reason your access was limited is: "Exceeded the maximum number of page requests per...

Read More »How Housing Policy Benefits from a Socioeconomic Perspective

Your access to this site has been limited Your access to this service has been temporarily limited. Please try again in a few minutes. (HTTP response code 503) Reason: Exceeded the maximum number of page requests per minute for humans. Important note for site admins: If you are the administrator of this website note that your access has been limited because you broke one of the Wordfence blocking rules. The reason your access was limited is: "Exceeded the maximum number of page requests per...

Read More »The in-betweeners

How effective is monetary policy?Highly effective, according to the Governor of the Bank of England. In a speech earlier this week, Mark Carney robustly defended the Bank of England's record: "Simulations using the Bank’s main forecasting model suggest that the Bank’s monetary policy measures raised the level of GDP by around 8% relative to trend and lowered unemployment by 4 percentage points at their peak. Without this action, real wages would have been 8% lower, or around £2,000 per...

Read More »Mtg purchase apps, new home sales, Payroll taxes

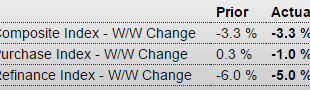

Down some, still depressed and going nowhere: MBA Mortgage ApplicationsHighlightsPurchase applications for home mortgages fell back by 1 percent in the March 18 week, bringing down the year-on-year increase to a still very strong 25 percent, though some loss of momentum in this component is evident. Refinancing applications continued in the decline of recent weeks, dropping 5 percent in the latest week despite a 1 basis point slip to 3.93 percent in the average rate for 30-year conforming...

Read More »Mtg prch apps, CPI, Housing starts, Industrial production

Working their way a bit higher but still seriously depressed:With the year over year CPI increase now only 1% the Fed can only wait and see if headline will catch up to core and ‘justify’ their tightening bias. Consumer Price IndexHighlightsThe CPI core is showing pressure for a second month, up a higher-than-expected 0.3 percent in February with the year-on-year rate up 1 tenth to plus 2.3 percent and further above the Federal Reserve’s 2 percent line.Gains are once again led by health...

Read More »Retail sales, Redbook retail sales, Housing index, Business inventories and sales, Empire manufacturing, MEW, Atlanta Fed

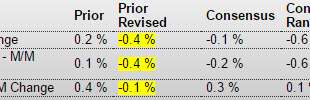

Just plain bad. Including last month’s downward revision. And, again, sales = income, and lower income means less to spend in the next period: Retail SalesHighlightsConsumer spending did not get off to a good start after all in 2016 as big downward revisions to January retail sales badly upstage respectable strength in February. January retail sales are now at minus 0.4 percent vs an initial gain of 0.2 percent. The two major sub-readings also show major downward revisions with ex-auto...

Read More »Chicago PMI, Pending home sales, EU inflation, G20 statement, Virginia jobless claims

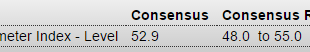

As previously suspected, last month’s higher print was just a bit of volatility on the way down, as per the chart: Chicago PMIHighlightsAnother month and another month of wild volatility for the Chicago PMI which lurched from solid expansion in January to noticeable contraction in February. At a headline 47.6, Chicago’s PMI has fallen outside Econoday’s consensus range for a third month in a row! Still, this report is closely watched and confirms other early indications of February...

Read More »New home sales, PMI services, Mtg purchase apps, Tsy yield

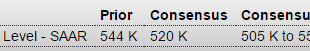

Challenging to put a good spin on this one, but they gave it their best shot, as the wheels are coming off at every turn: New Home SalesHighlightsA downturn out West helped pull new homes sales down a steep 9.2 percent in January to a lower-than-expected annualized rate of 494,000. The level, however, is still respectable given that there is no revision to December which stands at a very solid 544,000. Sales in the West, which is a key region for the new home market, fell 32 percent in the...

Read More »Don’t blame the boomers

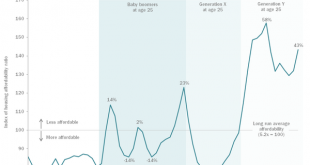

From Joe Sarling's blog comes this a lovely chart showing housing affordability by cohort since 1955: As can be seen, the current generation of young people - Generation Y - faces paying a far higher proportion of their incomes in mortgages or rent than any previous cohort. This does not, of course, take into account the considerable price difference between London and everywhere else: if London were excluded, I suspect their position would not look quite so dire. Nonetheless, this chart is...

Read More » Heterodox

Heterodox